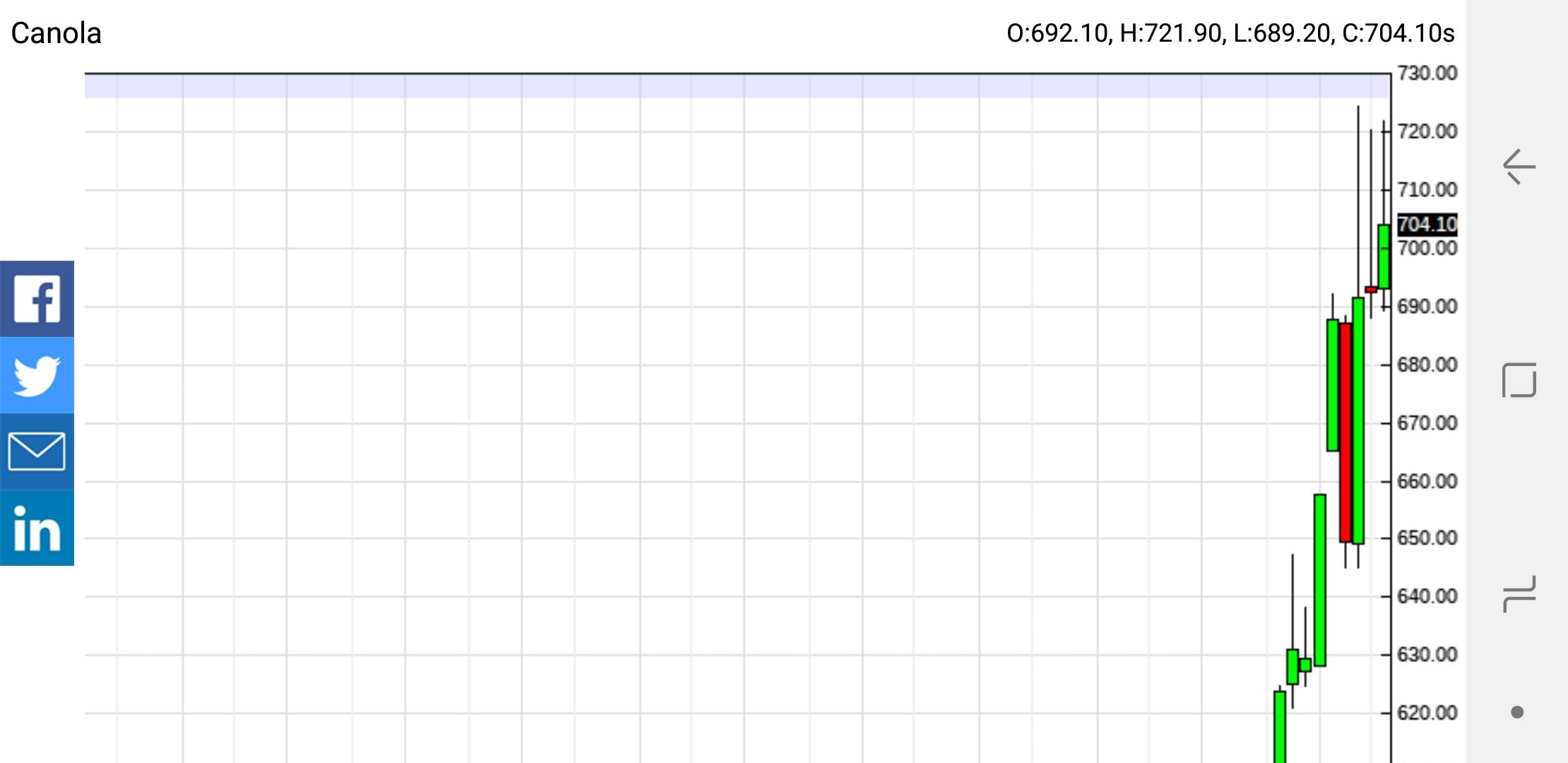

This could get interesting. Or not

13,354 call options to settle yet with nearly all of them in the money. 7 days till expiry....

13,354 call options to settle yet with nearly all of them in the money. 7 days till expiry....

This website uses tracking tools, including cookies. We use these technologies for a variety of reasons, including to recognize new and past website users, to customize your experience, perform analytics and deliver personalized advertising on our sites, apps and newsletters and across the Internet based on your interests.

You agree to our and by clicking I agree.

Comment