Fed pausing rates today may be a clear signal rate hikes are over, despite Powell’s tough talk of raising rates further. Inflation is now the least of the Fed’s concern.

There is a full-on commercial real estate crisis.in-progress. Home owners having difficulty refinancing failing bank stress tests. Banking industry fallout (fuelled by rate hikes) has been conveniently, but temporarily, swept-under-the-rug. Unemployment is now rising as corporate layoffs and bankruptcies accelerate.

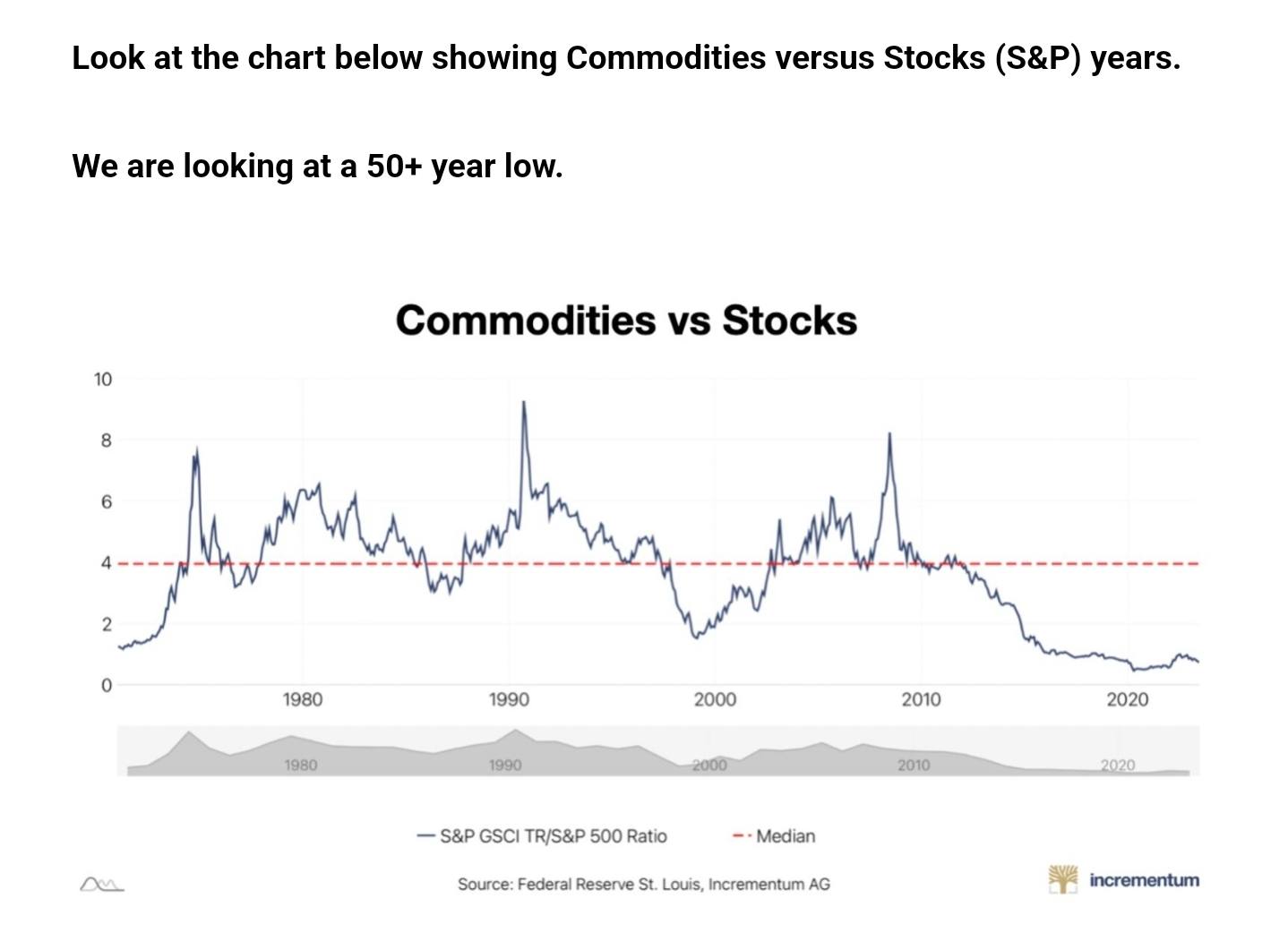

Truck freight volumes have dropped substantially, a key economic indicator. Commodities globally are in now on a bear market. from oil, copper, steel lumber to grains. China has just cut rates in an effort to stimulate their economy.

And the Bank of Canada, going it alone on rate hikes.

There is a full-on commercial real estate crisis.in-progress. Home owners having difficulty refinancing failing bank stress tests. Banking industry fallout (fuelled by rate hikes) has been conveniently, but temporarily, swept-under-the-rug. Unemployment is now rising as corporate layoffs and bankruptcies accelerate.

Truck freight volumes have dropped substantially, a key economic indicator. Commodities globally are in now on a bear market. from oil, copper, steel lumber to grains. China has just cut rates in an effort to stimulate their economy.

And the Bank of Canada, going it alone on rate hikes.

Comment