Announcement

Collapse

No announcement yet.

DEFLATION: Comin-in strong

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Originally posted by mustardman View PostYep theyve doubled our debt and have one of the lowest economic records in the country

but all the unaware people will vote them back in

They are Arrogant and Incompetent - a dangerous twosome. How Stupid are they that to OWN the Libs, instead of taking covid help from Feds they asked umpteen U.S States , even as far away as Pennsylvania-WTF !!!

So they finally accepted help from the Feds, but People Died to Own the libs

Must be getting your information from the cbc or the commonwealth again. TD bank and others have Sask economy leading all provinces last year and this year.

Comment

-

Guest

Guest

Yep amazing the horse shit that gets spewed on here

Some need the operation bin lurking spoke of

Comment

-

Our Bank of Canada buddy defending himself saying he's not responsible for his government spending habits so guess what that means more int. rate hikes. Jan inflation still coming in at over 6% for the year . It's like on old N-14 SHE'S slowing down but won't Stall ! -8 this morn better than -28 yestermorn!

Comment

-

Whatever deflation errol is expecting, many wont make it long enough to see it.

Every person or business that goes under is another person on supports that we have to pay for. And contrary to the thinking well you can just pull yourself up, its difficult to get out of a bad financial situation once you fall in.

Last edited by jazz; Feb 17, 2023, 08:05.

Comment

-

Commodity deflation imploding prices. Debt crisis spinning out-of-control.

Central bankers, hello, hello?

Comment

-

Guest

Guest

Originally posted by mustardman View PostYep theyve doubled our debt and have one of the lowest economic records in the country

but all the unaware people will vote them back in

They are Arrogant and Incompetent - a dangerous twosome. How Stupid are they that to OWN the Libs, instead of taking covid help from Feds they asked umpteen U.S States , even as far away as Pennsylvania-WTF !!!

So they finally accepted help from the Feds, but People Died to Own the libs

Comment

-

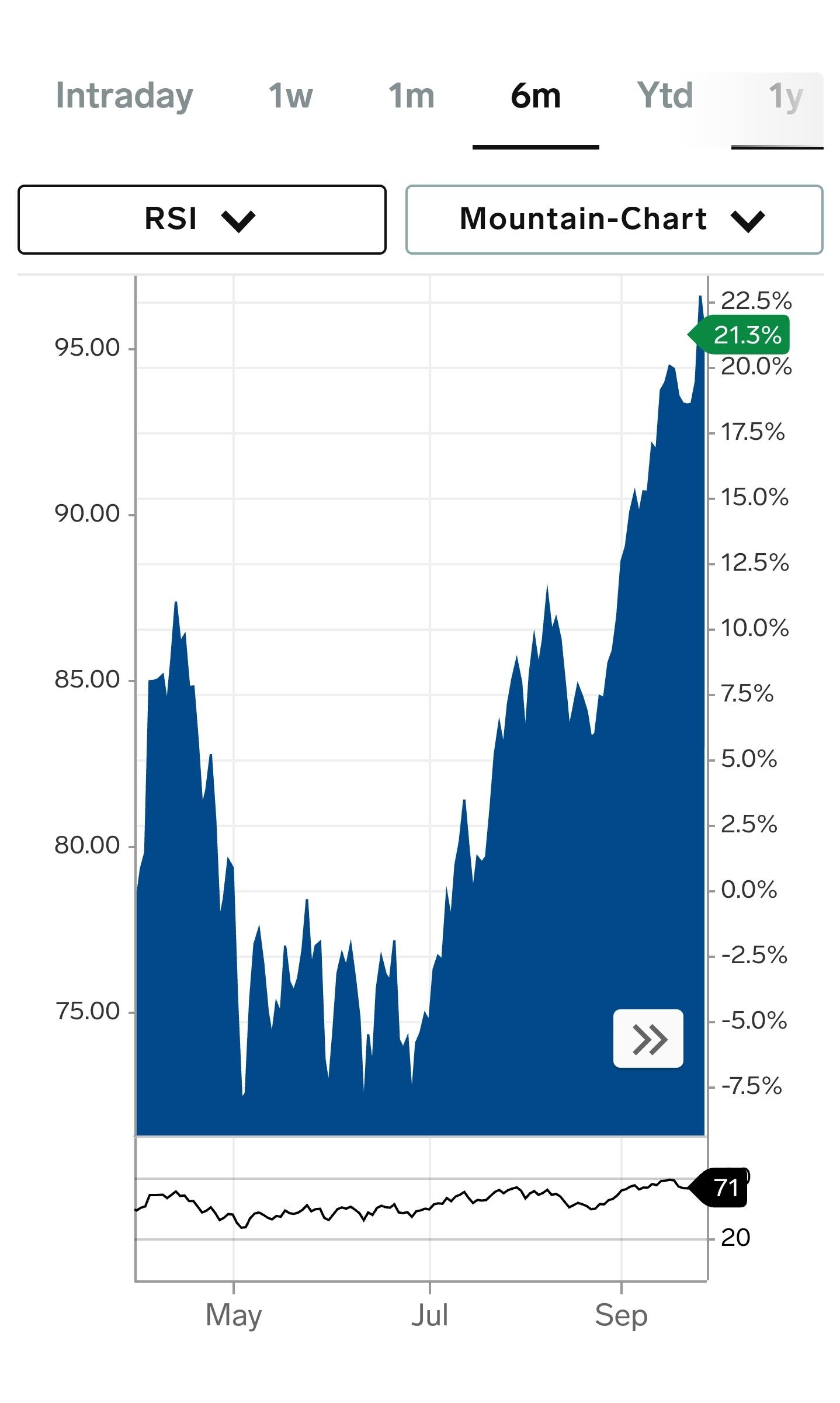

The manipulated stock market may be the 'sitting duck' . . . .

Commodities just reflecting economic reality. Q2 and Q3 economic data may rattle the equity cage as the Fed can no longer keep their magic tricks hidden. Powell and Yellen apparently no longer speak together. Contradictions?

Powell looked to be in a dead sweat at the post press conference yesterday. Answered questions nervously and poorly (IMO).

Comment

-

Global markets making it known loud ‘n clear . . . . Commodity prices are now in a downward spiral. Even the supply manipulated oil market appears topped showing a blow-off price reversal this week.

What’s next? Investors will begin to hoard cash.

Cash is king. This is bad news for banks and profits. Layoffs will accelerate. Corp revenues will drop. Stock market vulnerable.

The fallout in commodities is broad-based globally. Even the Saudis hinted a rollback in oil production cuts. Oil producers are feeling the decline in global demand. ie: China’s recession. Ocean tankers now awaiting unload, up 12% in September.

Inflation is the least of problems for central bankers. The massive debt crisis is the problem fueled by poor, ill-timed, reckless central bank policy rising rates far too quickly. Collapse of gold signals inflation in the rear-view mirror. Investors now race toward the USD for safe-haven buying, a tough pull to swallow for U.S. exports.

Welcome October, welcome market turbulence, welcome deflation . . . . .

Comment

-

U will be right one of these times Errol. Ain’t seeing no deflation in farm inputs or machinery yet

Comment

-

Guest

Guest

Or groceries, or fuel, or parts , or vehicles , or anything for that matter? Other than fert and roundup although they are still higher than before liberal shit show started

Comment

-

Grains under harvest pressure but I got the highest price for yearlings I have ever got and if you think this party is about over you can still pencil in a profit if you lock in a sept. futures for calves bought now. Trying sort all this world crap out while trying to make a living is very tiring !!!!!

Comment

- Reply to this Thread

- Return to Topic List

Comment