Glad to see u back Macdon. What u seeing for grain prices in the next 6 months?

Announcement

Collapse

No announcement yet.

Canola price & land prices

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

The issue is land prices always seemed a little more than what seemed reasonable.

Even when it was "cheap" few wanted the risk and investor money came in at bargin prices and looked like wizards.

In the late 80's there was large quantities of prime acres sat for years at less than $500/acres.

Shoulda~Coulda!

Comment

-

Circling back to the land craze, I think there will be more land being sold this winter as people can finally get paid to put money in the bank. Everyone gets older and inheritance’s are easier when dealing with dollars and cents then 1/4’s

I never farmed in the 80s, but I still have grey hair.. and I believe (and this will sounds crazy) land is still undervalued.

The reason I believe this is for a few reasons.. priced out some new equipment this fall; a large combine with 50’ header was 1.4 million, 135’ sprayer 850k, a nice pickup truck is closing in on 100k with taxes, a house sells in 3 days in Saskatoon for over asking price. My point to all of this is in 10 years I’d rather own that piece of land, even with a 25% price reduction, than a worn out combine, busted up sprayer, rusted truck or a house that needs to be remodelled.

A person just has to make sure he can stay afloat and not get caught making interest only pmts. And don’t use the rainy day fund for the down pmt.. that’s for when shit hits the fan!!

Comment

-

Well, the first thing you need to recognize is currency, Dr Death is traveling country to country and taking the scythe to everyone that's a component of the US $ index, Europe likely won't keep the lights on this winter, and if they do, they don't have enough water in their river system to transport or keep the herd happy. They are imploding, the union is done. Japan, well if you haven't heard the yen finally broke out of its eternal continuation pattern, it's dead. British pound, yeah old news now. So the loonie, $1.40 is the level on forex in watching, is confederation over? $1.40 is the level that will decide that, otherwise we keep trading as a oil currency, stronger than expected. Now the target on USD is 200 at this point, the Mississippi doesn't have enough water either and short of a hurricane replenishing it, they are gonna have issues moving product as well. I'm expecting stronger than normal basis, we are already seeing it. If canola can get over the 912 level, it has legs and lots of them, 1300~ ish As long as no peace talks happen in eastern Europe we are going to see traditionally "outstanding" grain prices, hence the ratchet. Wheat, is my nemesis, but I'll take stab at Chicago #'s, I'm expecting $18. November is a turn point and it'll be significant either way, it just needs to punch through the 940 level and it's gone. The rumor mill says we see mushroom clouds in Ukraine Nov 7 weekOriginally posted by FarmJunkie View PostGlad to see u back Macdon. What u seeing for grain prices in the next 6 months?

