The one thing that's hit home for me post '08, is that everything takes far longer than you think. The age old adage goes: "the market can remain irrational far longer than you can remain solvent."

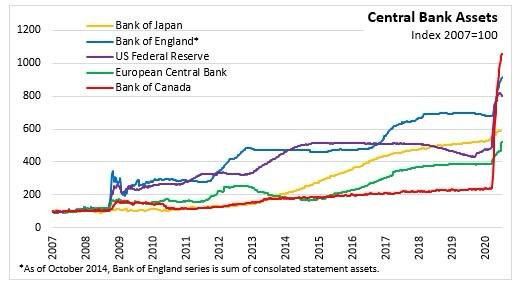

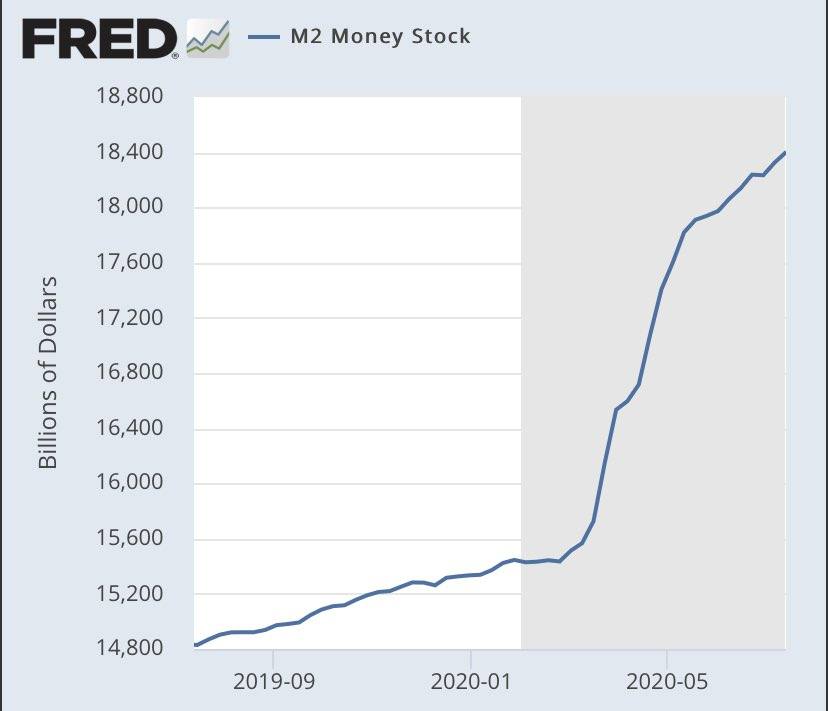

I feel this likely has considerable room to get far worse long before it starts to correct... If central banks can print $T's to purchase junk bonds and distressed equities, what's to stop governments world wide from demanding they print huge sums for UBI, low income housing, or massive expansions of the public service?

We're long past the point of disciplined fiscal and monetary policy. I'm thinking this gets a WHOLE lot worse...

I feel this likely has considerable room to get far worse long before it starts to correct... If central banks can print $T's to purchase junk bonds and distressed equities, what's to stop governments world wide from demanding they print huge sums for UBI, low income housing, or massive expansions of the public service?

We're long past the point of disciplined fiscal and monetary policy. I'm thinking this gets a WHOLE lot worse...

Comment