Originally posted by TOM4CWB

View Post

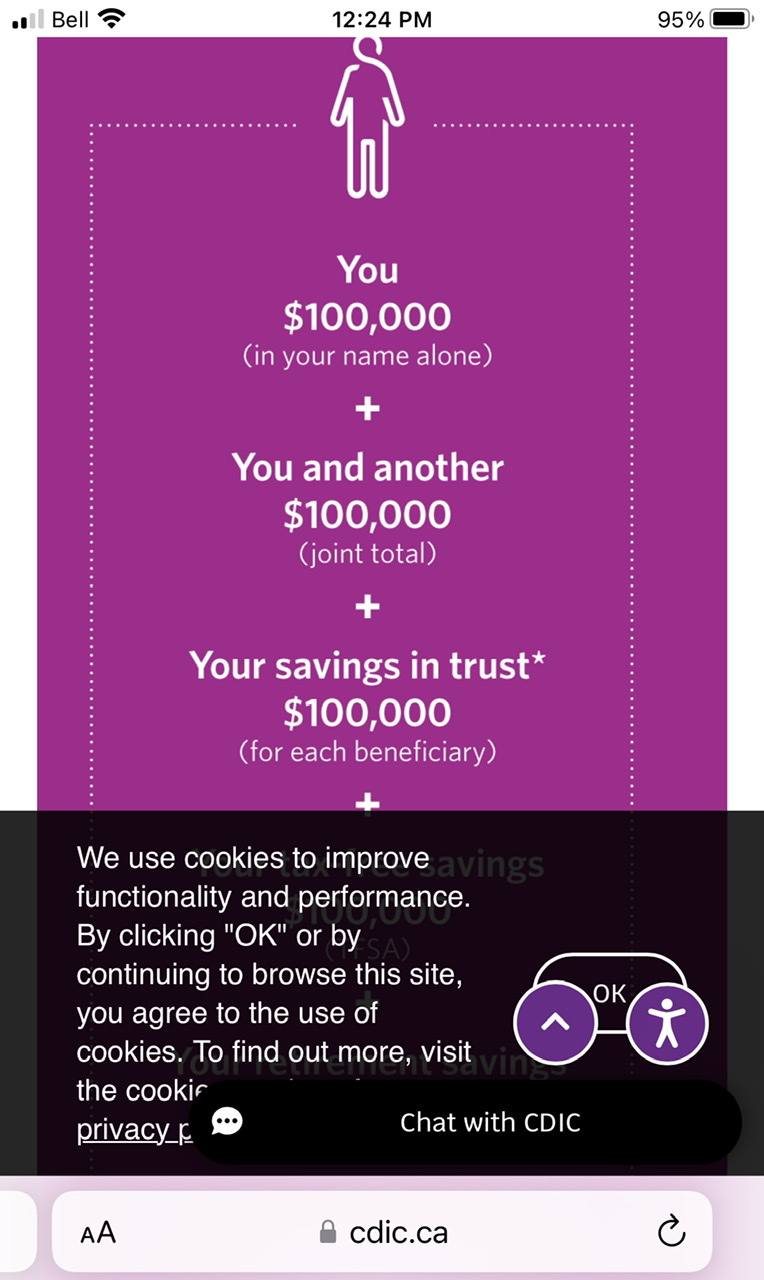

Trudeau put 'bail in' legislation through in 2018. This is all scripted.

Comment