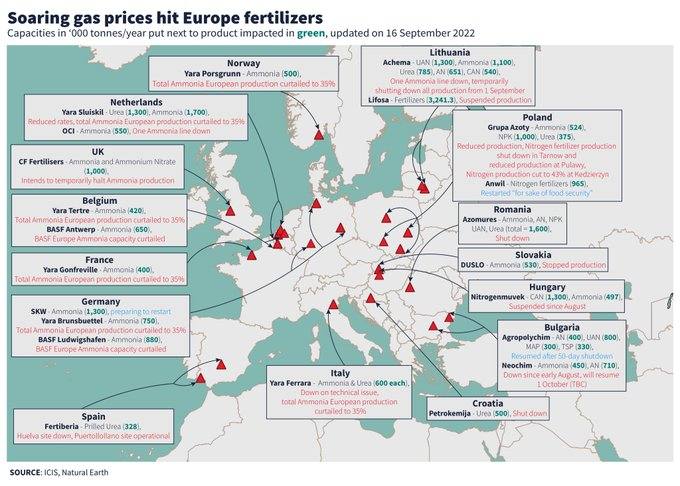

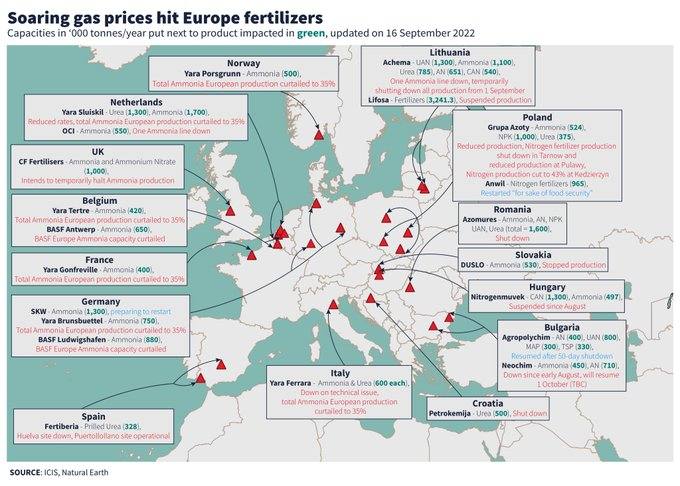

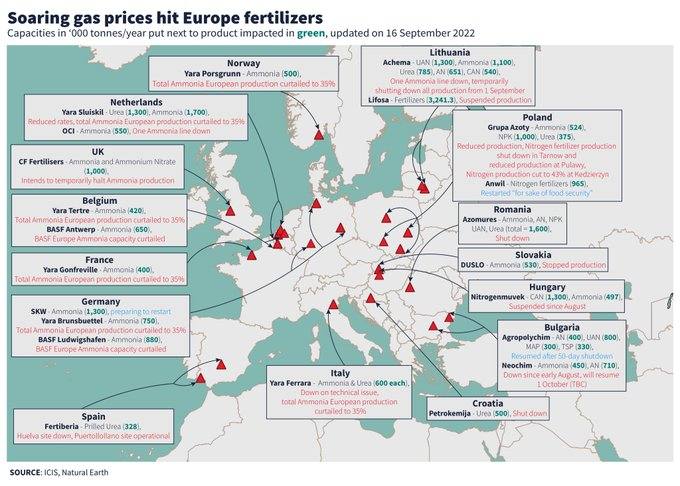

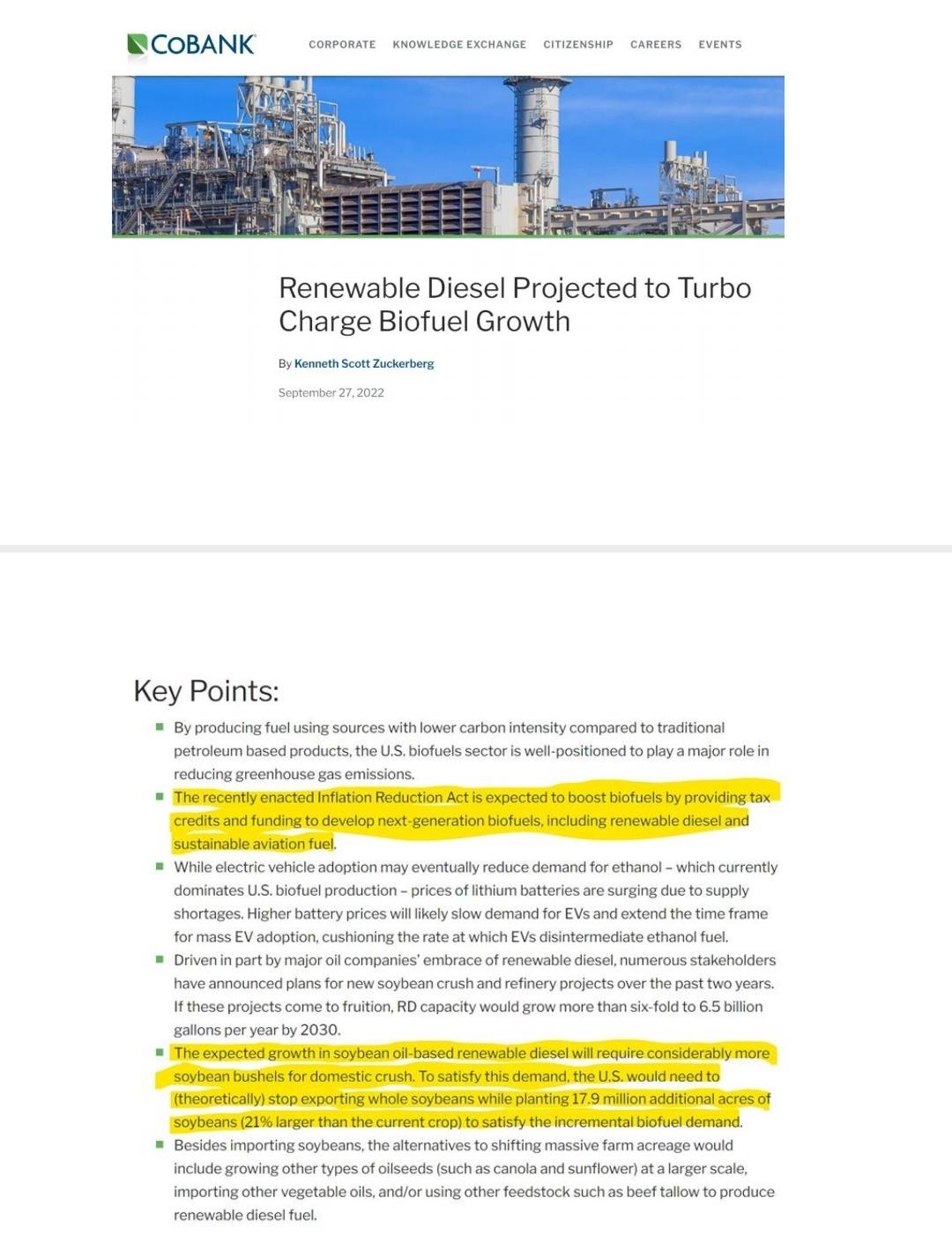

Here's a map of the fert and chem plants in Europe that are throttled due to ng availability, it's probably worse now, unless the new pipe announced same day as NS ruptured fills the gap... the most important is that chem plant a they produce a lot of our active ingredients. Then we got Brazil, if they change president's, that idiot Lula is promising to destroy agriculture. So I don't know where the fat kids are getting their donuts and French fries because California and BC are taking every bushel of canola we grow for diesel, North America will be an importer of veg oil with current regulation veg oil for fuel. It helps to know well connected Americans that have spent time on a trading floor. We are being slow played on the significance of Clean Fuels, and the Inflation Reduction act. Both are LOADED with subsidies to Big Oil to not use crude, it just comes down to when does the USD top out and gold breaks out with its hair on fire because as we've already seen here in Canada, people are losing confidence in govt like never seen. Did watch an interesting video with Charlie Munger that fits this, he figures all currency goes to 0. Japan had no currency for 600 years because the emperors kept devaluing. It's what you can touch and defend that holds value. Something will be used for transactions, but wealth won't be held in a bank or in paper of any form. And here's what's important when that happens, the story of a Bosnian

