MARKETS PARTY LIKE THE 1920’s WITH THE ECONOMY OF THE 1930’s. Be aware of the potential for an incoming volatility shock. Printing money (stimulus) provides no lasting economy, rather deepens the incoming financial crisis and need for financial reset. ProMarket Wire, Calgary

Announcement

Collapse

No announcement yet.

Markets Party Like the 1920's with an Economy of the 1930's

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Tags: None

-

I think the grain markets need to party....as stated in the saskwheat release. ...6 dollar wheat in 1975 is equivalent to 26 bucks today....Originally posted by errolanderson View PostMARKETS PARTY LIKE THE 1920’s WITH THE ECONOMY OF THE 1930’s. Be aware of the potential for an incoming volatility shock. Printing money (stimulus) provides no lasting economy, rather deepens the incoming financial crisis and need for financial reset. ProMarket Wire, Calgary

Everything else in my life has been indexed ....except for the price I receive for my grain. ..

-

Many industries and sectors of the economy have been far harder hit than our grain industry. Grains have been a leader to the upside and profitability during these difficult times . . . .Originally posted by bucket View PostI think the grain markets need to party....as stated in the saskwheat release. ...6 dollar wheat in 1975 is equivalent to 26 bucks today....

Everything else in my life has been indexed ....except for the price I receive for my grain. ..

Comment

-

Do a comparison from 1975 and then rethink what you just said...Originally posted by errolanderson View PostMany industries and sectors of the economy have been far harder hit than our grain industry. Grains have been a leader to the upside and profitability during these difficult times . . . .

I doubt you are working for 2005 wages let alone 1975 wages which wouldn't be enough to fill your gas tank....

BTW oil prices are the same as 1975 and gasoline is 50 times the 1975 price at the pumps...

Comment

-

errol, the equities market decoupled with main street about 2 recessions ago. I dont expect this to reverse anytime soon. The average bloke owns a bit of the equities in their pensions and 401ks. The equities market is really a proxy for the 1% now. Wealth always concentrates at the top.

What you are seeing is stimulus cash finding its way into equities either by direct govt intervention or stock buy backs and dividend repurchases.

Comment

-

jazz . . . agree with you. But this doesn't mean that stocks forever go up on false economics protecting the wealthy. This is a Humpty Dumpty market if there ever was one (IMO) . . . .Originally posted by jazz View Posterrol, the equities market decoupled with main street about 2 recessions ago. I dont expect this to reverse anytime soon. The average bloke owns a bit of the equities in their pensions and 401ks. The equities market is really a proxy for the 1% now. Wealth always concentrates at the top.

What you are seeing is stimulus cash finding its way into equities either by direct govt intervention or stock buy backs and dividend repurchases.

Comment

-

Aren't governments and central banks keeping the equities stable/rising to protect the avg Joe&Jane 6-pack's IRA and RSP and their corporate pension???Originally posted by errolanderson View Postjazz . . . agree with you. But this doesn't mean that stocks forever go up on false economics protecting the wealthy. This is a Humpty Dumpty market if there ever was one (IMO) . . . .

The ultra rich are benefitting from government actions to avoid a crash, that would wipe out 70% of the citizens.

Comment

-

The MSM narrative of the deflationary boogeyman is equivalent of the Covid 19 boogeyman. Neither have any teeth. What we have is the 'crack up boom' facilitated by monetary expansion. It's equivalent to the ancient alchemaic pursuit to turn lead into gold, in modern day its the goal of turning freshly printed paper into prosperity. All attempts of the fiat monetary experiment fail miserably. The modern monetary theory that countries are embarking upon IS inflation on steroids, price inflation lags but always follows.Last edited by biglentil; Dec 30, 2020, 10:17.

Comment

-

It's surprising what can happen when interest rates go all the way back to zero. Remember the days when we were told that interest rates were well on their way to normalizing? Eighteen months ago that was all we heard from the mainstream financial gurus. That didn't last long.

Not that any of this is sustainable, but the primary purpose of zero percent interest is to allow governments to borrow incredibly vast amounts of capital with which to buy votes. This has the added bonus of boosting GDP numbers, as well as boosting real estate, equity and farmland values.

Those who are selling their real estate, equities and farmland appear to be doing quite well, but the buyers of these assets are getting squeezed. As the drop in interest charges gets converted into a bid on the asset, profit margins are following interest rates to zero. The phenomenon of Net Present Value is an inescapable fact of financial life.

When will this end? Central banks have staved off the collapse for the time being. But they're going to have to embrace negative interest to keep the collapse at bay. But that creates an economy with nothing but zombie businesses that consume more capital than they produce so at that point it's just a matter of figuring out how long it will take for the capital stock to go to zero.

Comment

-

Since most pensions either invest or are required to invest in fixed income, how does zero percent interest protect a pension plan?Originally posted by beaverdam View PostAren't governments and central banks keeping the equities stable/rising to protect the avg Joe&Jane 6-pack's IRA and RSP and their corporate pension???

The ultra rich are benefitting from government actions to avoid a crash, that would wipe out 70% of the citizens.

Comment

-

CPPIB bought what ....125000 acres of land...until they got their hands slapped.....the rent will be far more than current interest rates...Originally posted by Austrian Economics View PostSince most pensions either invest or are required to invest in fixed income, how does zero percent interest protect a pension plan?

