sounds like a glass half full kind of guy.

Announcement

Collapse

No announcement yet.

get ready to make some money

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

-

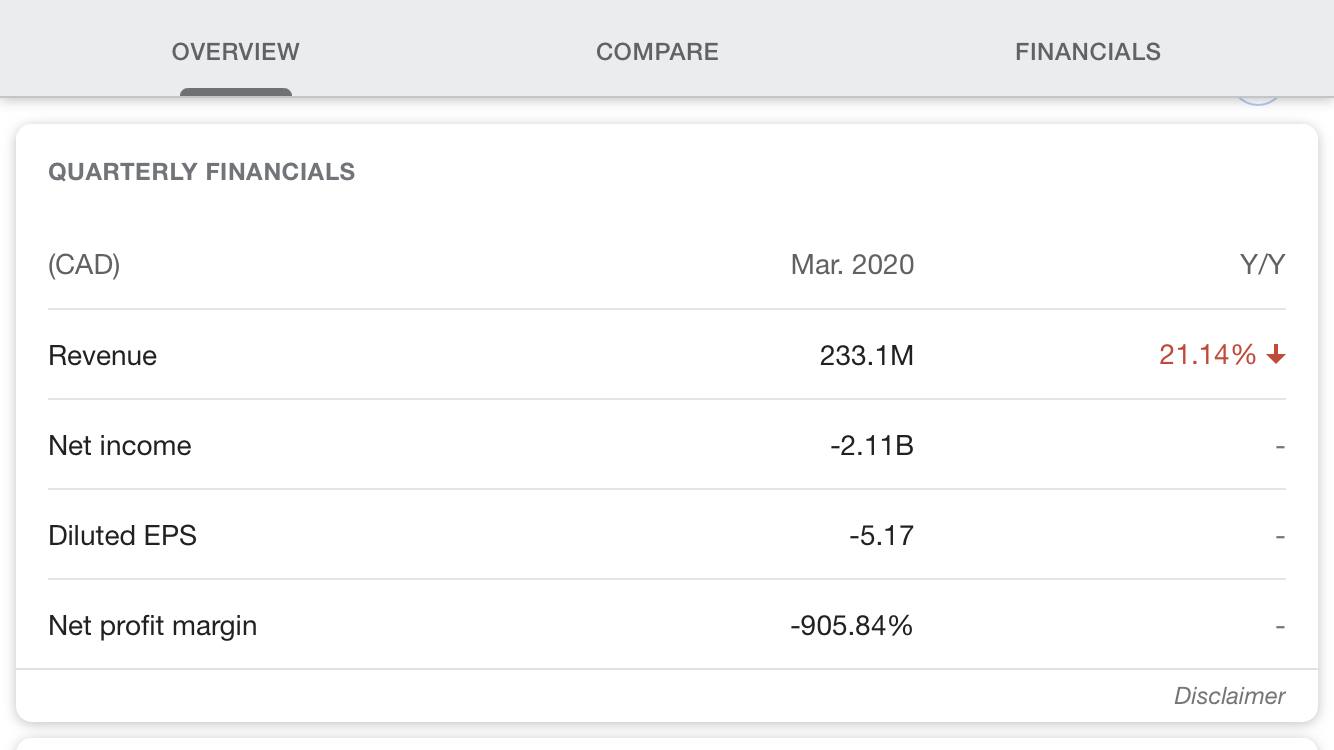

whitecap actually doubled their revenue over Q1 2019, mainly because of hedge gains. these were recorded at $47 US or $61 CDN. however they recorded a property, plant and equipment impairment of $2.8 billion which sunk the first quarter. I think you'll find most companies throwing all the bad news into the first quarter as they are compelled to report anything that might go down in value. you'll see the same thing with the banks as they take loan loss provisions due to lower house prices, or other loans they might not collect on. the thing is that as things improve, these impairments get reported back on the revenue side as a gain, which boosts earnings. I guess i'm hoping that the upward oil price trend continues, due to a supply shock, as the economy starts to come back.

Comment

-

this forum is set up to exchange ideas in commodity marketing. jazz, I agree that Suncor is a good choice to go the integrated route. however, I think there is more upside from the well run smaller players right now who have hedged production at profitable prices. I think whitecap has hedged close to 20,000 barrels a day at a minimum of $60Cdn, right through to the end of the year. I know i'm rolling the dice a bit, but i'm betting that oil is coming back stronger than expected and the capital gain will be very good. after farming for as many years as I have and taking on that risk every spring, this is child's play, at only about $1.70/share.

as I said, i'm also saying to think about locking in some lentil fall prices, and pretty soon durum, to cover some expenses. however, I still believe 35cent red lentils and $11 durum will show up before year end. add to that some pretty good fuel prices and full storage tanks going into seeding to help on the expense side, and things are setting up better this year than the last few.

Comment

-

- Reply to this Thread

- Return to Topic List

Comment