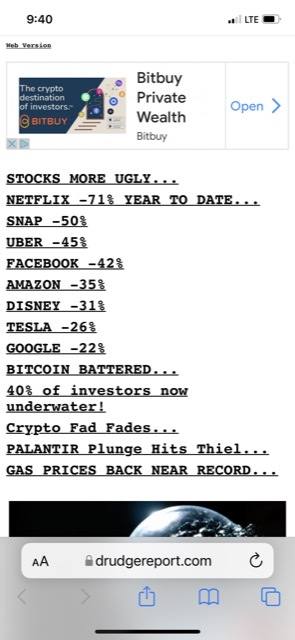

How to describe today’s stock market SWOON? PLUNGE? CRASH?

S&P 500 index breaks below 4,000 points.

This is the outcome of excessive money printing (for the past 13 years) by central bankers artificially jacking asset prices higher without true productivity, earnings or innovation. Markets are now spiralling on failing central bank Keynesian economic policy that may take years-to-repair. Inflation has taken-a-hit . . . .

S&P 500 index breaks below 4,000 points.

This is the outcome of excessive money printing (for the past 13 years) by central bankers artificially jacking asset prices higher without true productivity, earnings or innovation. Markets are now spiralling on failing central bank Keynesian economic policy that may take years-to-repair. Inflation has taken-a-hit . . . .

Comment