this post ended up very long, so first off, here is the Cliff's notes version:

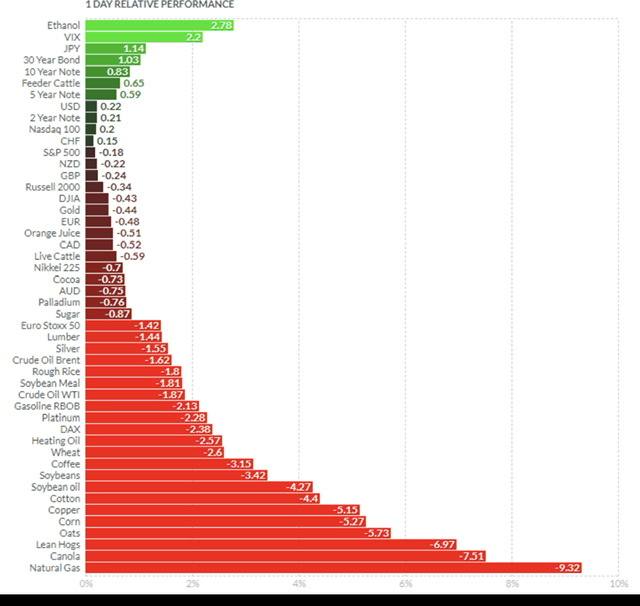

Anything central banks or governments do to try to control inflation can not possibly work on any product which is in short supply. As of today, the market may believe that commodity prices are(were) this high because of money printing, or cheap interest, and that removing those two will magically make the shortages or the causes of those shortages go away, so they are exiting from commodities. That may be true for lumber, etc. But most definitely doesn't apply to non discretionary products such as food, or the inputs required to grow process and distribute it.

The long version now:

This article about palm oil is worth reading:

Malaysian palm oil farmers weren't able to secure enough fertilizer, even if money was no issue. As a result of this and shortage of labour, the Malaysian Palm oil association predicts the yields will be off as much as 25% compared to earlier predictions. And Malaysia is responsible for about 10% of world veg oil production. Off the top of my head, that would be a bigger drop than Canada's canola oil drop due to drought last year. This is the last sentence:

plus there’s the high cost of labor and fertilizers,†Cheng said. “Oil palm plantations are not growing but shrinking due to areas being abandoned over the last few years Abandoned Due to high costs. Yet our politicians and bankers think that raising interest rates and withdrawing capital from the market will improve the supply shortages. It will only exacerbate them.

This is just a single example of what is happening all over the world right now, especially in the developing world. Peter Zeihan has been beating this drum for months. He says we won't know until harvest, but that yields in much of the(developing) world will be greatly reduced due to input shortages and being cost prohibitive. Does this 25% reduction apply across the board? He is talking about global famine starting very soon.

The reason we had the pleasure of paying so much for fertilizer, is that we had to compete with the rest of the world for a much reduced supply. First world countries with strong currencies ( relatively speaking) and access to capital/financing, and home grown production in many cases, managed to obtain our inputs at the expense of the rest of the world who fought over the table scraps.

There exists the very real possibility ( I'd go so far as to say it is guaranteed) that Russia will cut off gas to Europe next winter, if sanctions and equipment shortages or war don't do it sooner. Fertilizer will be the first industry to be shut down again when gas is in short supply. All oil, gas and coal are in a structural deficit that will take years to recitify, even without economic growth, even with economic contraction. The industry has been so starved of capital due to low prices and insane green policies that even with oil now at over $100, replacement at all stages is still way behind usage.

And not just natural gas. the same applies directly to fertilizer and food.

South America imports virtually all fertilizer. Brazil has a plan to reduce imports from 85% to 45%. By 2050. Almost 30 years. This isn't going to be solved overnight by hiking interest rates. That won't speed up that timeline from 30 years to 30 days, in fact it will extend the timeline, given how captial intensive the process will be.

Shortage of inputs, plus increasing capital costs will reduce production of virtually everything, at a time when they need to be increasing.

