Announcement

Collapse

No announcement yet.

The great debt crash

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Few people starting to notice (wake up ) on the the little fuel tax present we are receiving on Canada day. Cheaper fuel was the only item that brought inflation under 4% last month so look for more int. rate increases in the future. It will be a lot more costly to fill the camper on labour day than now.

Comment

-

-

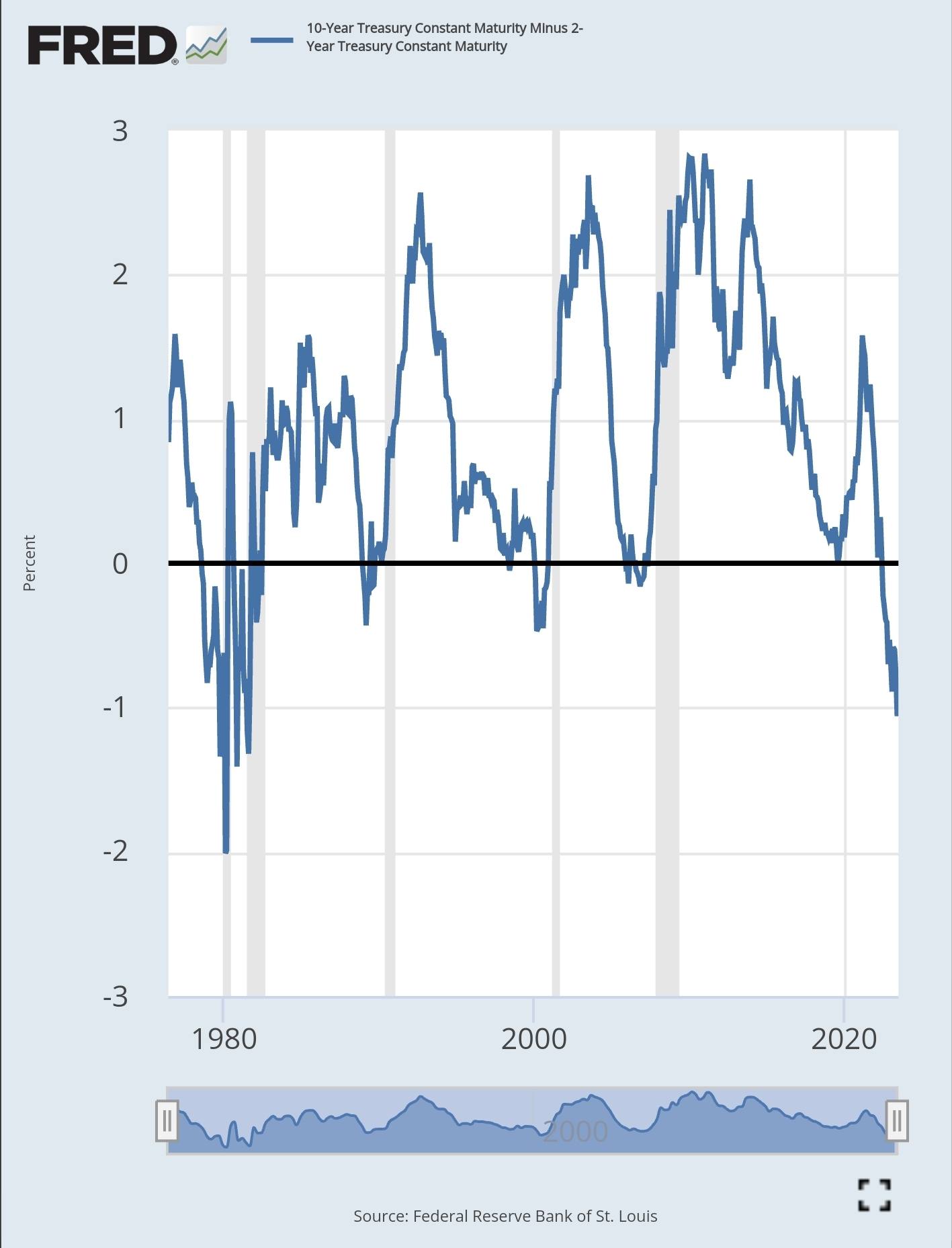

So the prudent thing to do would be to sit tight and pay down debt in the next few years?Originally posted by biglentil View PostInversion of the yield curve is considered one of the best leading indicator of recession and has decended to levels not seen since the early 80's. Buckle up.

Or are we gonna party on for another 5-10 years like we have been doing, before the hangover sets in?Last edited by flea beetle; Jul 3, 2023, 22:41.

Comment

-

I don't think we are going to have to wait that long. A yield curve inversion - in which shorter-dated Treasuries trade at higher yields than longer-dated securities - has been a reliable signal of upcoming recessions. The 2/10 year yield curve has inverted six to 24 months before each recession since 1955, according to a 2018 report by researchers at the San Francisco Fed, offering only one false signal in that time.

The spread between 2 and 10-year Treasuries has been inverted since July 22.Last edited by biglentil; Jul 3, 2023, 22:58.

Comment

-

How reliable is the relationship between recessions and falling interest rates?Originally posted by biglentil View PostI don't think we are going to have to wait that long. A yield curve inversion - in which shorter-dated Treasuries trade at higher yields than longer-dated securities - has been a reliable signal of upcoming recessions. The 2/10 year yield curve has inverted six to 24 months before each recession since 1955, according to a 2018 report by researchers at the San Francisco Fed, offering only one false signal in that time.

The spread between 2 and 10-year Treasuries has been inverted since July 22.

Comment

-

Errol, please look at the date of your prediction. Exactly one year ago.Originally posted by errolanderson View PostCan’t imagine the Bank of Canada hiking rates next week, but they will.

Markets are far faster than central bankers and their ability to respond. Inflation is now dead. Deflation is the new kid on the block. Asset prices are already tumbling. This has created a conundrum for bankers making their courageous battle with inflation, that is no longer there.

Now the tide has turned . . . and so have bank profits. An outcome not planned by the financial industry.

There is now a real possibility of rate cuts later this year.

#1 Was inflation dead a year ago?

And #2 were bank rates cut or did they increase instead?

Comment

-

Mortgage rates stateside are now in-decline. Watch for bank fallout to intensify. Crude oil is a bear market. Global demand is dropping and Saudi power diminished. Base commodities are now deflationary.

As for rates, central bankers only react looking in the rearview-mirror. Fed has already paused, further hikes are now likely over (IMO). A central banker doesn’t typically pause rates and then continue hiking. Something has gone wrong with their policy. Maybe they should take a look a look at commodity and freight demand as an indicator?

Inflation is now dropping sharply. Deflation had taken hold of many asset classes. These games have just begun . . . . .

Comment

- Reply to this Thread

- Return to Topic List

Comment