https://prephole.com/surviving-a-year-of-shtf-in-90s-bosnia-war-selco-forum-thread-6265/Last edited by macdon02; Oct 8, 2022, 20:41.

Comment

-

Do you have a timeframe for the $18 wheat?Originally posted by macdon02 View PostWell, the first thing you need to recognize is currency, Dr Death is traveling country to country and taking the scythe to everyone that's a component of the US $ index, Europe likely won't keep the lights on this winter, and if they do, they don't have enough water in their river system to transport or keep the herd happy. They are imploding, the union is done. Japan, well if you haven't heard the yen finally broke out of its eternal continuation pattern, it's dead. British pound, yeah old news now. So the loonie, $1.40 is the level on forex in watching, is confederation over? $1.40 is the level that will decide that, otherwise we keep trading as a oil currency, stronger than expected. Now the target on USD is 200 at this point, the Mississippi doesn't have enough water either and short of a hurricane replenishing it, they are gonna have issues moving product as well. I'm expecting stronger than normal basis, we are already seeing it. If canola can get over the 912 level, it has legs and lots of them, 1300~ ish As long as no peace talks happen in eastern Europe we are going to see traditionally "outstanding" grain prices, hence the ratchet. Wheat, is my nemesis, but I'll take stab at Chicago #'s, I'm expecting $18. November is a turn point and it'll be significant either way, it just needs to punch through the 940 level and it's gone. The rumor mill says we see mushroom clouds in Ukraine Nov 7 week

