Ag Commodity Corner+ podcast

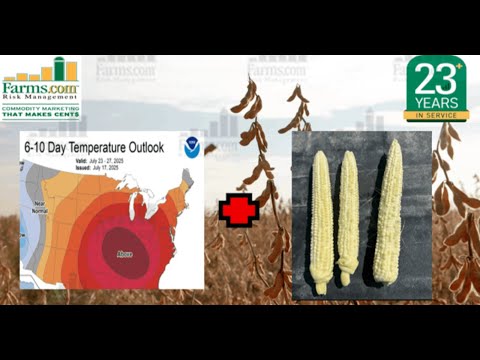

A high-pressure ridge “Heat Dome” is forecast for mid next week over the heart of the U.S. corn Belt, U.S. corn pollination issues from early April planted corn and high nighttime temps from the last 30 days.

More rain is forecast for the Canadian Prairies over the next 2-weeks from 1-3 inches.

Trump announced 30% tariffs 2 of the U.S. largest U.S. trading partners the EU and Mexico effective August 1.

Soyoil futures break out above resistance at $55 while corn futures put in a reversal higher.

Trump was looking to fire Powell; U.S. passed the first crypto legislation this week and the removal of high corn fructose syrup in Coke.

A high-pressure ridge “Heat Dome” is forecast for mid next week over the heart of the U.S. corn Belt, U.S. corn pollination issues from early April planted corn and high nighttime temps from the last 30 days.

More rain is forecast for the Canadian Prairies over the next 2-weeks from 1-3 inches.

Trump announced 30% tariffs 2 of the U.S. largest U.S. trading partners the EU and Mexico effective August 1.

Soyoil futures break out above resistance at $55 while corn futures put in a reversal higher.

Trump was looking to fire Powell; U.S. passed the first crypto legislation this week and the removal of high corn fructose syrup in Coke.

Comment