From John De Pape's CWB monitor

Announcement

Collapse

No announcement yet.

09-10 pool vs open market

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Wheat Growers news release from last week.

<b>Open market outperforms the Canadian Wheat Board</b>

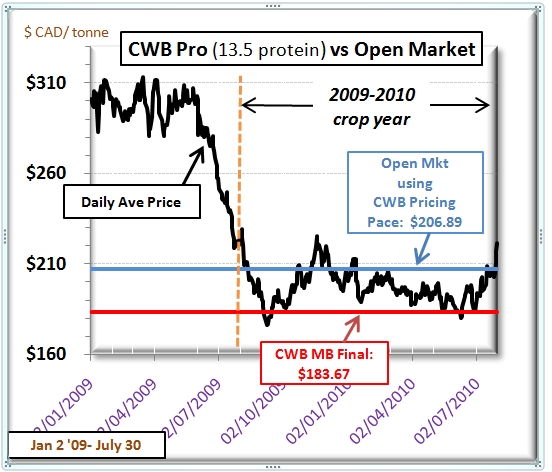

The release of Canadian Wheat Board (CWB) final payment information last Friday confirms the final prices that prairie farmers received for their wheat in the 2009/10 crop year were again lower than the returns that were available on the open market.

The final pool price for the CWB’s flagship wheat class (1 CWRS 13.5% protein) in the 2009/10 crop year was $185.87 per tonne, basis Manitoba. Over the same time period, the average daily price for wheat of similar quality at over 300 northern U.S. elevators was Cdn $197.80 per tonne.

“The analysis shows there were only 11 days throughout the entire crop year in which a U.S. farmer would have got a lower price than the pool price received by prairie farmers,” says Rolf Penner, Manitoba Vice President of the Wheat Growers. “If a prairie farmer could have sold an equal amount of his crop on the open market each week, he would have fared much better than selling his crop through the CWB marketing system.”

The Wheat Growers have also compared returns based on its estimates of the CWB’s pricing pace, which takes into account that the CWB starts selling the anticipated crop prior to the start of the crop year. Pricing pace information for the 2009/10 crop year is not available, however if similar to the pricing pace established for the 2010/11 crop year, then the U.S. average price over this time period was about Cdn $23 per tonne higher than the returns achieved by the CWB pool. In other words, if a U.S. farmer had been pricing his crop at the exact same pace as the CWB, his return would have been Cdn $23 per tonne, or more than 60 cents per bushel, greater than the return received by a Canadian farmer.

This comparison does not take into account the higher storage and interest costs incurred by western Canadian farmers. U.S. farmers have the opportunity to deliver their grain at a time of their choosing, whereas prairie farmers in general incur higher storage and interest costs due to CWB delivery restrictions.

The Wheat Growers stress the comparison to U.S. returns is not based on the assumption that our wheat would be sold into the U.S. under an open market. The comparisons to U.S. returns are made because it is the nearest open market and its prices arbitrage with the rest of the world. In an open market, Canadian prices would also reflect these world values.

“It is often argued that the CWB monopoly should remain in place because it gives farmers a price premium. Once again there is no evidence this is the case,” says Penner. “How can politicians or anyone else justify taking away the right to sell our own grain, when there’s no demonstrated benefit to farmers?”

The Wheat Growers continue to seek a voluntary CWB, where each farmer would be free to market their grain on their own or in collaboration with others.

Comment

-

From the CWB monitor

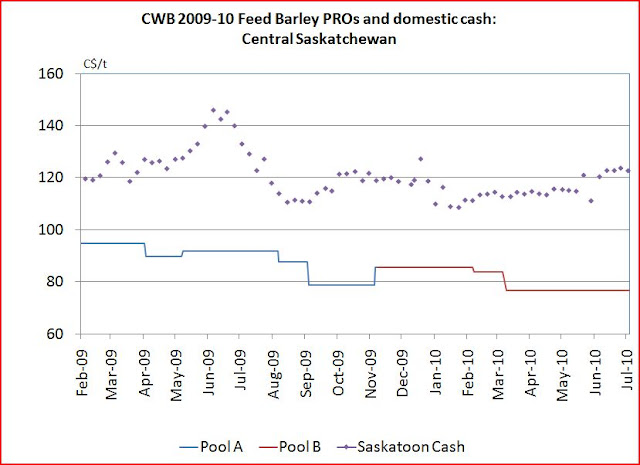

<b>The "benefits" of pooling and the Single Desk are wasted on feed barley</b>

Did you know....

When the 2009-10 CWB final payments were announced, feed barley wasn’t mentioned in the official release by the CWB. You had to look at the full payment document and go right to the end of the 12 pages to find this statement:

NOTE: Feed Barley Pool A and Pool B received no deliveries so are not shown above.

