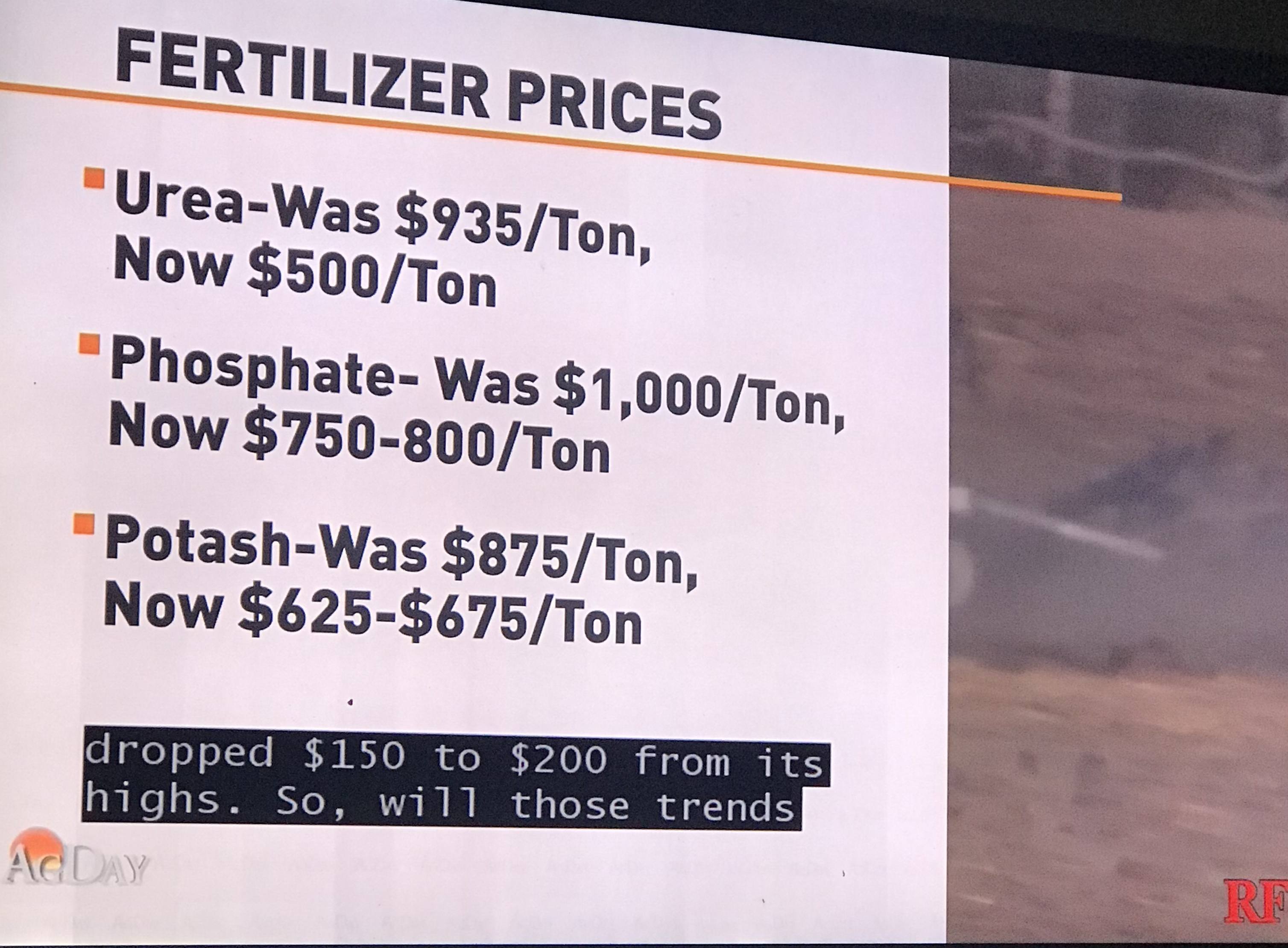

Phoned my dealer of the past 25 years and asked if we should look into purchasing Fertilizer for fall at current reduced prices.

His answer was to hold off as Fertilizer prices will continue to soften.

He was same dealer advising to buy last August at $700.00/ tonne Urea.

His answer was to hold off as Fertilizer prices will continue to soften.

He was same dealer advising to buy last August at $700.00/ tonne Urea.

Comment