Announcement

Collapse

No announcement yet.

Canola

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Tags: None

-

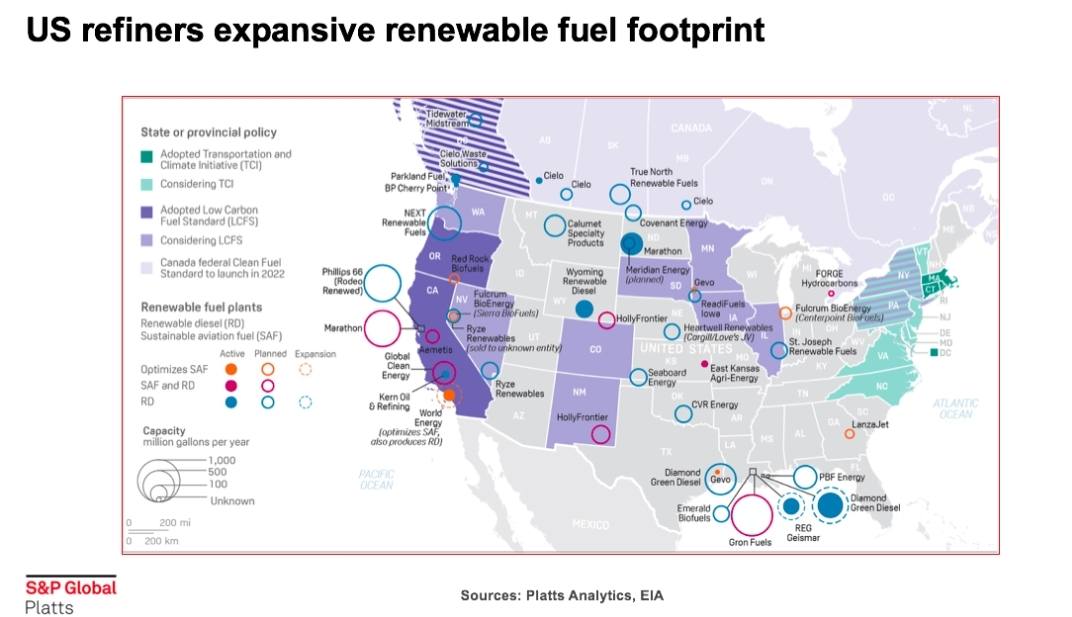

And the underlying commodities seem to be supporting this move. Palm oil keeps making new highs, soyoil heading towards that direction.

Any targets on your chart, or is this blue sky?

-

-

There is a lot of blue sky above the recent high.Originally posted by AlbertaFarmer5 View PostAnd the underlying commodities seem to be supporting this move. Palm oil keeps making new highs, soyoil heading towards that direction.

Any targets on your chart, or is this blue sky?

If new highs are made, then my next levels of interest are 970 and 1018, and will reassess if they are reached.

I have no idea when or if that will happen.

The challenge of being deterministic in a probabilistic world.

Comment

-

Great opportunities for those will canola in the bin , probably best in a lifetime ðŸ‘ðŸ‘

Nightmare on elm street for those with no crop ...Last edited by furrowtickler; Oct 26, 2021, 22:22.

Comment

-

There was a buy signal (that I follow) on the daily Jan Canola chart triggered back in mid September. It is working out nicely with an initial target of $1015/t and a secondary at $1,059.

To help along the way, the soybean oil weekly chart recently triggered a very nice buy signal following the summer consolidation with a target of 85 cents/lb. For those not following, Dec Bean Oil is currently 62.30 cents/lb.

