Originally posted by Richard5

View Post

Cenovus

Crescent Point

Enbridge

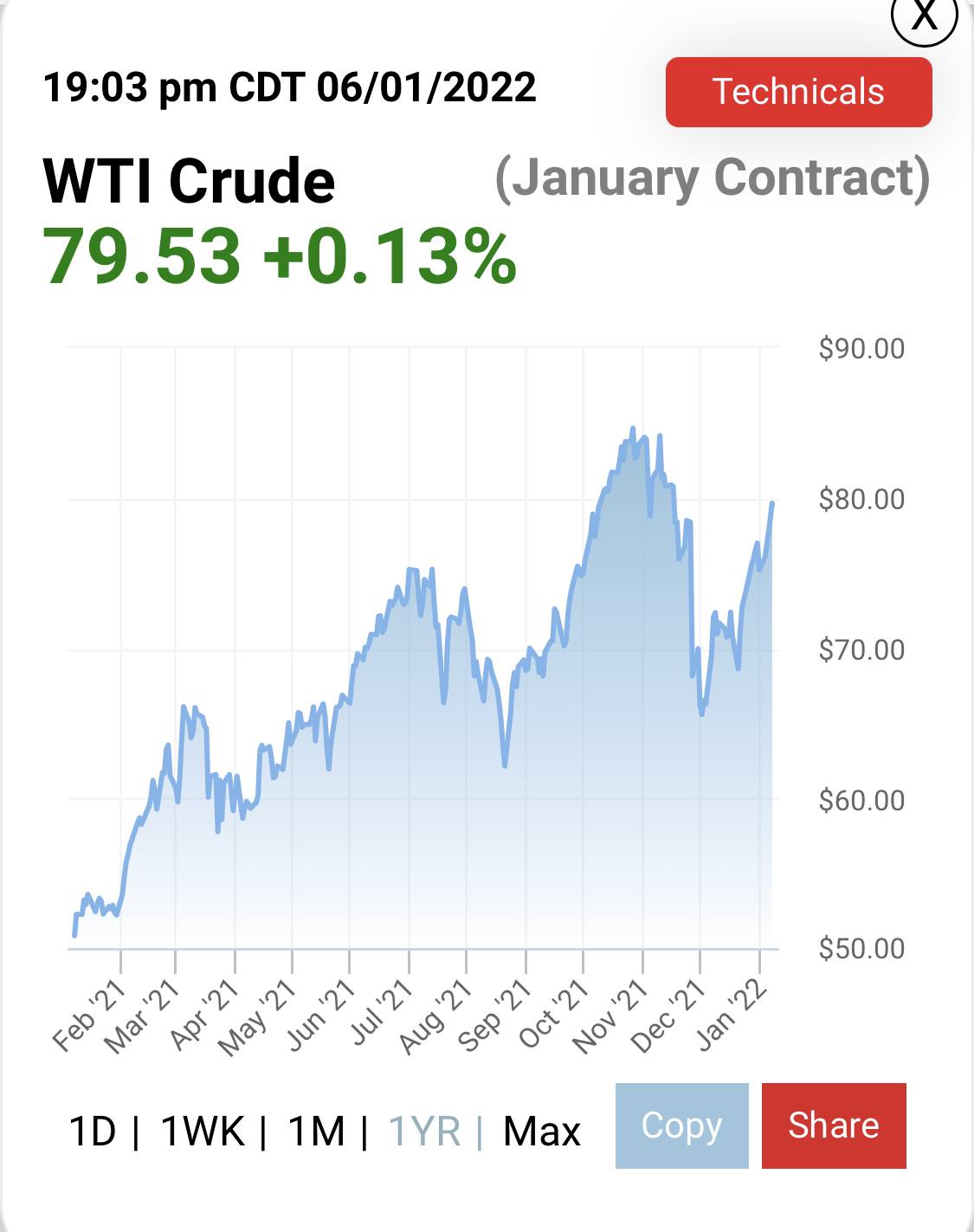

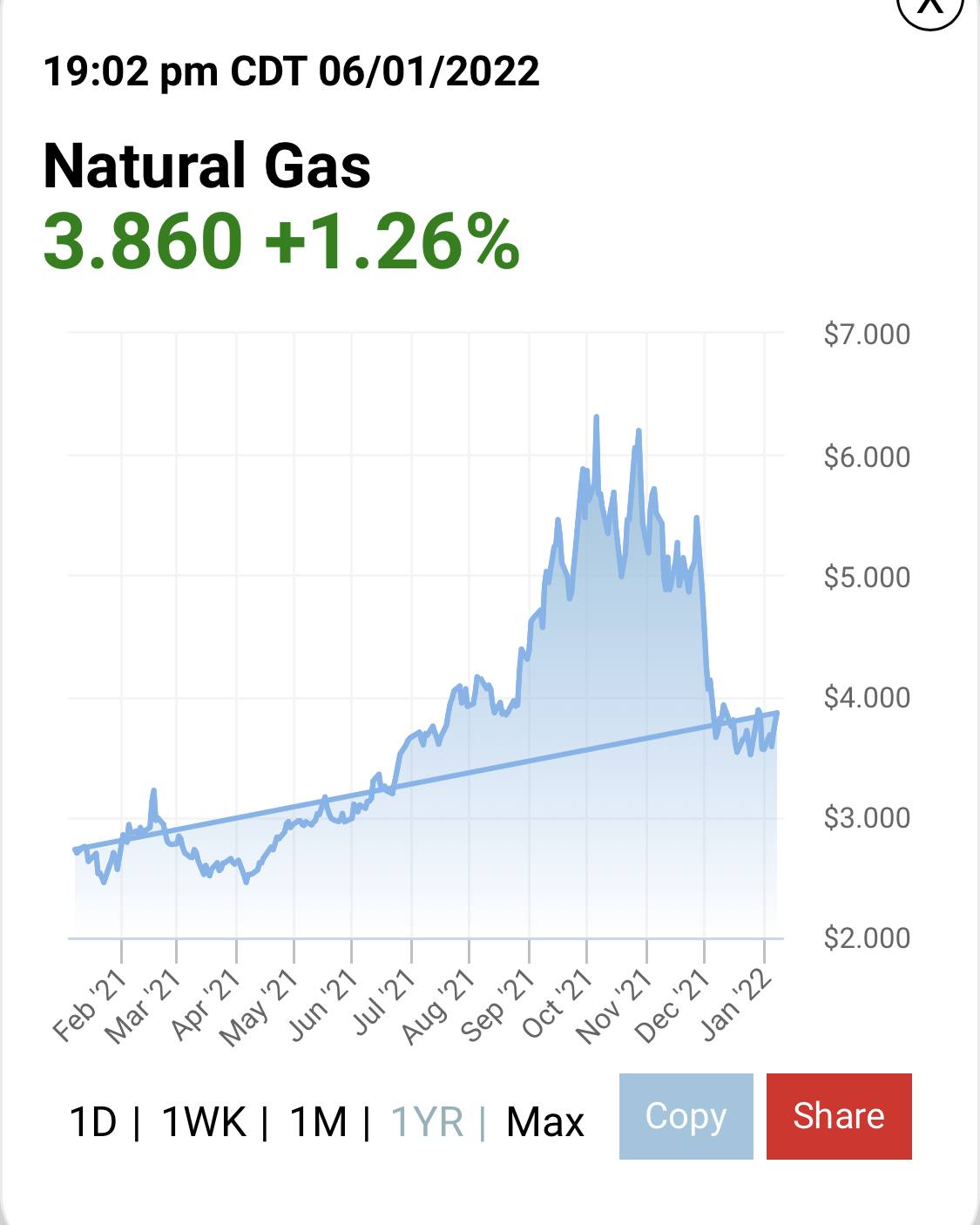

I respect errol, but he is wrong about oil. It has nothing to do with inflation. It has everything to do with supply side constraints due to ESG lunacy and underinvestment for the past decade.

The policy will first drive oil into the triple digits, maybe even as high as $200.

Then some braniac will realize that NG is the only bridge fuel that exists, then some next genius will finally realize nuclear is the only source that will ever supply this fairy take. I am bullish on oil, gas and uranium.

Comment