https://www.rt.com/business/429573-us-china-russia-physical-gold/ https://www.rt.com/business/429573-us-china-russia-physical-gold/

Announcement

Collapse

No announcement yet.

Russia and China buying gold

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Where to even start...

When the article starts off by asserting that the US is purposely supressing gold, that is all that you really need to know. Anything that requires a conspiracy theory, isn't worth the time it takes to read it. But if China and Russia want to invest in gold which has been essentially flat for years, while the USD is in the early stages of a bull market( by some analysts anyways), they are free to do so. Some day the gold bugs will be right, but the broken record gets old after a while. I'm sure Macdon has a lot more he could add to the conversation.

-

It’s not a conspiracy theory, it’s a matter of public record. Even Greenspan admitted it. Theirs no way the western world wants gold to go up because it’s like the “canary in the coal mineâ€. Many years ago gold went up when bad events or the economy was having problems so these idiots suppress it by selling paper not physical.

Never have the bullion banks who work for the feds ever been long in gold or silver. Why not?

Just watch the trading patterns, they will dump 4000 contracts in 1 minute then another 2000 in 2 minuts for example and drop the price big time in that short amount of time. Not really the work of a hedger or investor trying to maximize their return.

All this has done is allow the East to buy up cheap physical gold. The old saying “he who has the gold wins†has more truth than most realize.

Inflation is here boys, we can see it in our daily lives, gold and silver will be the only saviour for many. On an inflation adjusted basis gold should be in that 3000 dollar range so that shows how much it has been held down. When these crooks decide to let go and buy back those contracts, look out above.

Comment

-

Blog/UncategorizedPosted May 29, 2014 by Martin Armstrong

A number of questions have come in about the precious metals and real estate along side the stock market. Precious metals have their place. As long as you trade them and not turn them into some conspiracy, they are a tradable market and you can buy or sell. It is just when people preach nonsense that cause others to lose their shirt with no regard for what they are saying. That is wrong. The metals will rally when it is time.

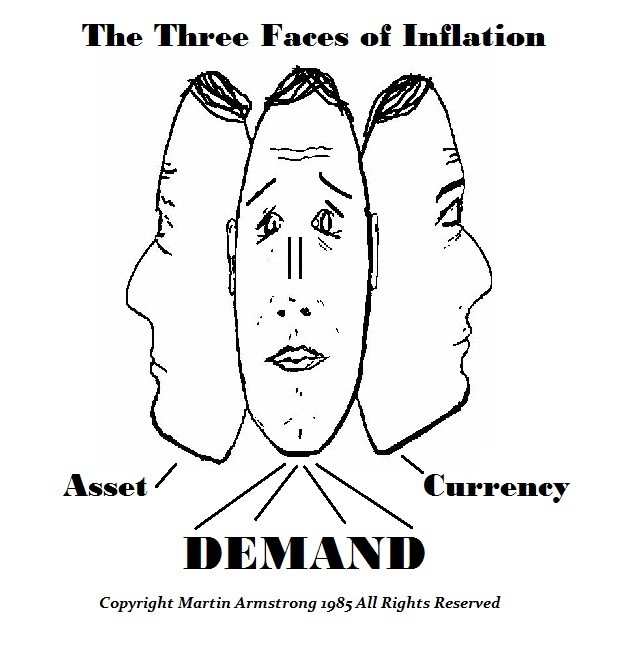

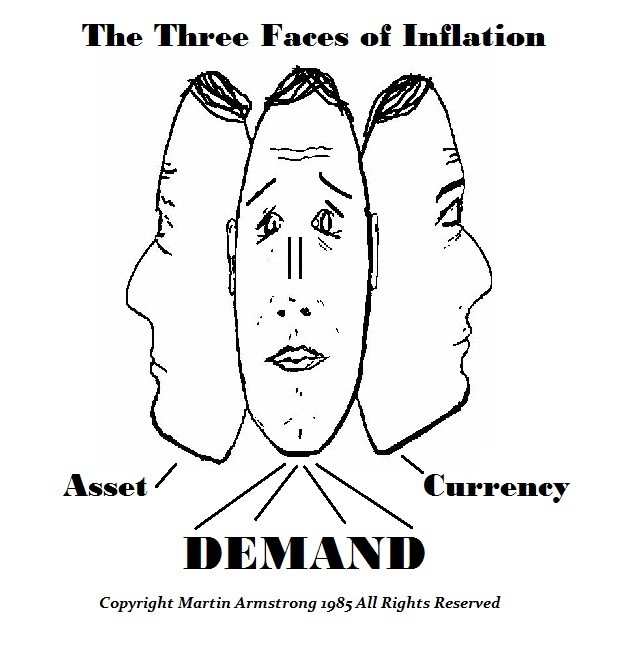

Keep in mind that there are different types of inflation. What we are seeing in the high-end real estate and stocks is the demand-inflation driven by several forces:

(1) People trying to get off the grid fearing banks

(2) Pension funds underwater having no choice but to run into equities especially when interest rates are poised to go negative. These morons in government cannot even think about what negative rates will do to pensions.