Comment

-

Soaring asset values have given rise to what we commonly call the "wealth effect". But what's the actual nature of this effect when interest rates go to zero in a fiat currency system?

Today's wealth effect is actually a corrosive process in which one person's capital is converted into income that is then consumed.

This is not the same process that occurs when capital is invested and the dividend provides income which is then consumed.

With dividend yields collapsing along with interest rates, this sustainable cycle is not happening any more. Capital itself is being cashed out and consumed as if it were income as people retire or simply give up trying to run a business with next to negative returns. When the capital is consumed, it's gone forever.

Comment

-

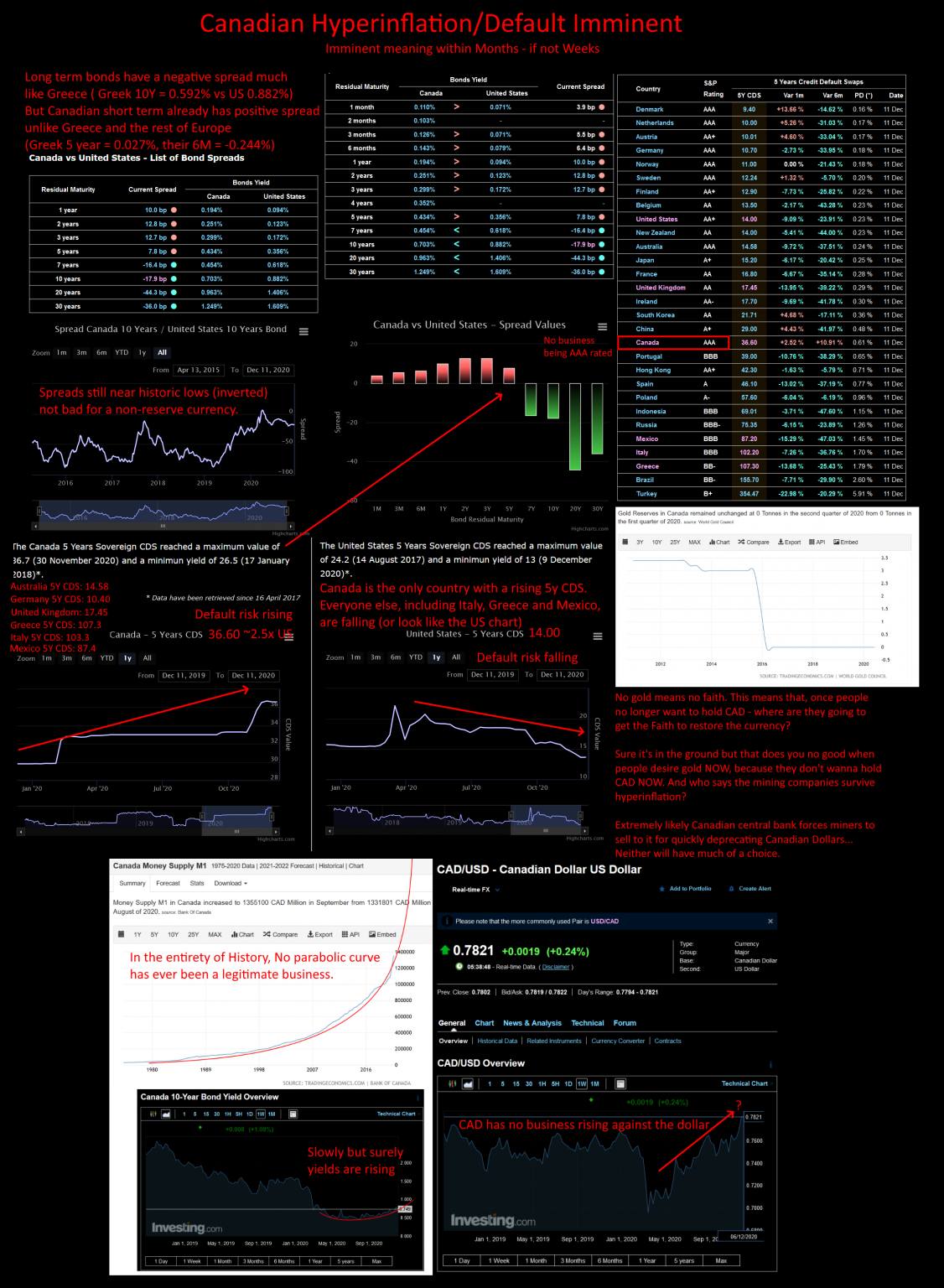

3 things come to mind based on biglentil's attached graphic:

Why will Canada default?

Why will those who hold Canadian denominated debt suddenly lose faith that they can redeem it and what will they exchange that debt for?

Just why is the CAD rising against the USD?

Comment

-

Look at the mandates for pension funds, mainly pensions for government workers. It's common for them to have a legal requirement for significant portions of their portfolios to be invested in government debt. The interest on that is effectively zero now.Originally posted by bucket View PostCPPIB bought what ....125000 acres of land...until they got their hands slapped.....the rent will be far more than current interest rates...

Rent is following interest rates as a proportion of land value. In other words, land values are appreciating at a far faster rate than rent, as is generally the case. These pension funds typically have to flip the land after a few years for a capital gain which the pension fund then doles out to retirees to be consumed. None of this is sustainable.

Comment

- Reply to this Thread

- Return to Topic List

Comment