Investors need to be calmed over the weekend or risk Meltdown Monday. Top of cattle market as well?

Announcement

Collapse

No announcement yet.

Banking failure

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

-

Gold had a big day Friday Errol, commodities seen as a safe haven. The beef market is tight on the supply side I don't see a pull back coming, like booze and cigarettes demand is somewhat inelastic.Originally posted by errolanderson View PostInvestors need to be calmed over the weekend or risk Meltdown Monday. Top of cattle market as well?Last edited by biglentil; Mar 11, 2023, 13:02.

Comment

-

Listening a round table discussion including Mark Cuban this morning. Apparently, SVB is the 2nd largest bank failure in U.S.history.

Indications are (from discussion) more banks are likely going to go down. Payrolls may not be made in some cases. Bank industry turmoil.

Record credit card debt and car loans are flash points. U.S. innovation will suffer a setback with many banks tied into SVB (from discussion).

Many more questions than answers. Have central bankers (The Fed) totally blown it? Participants suggest regulators to blame. Also, a lot of greed and risk-taking appear imploding (according to participants).

Comment

-

That’s why there are an every increasing number of 25,000 acre farms with 40 million+ debt. These guys will be the smartest ones by borrowing as much as you canOriginally posted by TOM4CWB View PostUS FDIC shut down Silicon Valley…

They have 151$Billion in uninsured deposits… all the tech layoffs are coming home to roost…. Money not going in as fast as being withdrawn…

$250K limit on insured deposits… in the US…

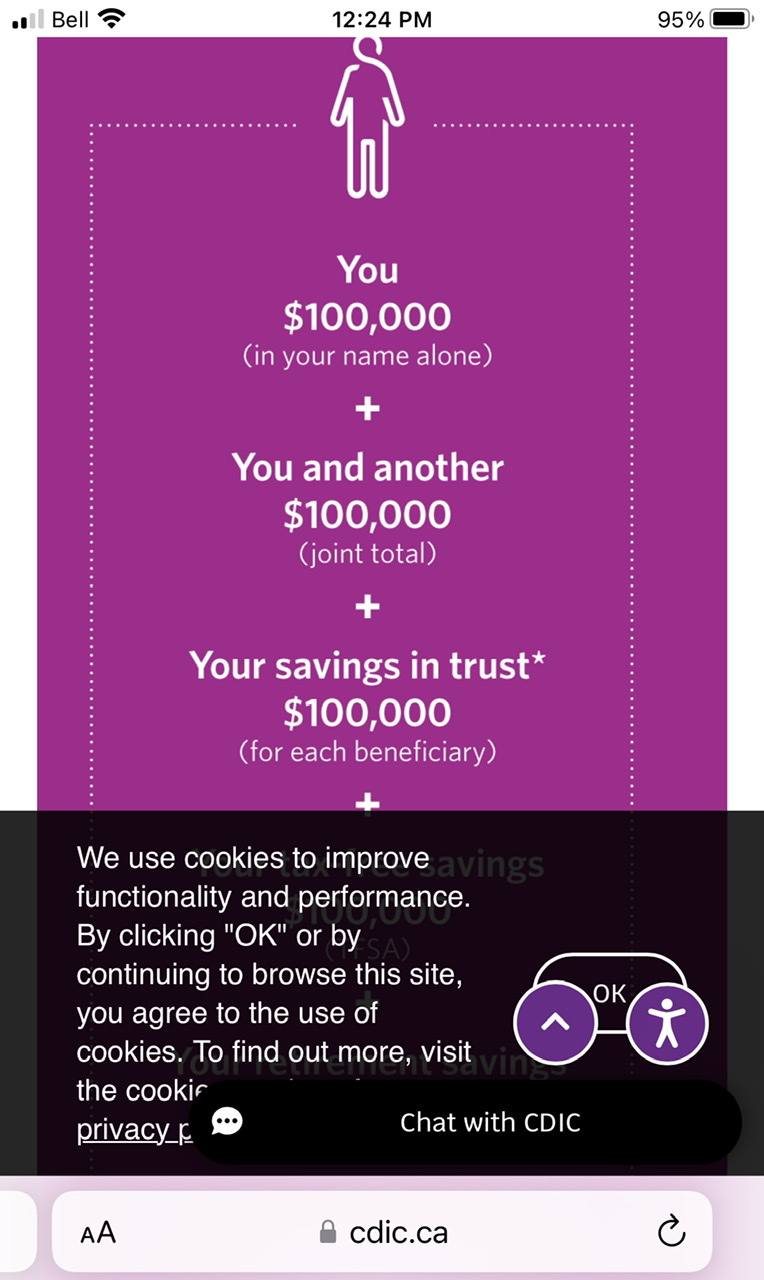

CDIC in Canada… $100K! At Chartered Banks…

What insanity. Why isn’t the limit $1Million????

Land is worth 10x 2000 levels…. Combines and Tractors… close to the same….

Trust the Government????

Cheers

Comment

-

There is alot more money around now than in the 80’s ( 43 years ago)

, markets are cycles, prices for everything goes up and down(sometimes) ot many could hold out for smokes to go down, iPhones, or homes, etc

Doing nothing is a decision, not always a good one

Comment

- Reply to this Thread

- Return to Topic List

Comment