Here's a map of the fert and chem plants in Europe that are throttled due to ng availability, it's probably worse now, unless the new pipe announced same day as NS ruptured fills the gap... the most important is that chem plant a they produce a lot of our active ingredients. Then we got Brazil, if they change president's, that idiot Lula is promising to destroy agriculture. So I don't know where the fat kids are getting their donuts and French fries because California and BC are taking every bushel of canola we grow for diesel, North America will be an importer of veg oil with current regulation veg oil for fuel. It helps to know well connected Americans that have spent time on a trading floor. We are being slow played on the significance of Clean Fuels, and the Inflation Reduction act. Both are LOADED with subsidies to Big Oil to not use crude, it just comes down to when does the USD top out and gold breaks out with its hair on fire because as we've already seen here in Canada, people are losing confidence in govt like never seen. Did watch an interesting video with Charlie Munger that fits this, he figures all currency goes to 0. Japan had no currency for 600 years because the emperors kept devaluing. It's what you can touch and defend that holds value. Something will be used for transactions, but wealth won't be held in a bank or in paper of any form. And here's what's important when that happens, the story of a Bosnian

https://prephole.com/surviving-a-year-of-shtf-in-90s-bosnia-war-selco-forum-thread-6265/

Comment

-

Watched that prepper video. Very interesting. Hard to believe having matches or lighters is worth more than having some foods. Hope it don’t come to thatOriginally posted by macdon02 View PostWell, the first thing you need to recognize is currency, Dr Death is traveling country to country and taking the scythe to everyone that's a component of the US $ index, Europe likely won't keep the lights on this winter, and if they do, they don't have enough water in their river system to transport or keep the herd happy. They are imploding, the union is done. Japan, well if you haven't heard the yen finally broke out of its eternal continuation pattern, it's dead. British pound, yeah old news now. So the loonie, $1.40 is the level on forex in watching, is confederation over? $1.40 is the level that will decide that, otherwise we keep trading as a oil currency, stronger than expected. Now the target on USD is 200 at this point, the Mississippi doesn't have enough water either and short of a hurricane replenishing it, they are gonna have issues moving product as well. I'm expecting stronger than normal basis, we are already seeing it. If canola can get over the 912 level, it has legs and lots of them, 1300~ ish As long as no peace talks happen in eastern Europe we are going to see traditionally "outstanding" grain prices, hence the ratchet. Wheat, is my nemesis, but I'll take stab at Chicago #'s, I'm expecting $18. November is a turn point and it'll be significant either way, it just needs to punch through the 940 level and it's gone. The rumor mill says we see mushroom clouds in Ukraine Nov 7 week

Here's a map of the fert and chem plants in Europe that are throttled due to ng availability, it's probably worse now, unless the new pipe announced same day as NS ruptured fills the gap... the most important is that chem plant a they produce a lot of our active ingredients. Then we got Brazil, if they change president's, that idiot Lula is promising to destroy agriculture. So I don't know where the fat kids are getting their donuts and French fries because California and BC are taking every bushel of canola we grow for diesel, North America will be an importer of veg oil with current regulation veg oil for fuel. It helps to know well connected Americans that have spent time on a trading floor. We are being slow played on the significance of Clean Fuels, and the Inflation Reduction act. Both are LOADED with subsidies to Big Oil to not use crude, it just comes down to when does the USD top out and gold breaks out with its hair on fire because as we've already seen here in Canada, people are losing confidence in govt like never seen. Did watch an interesting video with Charlie Munger that fits this, he figures all currency goes to 0. Japan had no currency for 600 years because the emperors kept devaluing. It's what you can touch and defend that holds value. Something will be used for transactions, but wealth won't be held in a bank or in paper of any form. And here's what's important when that happens, the story of a Bosnian

https://prephole.com/surviving-a-year-of-shtf-in-90s-bosnia-war-selco-forum-thread-6265/

Comment

-

Music to my ears.Originally posted by macdon02 View PostIt's my opinion we are in the mirror image of the flood years, except drought. It's an 8 year trend and if you were a winner during the wet years, it ain't your years coming up.

With sympathies to those on the others side of the pendulum.Last edited by AlbertaFarmer5; Oct 11, 2022, 13:01.

Comment

-

I'm in your area and am curious too.Originally posted by ajl View PostI am seeing some more land coming up for sale and we will likely see more as the fall progresses. Premier auctions has 5 quarters south of Camrose coming up in November. A week later there is a half 10 miles east of Camrose on CLH. I like to watch auctions as they are real valuation rather than old land owners figuring what their land is worth. Usually land is never for sale around Camrose. The higher interest rates could get the sales that have been postponed for the decade or more on the go. Stay tuned. 5.25% GIC: gicwealth.ca

The ratio of owned or old low pmnt acres to buy a new one has simply gone from 4-10. Lots of high equity farmer buyers left.