We should see the precious metals rally as well. But that comes when the ECM turns down and people once again begin to question government. Will gold go to $50,000? That depends upon the currency for that is*NOT*real nominal value – just fictional. Saying this implies gold will rise to that value and you become rich. That is not true. Gold will rise as a hedge against government and that requires the decline in confidence. That is why gold rallied with the decline in the ECM after 2007.

Currency-Inflation takes place when the currency value declines on a wholesale basis and that produces advances in prices in*EVERYTHING*across the board. That is distinct from cost-push inflation like beef caused by shortages, or demand-inflation that is a rush into particular sectors because people perceive (a) rising prices or (b) better alternative.

Some have asked are Europeans better just taking the 10% haircut rather than running into real estate? I seriously doubt that 10% is going to fix anything and this will be an on-going problem. It is probably less risky to just get-off-the-grid for ultimately we will see all currencies reset.

That reset will come only when there are*ZERO*options left and we have to default on national debts. We will see. The IRS is targeting frequent-flyer points, bonuses or any kind, and eventually the healthcare Obama tax. These people will tax everything possible. They follow the same pattern regardless of what century, culture, race, creed, or politician persuasion.

Diocletian*restricted movement until you paid your taxes during the reorganization of Rome. The IRS has done the very same thing.*You cannot leave the USA if you owe $50,000 in taxes. See – history repeats because the*GREED*of those in government never changes regardless of the century. What took place before, will take place again. I need not express my personal opinions nor get involved in conspiracy theories. I look only at the facts – have they done this one before? What happens? And what comes next?

Comment

-

We are likely looking at a low in 2021 after USD tops out like 1985 ish. Having said that being bearish CAD you'll pickup the currency gain but in real terms there's better things to own then metal. It really isn't any different then the machinery in your shed fwiw.Originally posted by macdon02 View PostBlog/UncategorizedPosted May 29, 2014 by Martin Armstrong

A number of questions have come in about the precious metals and real estate along side the stock market. Precious metals have their place. As long as you trade them and not turn them into some conspiracy, they are a tradable market and you can buy or sell. It is just when people preach nonsense that cause others to lose their shirt with no regard for what they are saying. That is wrong. The metals will rally when it is time.

Keep in mind that there are different types of inflation. What we are seeing in the high-end real estate and stocks is the demand-inflation driven by several forces:

(1) People trying to get off the grid fearing banks

(2) Pension funds underwater having no choice but to run into equities especially when interest rates are poised to go negative. These morons in government cannot even think about what negative rates will do to pensions.

We should see the precious metals rally as well. But that comes when the ECM turns down and people once again begin to question government. Will gold go to $50,000? That depends upon the currency for that is*NOT*real nominal value – just fictional. Saying this implies gold will rise to that value and you become rich. That is not true. Gold will rise as a hedge against government and that requires the decline in confidence. That is why gold rallied with the decline in the ECM after 2007.

Currency-Inflation takes place when the currency value declines on a wholesale basis and that produces advances in prices in*EVERYTHING*across the board. That is distinct from cost-push inflation like beef caused by shortages, or demand-inflation that is a rush into particular sectors because people perceive (a) rising prices or (b) better alternative.

Some have asked are Europeans better just taking the 10% haircut rather than running into real estate? I seriously doubt that 10% is going to fix anything and this will be an on-going problem. It is probably less risky to just get-off-the-grid for ultimately we will see all currencies reset.

That reset will come only when there are*ZERO*options left and we have to default on national debts. We will see. The IRS is targeting frequent-flyer points, bonuses or any kind, and eventually the healthcare Obama tax. These people will tax everything possible. They follow the same pattern regardless of what century, culture, race, creed, or politician persuasion.

Diocletian*restricted movement until you paid your taxes during the reorganization of Rome. The IRS has done the very same thing.*You cannot leave the USA if you owe $50,000 in taxes. See – history repeats because the*GREED*of those in government never changes regardless of the century. What took place before, will take place again. I need not express my personal opinions nor get involved in conspiracy theories. I look only at the facts – have they done this one before? What happens? And what comes next?

Comment

-

Why Would China Allow The Gold Price To Be Suppressed?

Written by Chris Marcus for the Miles Franklin blog

If the precious metals markets are manipulatively suppressed lower as many allege (and as court records and other sources document with evidence), one of the questions many often raise is why would China allow this to occur?

Many look at the developments with the Yuan (such as the creation of the PetroYuan, its possible use as a reserve currency, and the launching of a Yuan-backed precious metals contract) as well as the large amounts of gold that China continues to accumulate, and wonder why they would allow the prices to be suppressed lower.

Yet a recent article from the Russia Times titled, "US paper gold suppression allowing Russia & China to buy real gold at discount prices" explained my understanding of what's occurring rather succinctly.

"Efforts by the US to suppress gold prices in order to prop up the dollar are allowing Russia and China to build up huge reserves of physical gold by purchasing large quantities of the precious metal at significantly lower prices."

So while it makes sense that if China and Russia are accumulating gold that they would eventually want to see the price adjusted appropriately, it has also made sense that they would continue to accumulate as much as possible at the lower prices first. Which is the conclusion RT has come to as well.