Comment

-

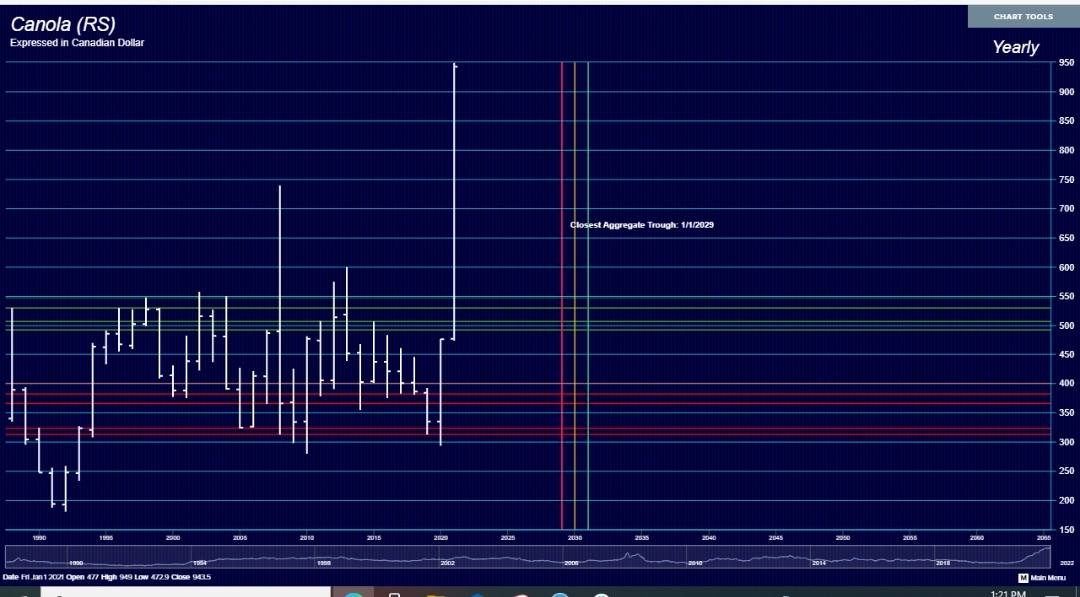

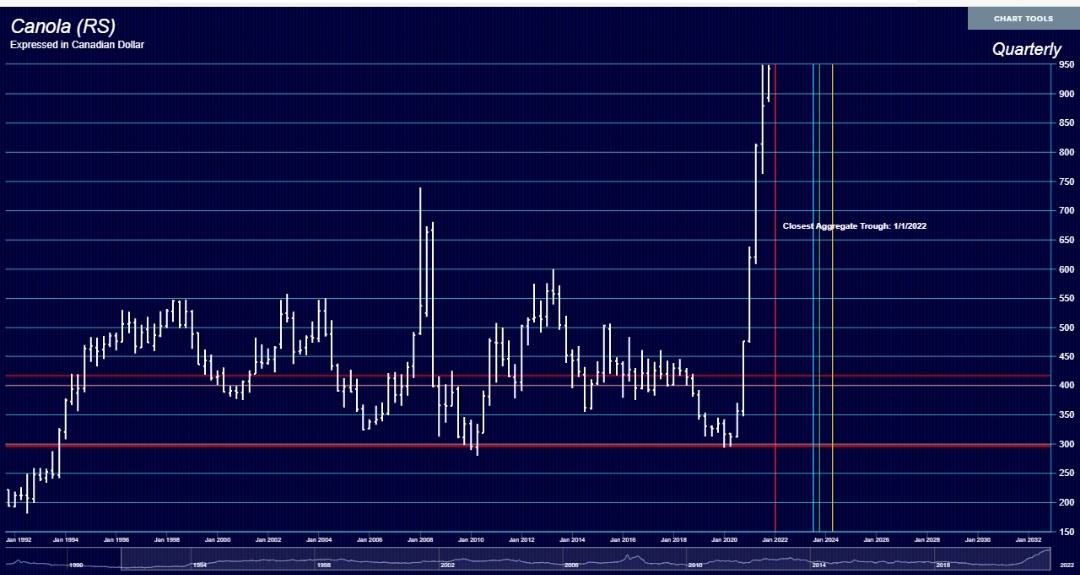

Vertical lines are timing, horizontal are resistance and support. With our new environment minister, talk of fert reduction mandates, does an 8 year rally on a yearly level sound reasonable? This isn't a straight up move but progressively higher highs and higher lows. Idk wtf is coming in February, but it's massive, just about every market i track is showing a Feb or March turn. Beware the ides of March. As we get closer the weekly and daily level will pin point the date, then it comes down to whether market is +/- resistance or support depending on direction of movement. I do show 1256 resistance which seems reasonable at this point in time.

