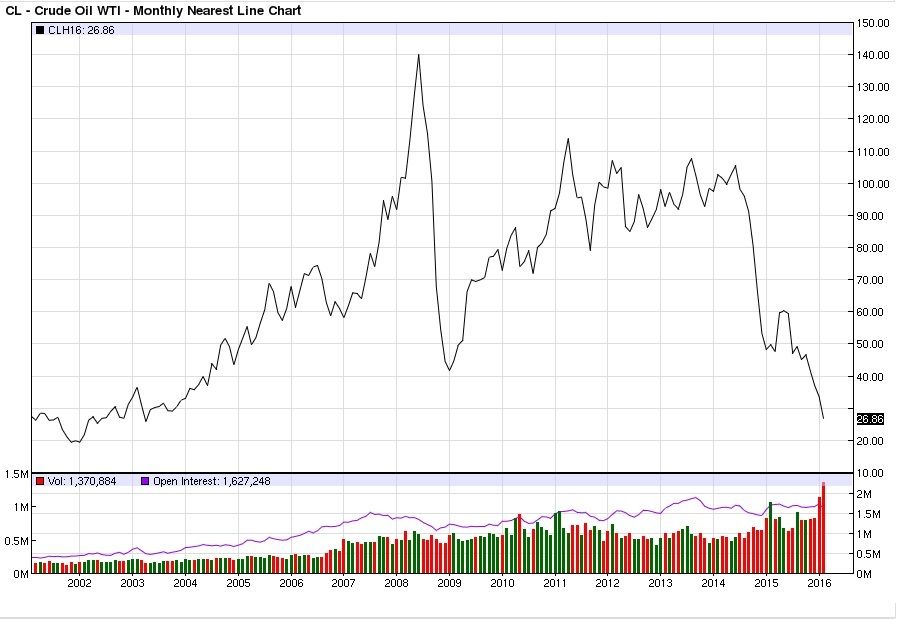

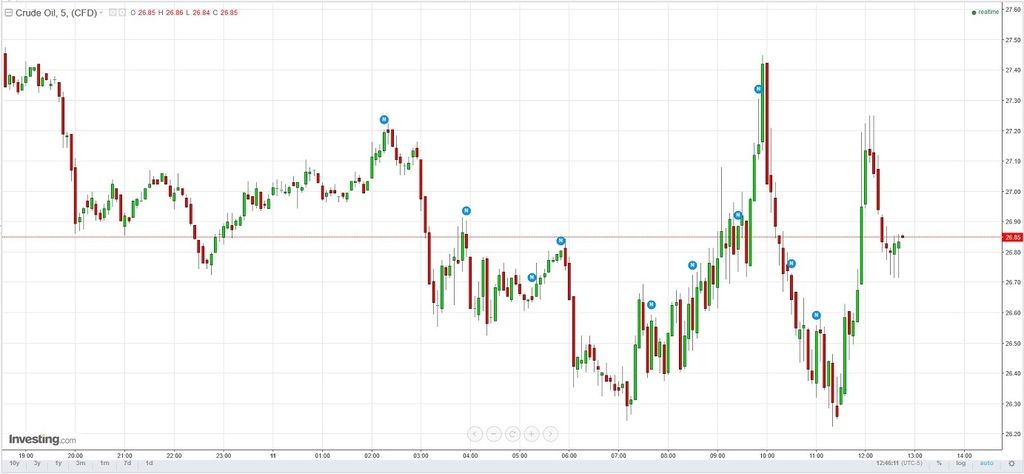

Wondering if Feb 11 will mark the low for a while or maybe for a very long time.

A close below 26.60H would say no.

A close below 26.60H would say no.

/URL]

/URL] /URL]

/URL]

This website uses tracking tools, including cookies. We use these technologies for a variety of reasons, including to recognize new and past website users, to customize your experience, perform analytics and deliver personalized advertising on our sites, apps and newsletters and across the Internet based on your interests.

You agree to our and by clicking I agree.

Comment