Of course China is no longer alone in understanding the merits of the case for gold. As several countries have repatriated their gold this year, mainstream fund managers have begun investing in gold, and there also seems to be a growing awareness of the leverage that the paper market trading has created.

I imagine that some nations and central banks are very well aware of the manipulation that goes on in the markets. While there are likely others that are probably just looking at the wild expansion in the global money supply and seeing gold as a natural response. Yet in either case, there is a growing dynamic where more and more attention is coming to the precious metals markets, and given the fundamentals, it's not the kind of thing that is easily reversed.

Then consider the following quote from the Russia Times article.

"According to Claudio Grass of the Precious Metal Advisory in Switzerland, the total trading volume in the London Over-the-Counter (OTC) gold market is estimated at the equivalent of 1.5 million tons of gold. Only 180,000 tons of gold have actually been mined up to today.

"The paper scams in London and New York will either blow up when the paper price of gold drops to zero or when just a fraction of investors insists upon receiving physical gold in return," Grass told RT."

Commentary like this is becoming more commonplace by the day. And while we have not seen the break point yet, all of the conditions that would logically lead to such an event are beginning to occur. Personally I am beyond fascinated to see how all of this eventually plays out. As when you just look at the events as a spectator, it is a truly incredible story unfolding before our eyes. That I imagine will be talked about and discussed for decades after it all occurs.

It's unfortunate that much of the saga involves behavior that in my opinion is clearly illegal and against the stated principles of our markets. Yet nature and economics have a way of resolving these types of imbalances, and that appears to be what's occurring again right now.

And I continue to expect that when that resolution is complete, the prices of gold and silver will both be considerably higher.

-Chris Marcus

-END-

Comment

-

What is the real intrinsic value of physical gold? Other than its uses, value in the market based on "just having it" seems redundant. Why not diamonds....they are hard, shiny and rare too!

And if the article is correct saying there is 1.5 million tonnes of gold traded on paper in the London OTC compared to the statement only 180,000 tonnes have ever been mined....that makes paper gold almost worthless. Another derivative pyramid scheme?

Why gold? Psychological bullshit.

But WTF do I know!

101, could you chart the USD and maybe some other important currencies against the world gold price for the last few decades(or what ever).

I guess gold is a low maintenance investment in some ways.Last edited by farmaholic; Jun 27, 2018, 22:14.

Comment

-

Diamonds can work well as an massive store of wealth in a compact unit. But they do not work well as currency. They are difficult to value since every diamond is unique and requires expert grading. They are also not easily nor typically desireable to be divided. They also burn in fire and can be manufactured.Originally posted by farmaholic View PostWhat is the real intrinsic value of physical gold? Other than its uses, value in the market based on "just having it" seems redundant. Why not diamonds....they are hard, shiny and rare too!

And if the article is correct saying there is 1.5 million tonnes of gold traded on paper in the London OTC compared to the statement only 180,000 tonnes have ever been mined....that makes paper gold almost worthless. Another derivative pyramid scheme?

Why gold? Psychological bullshit.

But WTF do I know!

101, could you chart the USD and maybe some other important currencies against the world gold price for the last few decades(or what ever).

I guess gold is a low maintenance investment in some ways.

Gold on the other hand is easily verified. Realitively easy to divide. Is impervious to corrosion and next to impossible to destroy. Its the only heavy metal that is beneficial to human health. Can be discovered on virtually every country on earth making it universal. One ounce can be hammered out to a sheet 2100sq ft in size. Luckily we haven't found many industrial applications for gold because its role as money would make those applications cost prohibitive.

Comment

-

Comment

-

-

I don't believe that anyone ever claimed wheat was a buy and hold forever type of investment. Why would it grow at the same rate as a stock in a company which pays dividends, has growth, and doesn't get diluted every day with new stock.

Change the start date on the gold chart, and it looks much different too.

Comment

-

Thanks for the encouragement burnt.Originally posted by burnt View PostWhat? You don't like to learn what your work is actually worth or it's relative value?

Aw don't worry - it's not like what we produce is actually important, after all...

We quit raising sunk hopper bins for the day, start again tomorrow morning when its cool again...maybe catch Weber on his SE Sask crop tour if I'm not too drunk from drinking beer in the shade all afternoon....actually lots of other things to do in the shade of the machine shed.

Take care

Comment

-

Originally posted by burnt View PostWhat? You don't like to learn what your work is actually worth or it's relative value?

Aw don't worry - it's not like what we produce is actually important, after all...

No one wants what we produce....lentils...no market....wheat...premium market gone....soybeans have the wrong protein and oil content....durum market is ****ed even though last year was a beauty quality wise...

what the **** can a guy grow without an excuse as to what is wrong with it...

Jesus ****ing christ already they are starting to manufacture hamburger because raising cows is ****ing near outlawed....or will be...

Maybe I should just start throwing stones like they do in the middle east...in protest...

****ing crazy when there are still 20 million starving in africa.

Comment

- Reply to this Thread

- Return to Topic List

Comment