Comment

-

I think you may be more right than not macdon, this won’t carry on forever and that’s the possible nightmare.

Great opportunities now for some but inputs gone crazy , next years risk at all time high .

Add that to the vast majority will be extremely gun-shy to lock in any contracts next year after being completely scorched this fall , and the worst hit areas by far still have had near zero rain as of now with soil dry over 6-8 ft down .

What options are out there to safely protect some high crop prices for next year without massive risk ?

With extremely high inputs, we need today’s pricing to even remotely make it work next year .

Comment

-

Just don't price what you don't physically hold. KISS, long in the bin, long in the field, know your seasonal sell points and pull the trigger less often. The entire game has changed. Pray that Moe doesn't take your cows. End users are going to have a bitch of a time getting forward coverage. Markets will seize up and we will be painted as the bad guy because the consumer has higher food pricesOriginally posted by furrowtickler View PostI think you may be more right than not macdon, this won’t carry on forever and that’s the possible nightmare.

Great opportunities now for some but inputs gone crazy , next years risk at all time high .

Add that to the vast majority will be extremely gun-shy to lock in any contracts next year after being completely scorched this fall , and the worst hit areas by far still have had near zero rain as of now with soil dry over 6-8 ft down .

What options are out there to safely protect some high crop prices for next year without massive risk ?

With extremely high inputs, we need today’s pricing to even remotely make it work next year .

Comment

-

-

A while back we discussed the repeating pattern that has been very predictable in the canola market for many months now.

Every long red bar is followed by a steady climb that goes higher than the red bar.

I should have been trading it when I first noticed. Not many things in life are that guaranteed.

Whenever I see such repeating patterns in a market, I wonder why the traders, user, producers, algo's and investors, would not front load for such events, to the point that they cease to exist. Same with seasonal chart patterns.

Comment

-

Buying the dip is more difficult than it seems.Originally posted by AlbertaFarmer5 View PostA while back we discussed the repeating pattern that has been very predictable in the canola market for many months now.

Every long red bar is followed by a steady climb that goes higher than the red bar.

I should have been trading it when I first noticed. Not many things in life are that guaranteed.

Whenever I see such repeating patterns in a market, I wonder why the traders, user, producers, algo's and investors, would not front load for such events, to the point that they cease to exist. Same with seasonal chart patterns.

BTFD works until it doesn't with the pain of loss being greater than the pleasure of gain.

Losses loom larger than gains.

Buyers tend to want lower prices until they get them.

Investing and trading are all about pattern recognition and that is great that you found something that works for you.

I am very interested in how it works out.

Keep us posted.

Comment

-

To clarify. I'm not buying futures. Already long two crops in the bins, and almost three, since we have 2022 inputs purchased, with no canola priced. I think that is enough risk without being Texas hedged too.Originally posted by wheatking16 View PostBuying the dip is more difficult than it seems.

BTFD works until it doesn't with the pain of loss being greater than the pleasure of gain.

Losses loom larger than gains.

Buyers tend to want lower prices until they get them.

Investing and trading are all about pattern recognition and that is great that you found something that works for you.

I am very interested in how it works out.

Keep us posted.

But for those unable to partake in this rally with physical, it might be a good strategy. Use a tight stop below the bottom of the red bar. Then let it ride for a few weeks at a time.

Comment

- Reply to this Thread

- Return to Topic List

Comment