We have never had investor buyers here because it is a stable weather area with farmers paying market price.

Agree that there is also a lot going to change hands in next ten years as the owners age.

Comment

-

That is the exact problem with grain in storage. Why didn't I pull the trigger at $28. Now have to sit on it until $30. Not getting younger.Originally posted by crusher View PostNice to see so many bulled up. Reminds me of when canola was $28 a few months ago and everyone was waiting for $30.

Comment

-

Guest

Guest -

Originally posted by macdon02 View Post

Honeywell announced a new ethanol-to-jet fuel (ETJ) processing technology that allows producers to convert corn-based, cellulosic, or sugar-based ethanol into sustainable aviation fuel (SAF). Depending on the type of ethanol feedstock used, jet fuel produced from Honeywell’s ethanol-to-jet fuel process can reduce greenhouse gas (GHG) emissions by up to 80%...

Honeywell announced a new ethanol-to-jet fuel (ETJ) processing technology that allows producers to convert corn-based, cellulosic, or sugar-based ethanol into sustainable aviation fuel (SAF). Depending on the type of ethanol feedstock used, jet fuel produced from Honeywell’s ethanol-to-jet fuel process can reduce greenhouse gas (GHG) emissions by up to 80%...

"Honeywell introduces new ethanol-to-jet technology

11 October 2022

Honeywell announced a new ethanol-to-jet fuel (ETJ) processing technology that allows producers to convert corn-based, cellulosic, or sugar-based ethanol into sustainable aviation fuel (SAF). Depending on the type of ethanol feedstock used, jet fuel produced from Honeywell’s ethanol-to-jet fuel process can reduce greenhouse gas (GHG) emissions by up to 80% on a total lifecycle basis, compared to petroleum-based jet fuel (based on the EPA’s summary LCA of GHG emissions for sugarcane.)

Ethanol and isobutanol feedstocks for Alcohol-to-Jet fuels are covered in Annex 5 of ASTM D7566. (Earlier post.)

Demand for SAF continues to grow, yet the aviation industry is challenged by limited supplies of traditional SAF feedstocks such as vegetable oils, animal fats and waste oils. Ethanol offers producers a widely available, economically viable feedstock. Honeywell says that its ready-now technology uses high-performance catalysts and heat management capabilities to maximize production efficiency, resulting in a cost-effective, lower carbon intensity aviation fuel.

A 2021 life-cycle analysis by the US Department of Energy’s (DOE) Argonne National Laboratory concluded that ethanol-to-jet fuel conversion, combined with other technologies such as carbon capture and sequestration (CCUS) and smart farming practices, can result in negative GHG emissions compared to petroleum-based jet fuel.

Honeywell pioneered SAF production with its Ecofining technology, and our new ethanol-to-jet fuel process builds on that original innovation to support the global aviation sector's efforts to reduce GHG emissions and meet SAF production targets with an abundant feedstock like ethanol. Honeywell’s ethanol-to-jet process, when used as a standalone or when coupled with Honeywell carbon capture technology, is ready now to provide a pathway to lower carbon-intensity SAF.

—Barry Glickman, vice president and general manager, Honeywell Sustainable Technology Solutions

SAF plants using Honeywell’s technology can be modularized off site enabling lower installed costs and faster, less labor-intensive installation compared to job site construction. By utilizing Honeywell’s ETJ technology and an integrated, modular construction approach, producers can build new SAF capacity more than a year faster than is possible with traditional construction approaches, the company says.

Petroleum refiners and transportation fuel producers can also benefit from Honeywell’s ETJ design that is purpose-built to enable conversion of current or idle facilities into SAF production plants, potentially maximizing use of exiting sites for SAF production to meet the growing market demand."

Comment

-

A neighbour seed plant told me that he sold a contract of yellow flax at $80/ bushel. Farmers are starting to combine flax around here now. Very few farmers have any acres of Canola still out. This week will be a wrap for the BTO at Lajord. What a fall! Who’d of thunk it when we were seeding in June?Last edited by sumdumguy; Oct 12, 2022, 07:05.

Comment

- Reply to this Thread

- Return to Topic List

Comment