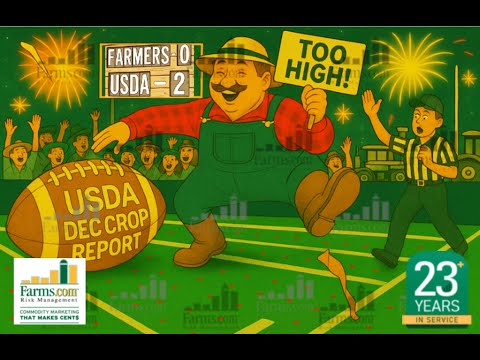

Historically, the USDA December crop report is a non-event or another dud report as the USDA reserves any final supply changes to the final report in January of the following year in this case 2026. But after the longest U.S. government shutdown in history at 43 days and no October crop report will they provide more data/surprise and make an exception?

Our China U.S. soybean purchase tracker is now at 26.6% or a total of 3.2 mmt but for traders it’s taking too long to unfold.

The final Stats Canada production report was bearish canola and wheat projection a record crop in both (it adds to the global glut of supplies) and bullish local corn and soybean prices in Ontario/Quebec thanks to a drought. It will not help the fund flow short-term, the USDA may need to offset it?

A U.S. Fed interest rate cut of another 25-basis point next Wednesday (probability 87.1%) could help fund flow and sentiment in stock and ag commodities into year end.

More inflows into Bitcoin this past week saw prices rebound back above 90,000 with support at 82,000 and resistance at 96,000.

A V-shaped bottom in cattle suggest the lows are in after Mexico reported another new world screwworm case. Lower weights, seasonal demand and higher U.S. beef select/choice values with a continued closure of the Mexican border to cattle will result in a resumption of higher cattle futures into yearend.

Australia is expected to produce its 3rd largest wheat crop ever at 36 mmt adding to the global glut of supplies.

Reports of ASF in hogs in Spain the largest pork exporter in Europe could see the U.S. win more pork export business long-term.

If the rains verify into next week of 3-5 inches for Brazil it would go a long way to fixing the dry regions from the last 2-months, but the European weather model has been wrong for the past 2-months!

Natural gas futures are surging to the 3rd price count as frigid hold temps set in.

CDN $ is also surging to end the week on a very resilient economy and better employment numbers suggesting no interest rate cuts next week.

Finally, the CFTC report showed funds were net buyers of soybeans but sellers of corn, canola and wheat. In real time the funds have gone back to selling as they take some profits.

?

Comment