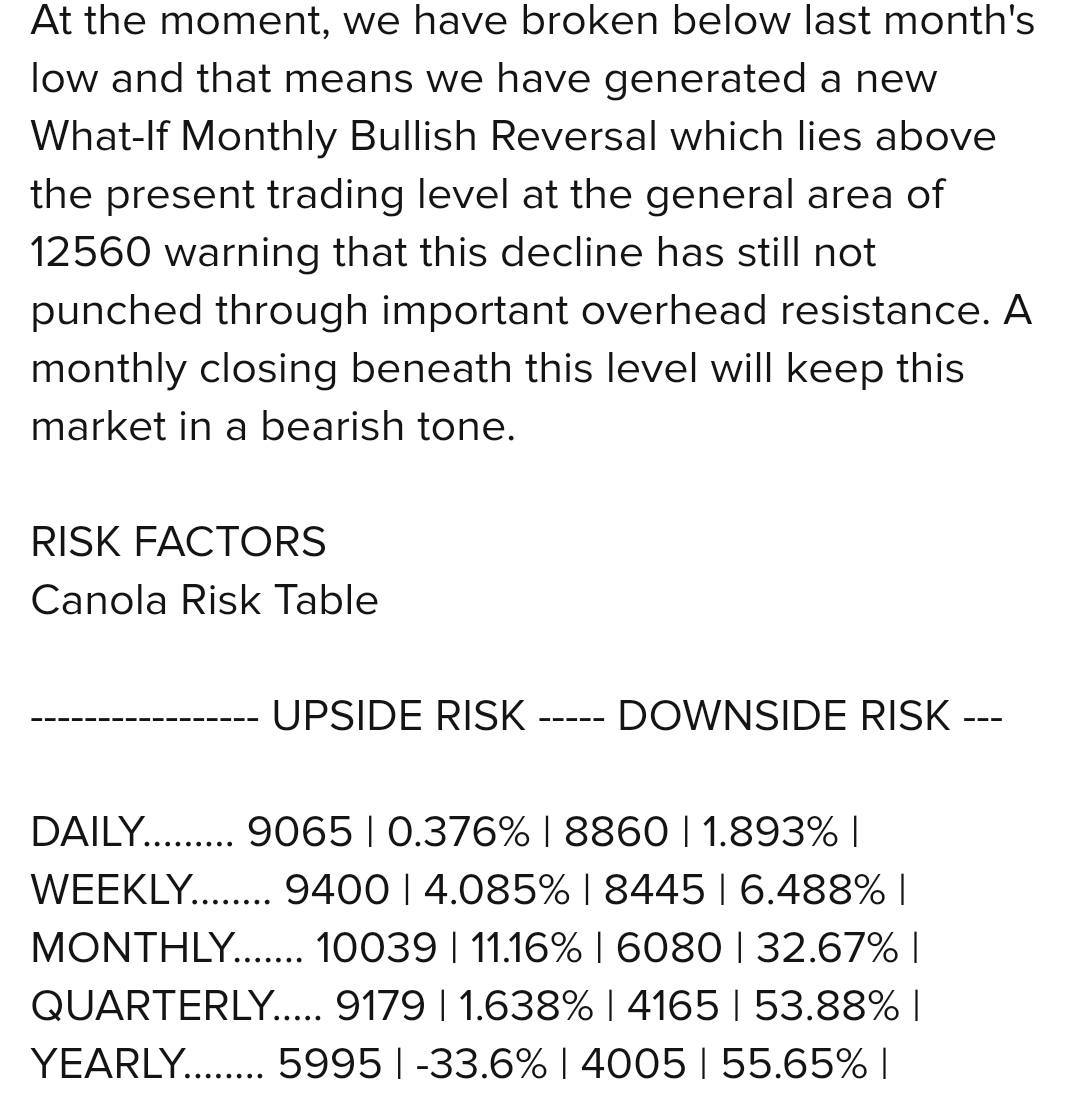

1256 new resistance level, courtesy of the quant. I got the above listed 599 and 608 as buy levels. Also a $2356~ target, yes that's $53/bushel as resistance. 2356 popped up back in Late july and i thought it was full of shit, but the drought got worse, it hadn't really rained since, and inputs are getting more scarce. There's no time limit on it but in my opinion we are in a 8 yr drought lining up with the solar cycle and global cooling, the inverse or the flip side of the previous 10 year wet. Be very phucking careful pricing. Feb looks like closest turn point, expecting a high. This is a long ways from over. Only a monthly close under 599 would get me bearish. Somebody shut up the covid threads.... we got $ to make, the kind you retire on.

Comment