Macdon02 errol ?

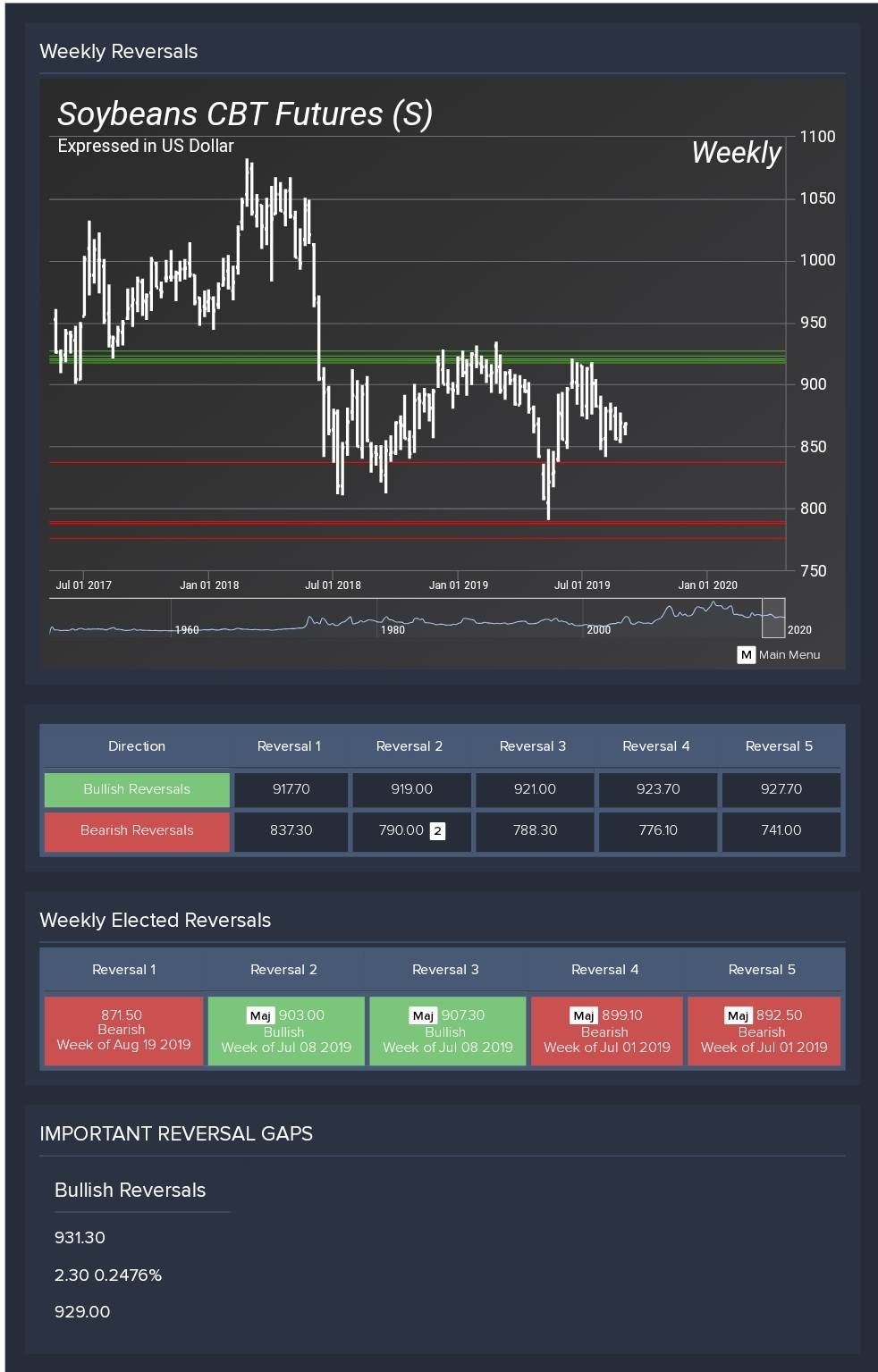

Is it beans beans beans? Or ultimately corn is king as usual and prices will follow corn yields, talking all crops will follow corn in sympathy.

See wheat traded on its own today.

Australian crop getting downgraded by the day not that it matters.

Domestic prices on the rise again.

cheers

Is it beans beans beans? Or ultimately corn is king as usual and prices will follow corn yields, talking all crops will follow corn in sympathy.

See wheat traded on its own today.

Australian crop getting downgraded by the day not that it matters.

Domestic prices on the rise again.

cheers

Comment