This is historic. This is the first year ever that the CWB received absolutely no deliveries to the feed barley pools. Zero. Zip. Zilch. Nada. Nuttin’.

And yet, in its “end of year” presentation, the CWB reported feed barley sales of 99,000 tonnes to Saudi Arabia and 133,000 tonnes to Japan in 09-10. A review of all CWB Bulletins from 09-10 shows no reference at all to any feed barley programs such as a Guaranteed Delivery Contract (GDC) or Guaranteed Price Contract (GPC). It’ll be interesting to read in the Annual Report how the CWB secured these supplies – and from whom (could have been bought directly from the trade). I wonder if they made any money for the Contingency Fund.

It’s no wonder no one sold into the pools with the Initial Payment for Pool B at $92 instore ($33/tonne in SK, or $0.72/bu). (I can’t find any reference on the CWB website to the Initial Payment for Pool A; it’s as if it never happened, which I guess is true. I will assume it was similar to the Initial for Pool B.)

If farmers aren’t taking advantage of pooling, I guess the other pillars – the government guarantee and the single desk – are pretty much of little value to them as well.

Now look at this year.

The CWB is reporting a Feed Barley PRO, so there must be a pool available. But the only way to sell into it is through a GDC or GPC, depending on the CWB’s choice of the day.

On December 15th, Sask Ag reported the domestic feed barley price was $144.04/tonne ($3.14/bu) basis instore Saskatoon. At the same time, the CWB Pool A PRO was $161.68/tonne ($3.52/bu) and the Pool B PRO was $154.68/tonne ($3.37/bu). Also, there are GDCs reported on the CWB website for a “Net Expected Value” of $212 instore Vancouver; this works back to SK at about $153/tonne ($3.33/bu).

So if you can find them, there are some CWB contracts out there for feed barley at better prices than domestic. And, although it’s not saying it now, the CWB had said all profits from these sales would go to farmers. Now that they are going through the pool, I guess the “profits” will show up there.

The critical question is, what value is the single desk in all this?

When the CWB sells offshore, it must be competitive. The big market – Saudi Arabia – won’t pay a premium for Canadian origin simply because someone said they had to. If its price is as little as $0.50 over a competing offer from Australia, Saudi camels will be munching on Aussie barley.

The domestic price is moving higher due to various factors – higher competing commodities such as imported corn and DDGs, tight barley balance sheets and the prospect of the potential of export movement at better prices. However, the export market is muted by the way the CWB is contracting out each sale to selected companies and not making it public or liquid.

I maintain that an open market would provide timely market responsive price signals that everyone would respond to – exporters, domestic buyers and farmers alike. And it would encourage competition, which would drive costs out of the system. The current CWB system does not allow that to happen, and it comes with its own inherent costs – all at a huge expense to barley farmers.

Those that think multiple sellers in an open market will push the price lower - think about why the CWB is so cautious when it sells feed barley – it buys the barley first (at large discounts to the potential sale value) because it’s concerned that it may not be able to buy in what it sold. Why would a grain company sell below a publicly reported market price when they would know they couldn’t buy it in cheaper? Why doesn’t it happen now in domestic barley? Multiple buyer and multiple sellers – it’s called competition, and it’s a good thing.

And to those that think grain companies will sell at the premium offshore prices and just buy at the much lower domestic prices (keeping the higher prices hidden), think about this. The only reason there is a large gap between domestic and export prices right now is because of the CWB system. Get it out of the way and multiple sellers and multiple buyers will arbitrage the markets together.

Get the single desk out of the way and let the market work for the benefit of barley farmers.

Comment

-

Fransisco,

The POOL price has always ended up far below the average asking price.

SIMPLE reason WHY.

Buyers of our grains load up when prices are low... and the CWB has no 'skin' in the market because grain growers back to pool account with their own bank accounts Via the CWB.

Any logical sane person could... and would... understand this most simple of economics principals.

No wonder the livestock folks squeal like scared rabbits when they see an Owls eye has caught attention of their presence voting for cheaper feed through the CWB!

Part of the CWB 'ProBono' obligation to livestock producers to provide cheap feed.

There will never be a solution through CWB votes... which is EXACTLY why Goodale set up CWB elections as he did!!!!

Comment

-

Case in point this years malt sales program which obviously sold the product in the spring before it was even planted and did nothing in the way of risk management to protect those sales leaving the farmers who did produce the small amount of malt on the hook for the decisions.

The board seems to do a whale of a job leaving the downside open while limiting the upside in a market year after year.

Comment

- Reply to this Thread

- Return to Topic List

Comment