For those that don’t appreciate my past comments, it’s best not to read any further . . . .

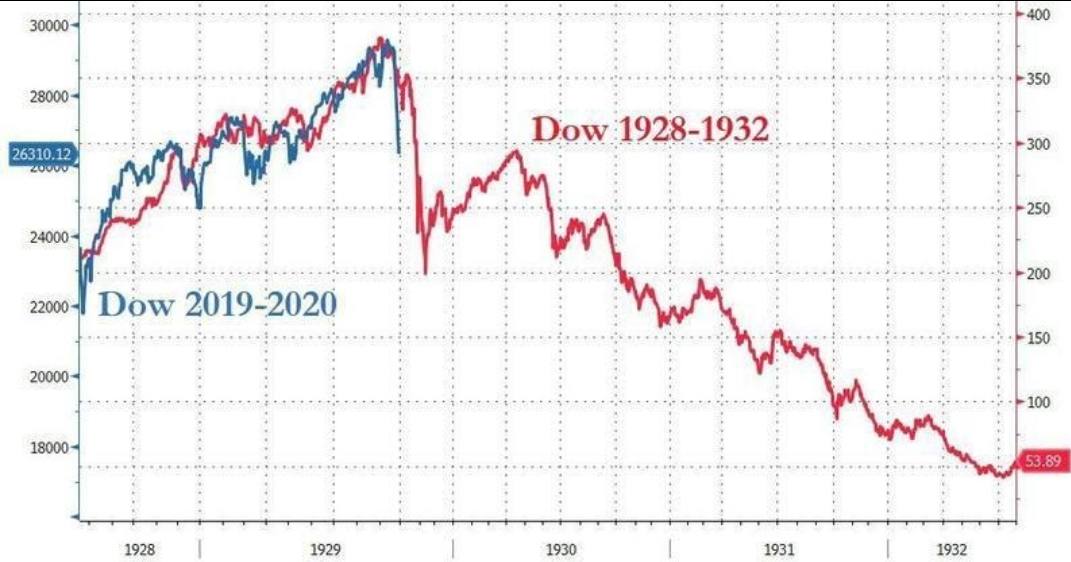

My apologies for touching a raw nerve for some Agrivillers with this week’s sell-off, but we are just in the 1st inning of this correction, meltdown, fallout, collapse . . . whatever you want to call it. A spade is a spade . . . .

‘Buy the dip’ investment community mentality is clearly old school (IMO). The Fed is hooped. Babysitting days protecting bad financial management and debt excessives have not only come-to-roost, they have fallen out-of-the-tree. No central banker can print their way out of this fiat money mess. The Fed may cut rates next week 1/2 percent in sheer panic. Markets may rebound temporarily or not. But rates cuts now will have little impact and make the big picture problem even worse?

Corona pushed these markets over this week, but it was eventually going to happen anyway. We need to do what we can personally to protect ourselves. Debt is insidious if it doesn’t create growth. Canada’s standard of living is now clearly in-decline. Gov’t Keynesian fallout is now upon us all . . ..

My apologies for touching a raw nerve for some Agrivillers with this week’s sell-off, but we are just in the 1st inning of this correction, meltdown, fallout, collapse . . . whatever you want to call it. A spade is a spade . . . .

‘Buy the dip’ investment community mentality is clearly old school (IMO). The Fed is hooped. Babysitting days protecting bad financial management and debt excessives have not only come-to-roost, they have fallen out-of-the-tree. No central banker can print their way out of this fiat money mess. The Fed may cut rates next week 1/2 percent in sheer panic. Markets may rebound temporarily or not. But rates cuts now will have little impact and make the big picture problem even worse?

Corona pushed these markets over this week, but it was eventually going to happen anyway. We need to do what we can personally to protect ourselves. Debt is insidious if it doesn’t create growth. Canada’s standard of living is now clearly in-decline. Gov’t Keynesian fallout is now upon us all . . ..

Comment