Gold $1972.90 at close March 4, 2022. Yep, looks like deflation to me. Hmmm

Announcement

Collapse

No announcement yet.

Inflation’s Collapse

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Oil price shock will fast-track the incoming global recession. U.S. Fed hinting this week rate, hikes may be pushed off. We’ll see, mid-March announcement.

To me, 100 percent probability of recession (it’s just the degree-of-severity now and what markets call the setback).

Can central banks catch up to-the-times quick enough. Do they have an impact anyway?

My opinion, not shared by many.

Comment

-

U.S. mortgage rates actually dropped this week.

A drop in the U.S. 10-year treasuries to a 6-week low is said to be the reason. 30 year mortgage rates dropped from 4.19 to 3.9 percent this past week.

Russia conflict and uncertainty is likely the real reason . . . .

Comment

-

Watched a Russian drive to 3 different gasoline stations in Russia. He figured around $.50/liter US for gas. 92 octane.

North America is getting to be a sad place for taxes.

Will Sask party drop pst seeing how commodities are crazy high? Or just keep putting screws to tax payers.

Comment

-

Hyperinflation of commodities without a doubt.

But how can it not end in recession?

How can they continue with the great green reset with the the commodities hyperinflated and susidies required to make it float?

Surely the run up in inflation will eventually kill the rapid expansion in the money supply? Why print more if it buys less?Last edited by shtferbrains; Mar 7, 2022, 10:24.

Comment

-

Interesting thread. For myself unless i am not getting it, I see very high inflation in so many things. I know of a few guys that refuse to lock in inputs for this spring as they feel they are too high and will drop. We will see. Glyphosate bought a year ago cost me $5532 for a 1000 Litre tote. The same tote today costs $14298. As a recreational hunter and shooter, anything firearm, ammo or reloading related has been on a huge increase. We all know about land, food and fuel cost increases. Maybe we will see deflation on stuff people realize they don't need in today's worlds. I see farmers going to auctions and paying unheard of prices for 30- and 40-year-old tractors because they don't want to pay the price on newer iron. It is sad that we don't have national leadership that could see that we should be see that we should be set up to service the world appetite that is high for so much of we produce whether it be from agriculture, oil, gas, mining or forestry. I see the markets today are thinking about the prospect of the Ukraine not getting a crop in. Would you plant if you thought Ivan might seize what you grew for war reparations like they did in WW2? I think this Ukraine thing just threw the S/U ratios out the window for another year at least. As a simple farmers just growing crops for people to buy I feel this could be the worst of times or the best of times for the next year.

Comment

-

The reality of the current crisis is that prices are rising for some commodities and collapsing for others. For example, it's almost to the point where you cannot give away Russian crude while simultaneously European consumers are going to go bankrupt heating their homes. This is the reality of severe economic dislocation.

Rising wheat prices are great if you only look at one side of the ledger. Rising costs for fertilizer and fuel are going to eat up margins. For that reason, it's better to focus on profit margins. I don't think this crisis is going to be positive for margins, especially if the B of C follows through with more interest rate hikes.

Comment

-

-

Comment

-

Interesting article from David Rosenberg this morning entitled;

Bank of Canada will have to 'kill the economy' to crush inflation.

Well, the 'kill the economy' appears well on-the-way . . . .

Comment

-

Are the panicked buying price highs in for oil, wheat and gold?

May Chicago / KC wheat off 20% from Monday highs. May MWE off about 15%. Crude oil could break $100 per barrel should OPEC budge on production? Gold swaying both sides of $2,000 . . . .

Comment

-

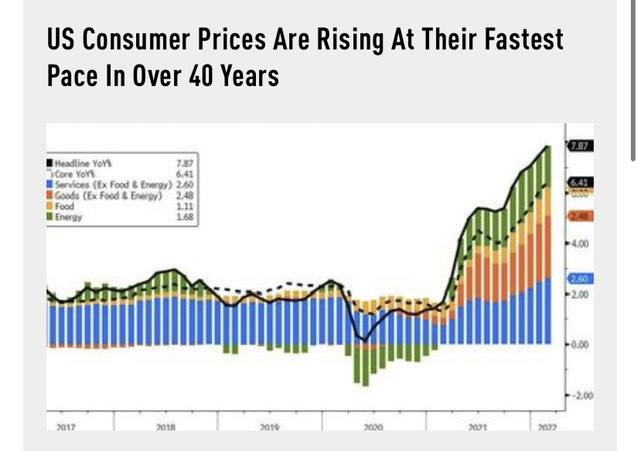

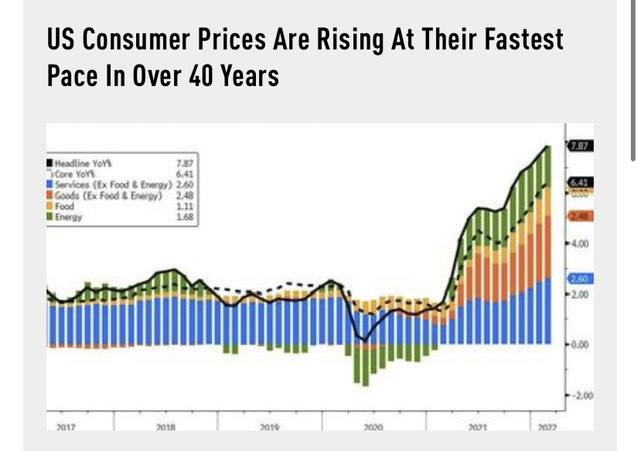

Interesting graph when you think of who is / was in power in the US the past 4-5 years ...

BYW this started long before the Ukrainian situation that government and media are going to try to blame it on .Last edited by furrowtickler; Mar 10, 2022, 10:55.

Comment

-

-

That is a great chart.Originally posted by furrowtickler View PostInteresting graph when you think of who is / was in power in the US the past 4-5 years ...

BYW this started long before the Ukrainian situation that government and media are going to try to blame it on .

The green lines are energy and drop below the line when Trump encouraged FF exploration and fracking bring down the cost of living in a buoyant economy.

Rapidly moved to the negative side with build back better theme.

Comment

- Reply to this Thread

- Return to Topic List

Comment