Originally posted by tweety

View Post

Announcement

Collapse

No announcement yet.

A Game-Changing Crash . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

LOL. Tell that to the guy that started farming and bought land in 1981. LOL Tread water for 32 years till he finally got the loan paid off if he wasn't bk first

-

The TSX is just about the same level as it was 10 yrs ago. In 2015 it just about touched the levels from 2000. It is a very flat and poorly diversified index which wouldn't be a problem if we actually developed our resources like other countries do. Instead we have to settle for mediocre everything and pretend. Canada has no tech or consumer staples industry nor health care or industrials of any magnitude. Its all real estate and lending for it and energy.Originally posted by dmlfarmer View PostDraw a trend line on the chart over the last 20 years and you will get a better look at performance.

Since 2016 when Trump was elected, the US index has provided twice the returns the TSX. Shows what a real economy can do when its turned loose.

Last edited by jazz; Feb 29, 2020, 08:56.

Comment

-

But you ignore the fact that Trump will have increased the debt in the US by over 5 Trillion dollars by the end of his first term. You ignore the massive tax breaks he handed corporate America. Both reasons for inflated stock values. You ignore sentiment that believes the US is doing great, therefore driving investment and instead you continually expose negative sentiment any time you can about Canada. With all the whining, why would investors flock here.Originally posted by jazz View PostThe TSX is just about the same level as it was 10 yrs ago. In 2015 it just about touched the levels from 2000. It is a very flat and poorly diversified index which wouldn't be a problem if we actually developed our resources like other countries do. Instead we have to settle for mediocre everything and pretend. Canada has no tech or consumer staples industry nor health care or industrials of any magnitude. Its all real estate and lending for it and energy.

Since 2016 when Trump was elected, the US index has provided twice the returns the TSX. Shows what a real economy can do when its turned loose.

[ATTACH]5656[/ATTACH]

And I love your claim " In 2015 it just about touched the levels from 2000." I note the Conservatives held power from 2006 to 2015, the majority of the time of flat growth so how is this all the fault of Liberals?

Comment

-

Our debt has increase too, its all dumped on the provinces and consumer debt ie housing.Originally posted by dmlfarmer View Postso how is this all the fault of Liberals?

Take a better look at the chart. Canada was in lock step with the US economy until Obama got in and started his US divergence from Canada by attacking our main exports and now Trudeau has accelerated it. Only reason we are hanging on at all is that Nafta from 30yrs ago.

Comment

-

You look at the chart again and you will see in 2015 when Trudeau was first elected the divergence actually began decreasing but in 2016 when Trump got in is when it started accelerating. So that brings in to question your claim as to if it was actually Trudeau or Trump which has been a bigger factor in the divergence.Originally posted by jazz View PostOur debt has increase too, its all dumped on the provinces and consumer debt ie housing.

Take a better look at the chart. Canada was in lock step with the US economy until Obama got in and started his US divergence from Canada by attacking our main exports and now Trudeau has accelerated it. Only reason we are hanging on at all is that Nafta from 30yrs ago.Last edited by dmlfarmer; Feb 29, 2020, 09:49.