Another good( bad) example is Sri Lanka. Supposedly went organic for altruistic reasons. But as it turned out, they couldn't afford to import inputs, so the government legislated all farms to be organic. And that was long before the war even started. Same with the Malaysia story above, it mentions that the trend of under fertilization has been going on for 2 to 3 years already. These examples will become increasingly common. Their exports are removed from the market, their imports increase, if they can afford to import food.

The current market action might be hard on the stomach, and might look justified based on weather and crop conditions across the first world as of today, and we might have convinced ourselves that demand for ag commodities is flexible, raise interest rates and we will all eat less calories, but, given all the above, even if the major exporters all have average or above crops, it cannot make up for the defecit of the rest of the world. We don't need to have a drought.

That won't keep the market from throwing the baby out with the bath water, but lower prices to producers will only make it worse.

Anything central banks or governments do to try to control inflation can not possibly work on any product which is in short supply. As of today, the market may believe that commodity prices are(were) this high because of money printing, or cheap interest, and that removing those two will magically make the shortages or the causes of those shortages go away, so they are exiting from commodities. That may be true for lumber, etc. But most definitely doesn't apply to non discretionary products such as food, or the inputs required to grow process and distribute it.

The long version now:

This article about palm oil is worth reading:

Malaysian palm oil farmers weren't able to secure enough fertilizer, even if money was no issue. As a result of this and shortage of labour, the Malaysian Palm oil association predicts the yields will be off as much as 25% compared to earlier predictions. And Malaysia is responsible for about 10% of world veg oil production. Off the top of my head, that would be a bigger drop than Canada's canola oil drop due to drought last year. This is the last sentence:

plus there’s the high cost of labor and fertilizers,†Cheng said. “Oil palm plantations are not growing but shrinking due to areas being abandoned over the last few years Abandoned Due to high costs. Yet our politicians and bankers think that raising interest rates and withdrawing capital from the market will improve the supply shortages. It will only exacerbate them.

This is just a single example of what is happening all over the world right now, especially in the developing world. Peter Zeihan has been beating this drum for months. He says we won't know until harvest, but that yields in much of the(developing) world will be greatly reduced due to input shortages and being cost prohibitive. Does this 25% reduction apply across the board? He is talking about global famine starting very soon.

The reason we had the pleasure of paying so much for fertilizer, is that we had to compete with the rest of the world for a much reduced supply. First world countries with strong currencies ( relatively speaking) and access to capital/financing, and home grown production in many cases, managed to obtain our inputs at the expense of the rest of the world who fought over the table scraps.

There exists the very real possibility ( I'd go so far as to say it is guaranteed) that Russia will cut off gas to Europe next winter, if sanctions and equipment shortages or war don't do it sooner. Fertilizer will be the first industry to be shut down again when gas is in short supply. All oil, gas and coal are in a structural deficit that will take years to recitify, even without economic growth, even with economic contraction. The industry has been so starved of capital due to low prices and insane green policies that even with oil now at over $100, replacement at all stages is still way behind usage.

And not just natural gas. the same applies directly to fertilizer and food.

South America imports virtually all fertilizer. Brazil has a plan to reduce imports from 85% to 45%. By 2050. Almost 30 years. This isn't going to be solved overnight by hiking interest rates. That won't speed up that timeline from 30 years to 30 days, in fact it will extend the timeline, given how captial intensive the process will be.

Shortage of inputs, plus increasing capital costs will reduce production of virtually everything, at a time when they need to be increasing.

Another good( bad) example is Sri Lanka. Supposedly went organic for altruistic reasons. But as it turned out, they couldn't afford to import inputs, so the government legislated all farms to be organic. And that was long before the war even started. Same with the Malaysia story above, it mentions that the trend of under fertilization has been going on for 2 to 3 years already. These examples will become increasingly common. Their exports are removed from the market, their imports increase, if they can afford to import food.

The current market action might be hard on the stomach, and might look justified based on weather and crop conditions across the first world as of today, and we might have convinced ourselves that demand for ag commodities is flexible, raise interest rates and we will all eat less calories, but, given all the above, even if the major exporters all have average or above crops, it cannot make up for the defecit of the rest of the world. We don't need to have a drought.

That won't keep the market from throwing the baby out with the bath water, but lower prices to producers will only make it worse.

Comment