Announcement

Collapse

No announcement yet.

A Game-Changing Crash . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

I came across an interesting article on global news. It is written by Michael Levy: "Business Report: Canada's stock market is the second worst performer in the world next to Venezuala." Certainly a sobering read and for those of you who believe Canadian governments are doing a great job, better than Trump, you really need to read this article. Keep in mind I am in no way shape or form a fan of Trump!!!!

Comment

-

Originally posted by Hamloc View PostI came across an interesting article on global news. It is written by Michael Levy: "Business Report: Canada's stock market is the second worst performer in the world next to Venezuala." Certainly a sobering read and for those of you who believe Canadian governments are doing a great job, better than Trump, you really need to read this article. Keep in mind I am in no way shape or form a fan of Trump!!!!

Don't warn anyone that's willing to buy Canadian, encourage it. It ends up being less about converting everyone and more to serving them to the wolves. Society is so split politically that the arguement isn't worth it. Just smile and nod and say "you should buy more" and leave it at that. When it crashes, encourage more buying because it's cheap. Trust me, never argue a trade or anything market related. In due time everyone knows whose right and wrong. Nothing is more humbling then having your political beliefs go to zero.

Comment

-

I keep looking at Trudeau and our govt and I cant believe this is real. It cant be. Not a single economic policy in 4 years. Basically grind it all down and ramp up the debt while squeezing every institution and pitting region and people against each other. This just cant be a fluke. Has to be by design.

Maybe Justin is the first Greta, a patsy manchurian candidate recruited by marxist factions behind the scenes driven by his own narcisistic impulses to live up to his name with a complicit media to back him up. Maybe while we werent looking the deep state slipped into Canada and took over.

I mean take a look at the guys twitter account. Its just straight out lies and propaganda like out of Nazi germany. Something out of an alternate universe.

Last edited by jazz; Feb 28, 2020, 22:44.

Comment

-

See what they think after the loonie moves...Originally posted by jazz View PostI keep looking at Trudeau and our govt and I cant believe this is real. It cant be. Not a single economic policy in 4 years. Basically grind it all down and ramp up the debt while squeezing every institution and pitting region and people against each other. This just cant be a fluke. Has to be by design.

Maybe Justin is the first Greta, a patsy manchurian candidate recruited by marxist factions behind the scenes driven by his own narcisistic impulses to live up to his name with a complicit media to back him up. Maybe while we werent looking the deep state slipped into Canada and took over.

I mean take a look at the guys twitter account. Its just straight out lies and propaganda like out of Nazi germany. Something out of an alternate universe.

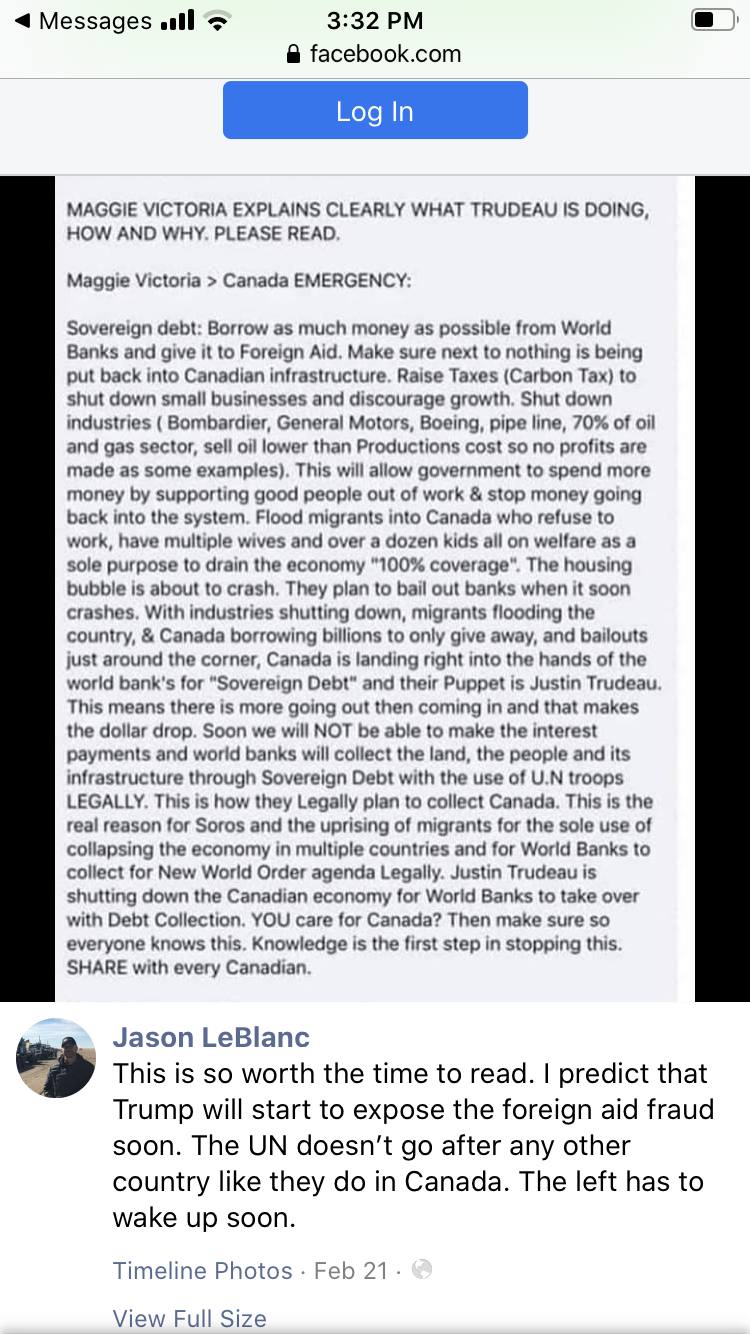

[ATTACH]5654[/ATTACH]

Comment

-

-

I don’t for one second believe Trudeau is smart enough to plan this. Reality is he is a stupid man. But like all actors he gets a script and studies on personal days then come on stage.

At the beginning I thought this can’t be happening in canada but ever day he is in power you see canada is getting dismantled and a UN state is being prepared.

Next it’s ag then guns then a total UN take over.

Welcome to the fourth rite.

Comment

-

Hamlock: So I found the article you reference. Did you notice the date on the article? It was more than 2 years old and was based on data ending in 2017. Do you realize that the TSX is heavily weighted in energy stocks and do you remember the global meltdown in energy prices that happened shortly before this article would be printed.Originally posted by Hamloc View PostI came across an interesting article on global news. It is written by Michael Levy: "Business Report: Canada's stock market is the second worst performer in the world next to Venezuala." Certainly a sobering read and for those of you who believe Canadian governments are doing a great job, better than Trump, you really need to read this article. Keep in mind I am in no way shape or form a fan of Trump!!!!

I hear over and over posters claiming "it all depends on the date you start" when talking about if global tempertatures are rising or not, yet you pull out an article written at a down turn of TSX stock pricing to rationalize a claim Canada economy is second worst in the world. Try looking at this 20 year chart of TSX stock prices. https://web.tmxmoney.com/charting.php?qm_symbol=^TSX https://web.tmxmoney.com/charting.php?qm_symbol=^TSX

Draw a trend line on the chart over the last 20 years and you will get a better look at performance.

Comment

- Reply to this Thread

- Return to Topic List

Comment