Comment

-

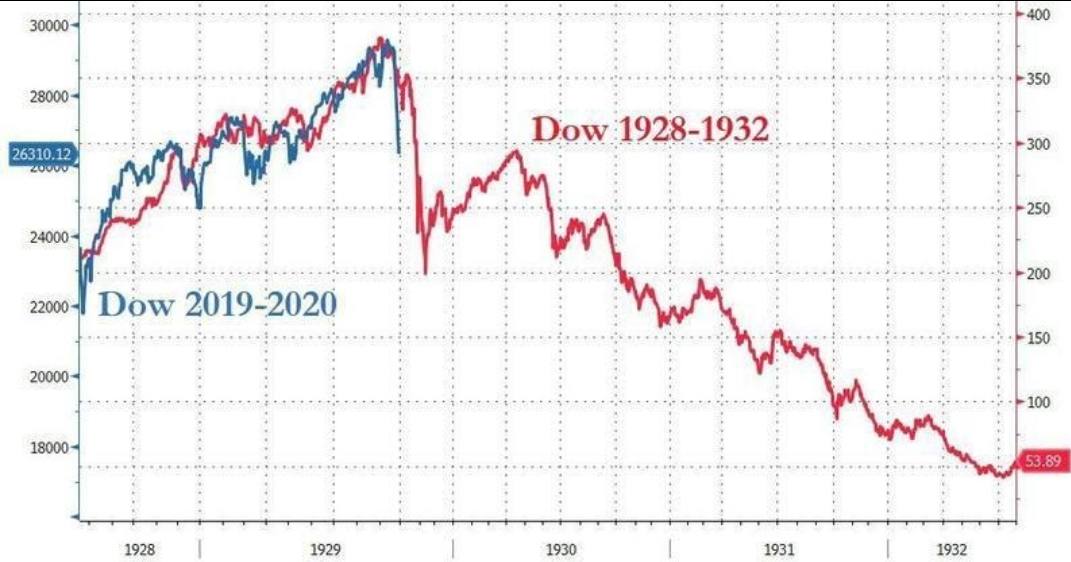

For those that don’t appreciate my past comments, it’s best not to read any further . . . .

My apologies for touching a raw nerve for some Agrivillers with this week’s sell-off, but we are just in the 1st inning of this correction, meltdown, fallout, collapse . . . whatever you want to call it. A spade is a spade . . . .

‘Buy the dip’ investment community mentality is clearly old school (IMO). The Fed is hooped. Babysitting days protecting bad financial management and debt excessives have not only come-to-roost, they have fallen out-of-the-tree. No central banker can print their way out of this fiat money mess. The Fed may cut rates next week 1/2 percent in sheer panic. Markets may rebound temporarily or not. But rates cuts now will have little impact and make the big picture problem even worse?

Corona pushed these markets over this week, but it was eventually going to happen anyway. We need to do what we can personally to protect ourselves. Debt is insidious if it doesn’t create growth. Canada’s standard of living is now clearly in-decline. Gov’t Keynesian fallout is now upon us all . . ..

Comment

-

All Good Errol....Just tells us when commodities like fertilizer and fuel are coming down please....Originally posted by errolanderson View PostFor those that don’t appreciate my past comments, it’s best not to read any further . . . .

My apologies for touching a raw nerve for some Agrivillers with this week’s sell-off, but we are just in the 1st inning of this correction, meltdown, fallout, collapse . . . whatever you want to call it. A spade is a spade . . . .

‘Buy the dip’ investment community mentality is clearly old school (IMO). The Fed is hooped. Babysitting days protecting bad financial management and debt excessives have not only come-to-roost, they have fallen out-of-the-tree. No central banker can print their way out of this fiat money mess. The Fed may cut rates next week 1/2 percent in sheer panic. Markets may rebound temporarily or not. But rates cuts now will have little impact and make the big picture problem even worse?

Corona pushed these markets over this week, but it was eventually going to happen anyway. We need to do what we can personally to protect ourselves. Debt is insidious if it doesn’t create growth. Canada’s standard of living is now clearly in-decline. Gov’t Keynesian fallout is now upon us all . . ..

Why do they not get hit with price declines whereas grains do?

Comment

-

Both of you are looking at this from the wrong perspective. Government intervention can only do harm, it is the degree of damage that different well intentioned but hapless government policies are able to inflict that is in debate. In the short term ( at least) right now, Trump's policies are doing less damage than his predecessor, Trudeau's are doing more damage than his predecessors( of all parties), likely in all time frames.Originally posted by dmlfarmer View PostYou look at the chart again and you will see in 2015 when Trudeau was first elected the divergence actually began decreasing but in 2016 when Trump got in is when it started accelerating. So that brings in to question your claim as to if it was actually Trudeau or Trump which has been a bigger factor in the divergence.

Comment

- Reply to this Thread

- Return to Topic List

Comment