The Mexicans wouldn’t take Canadian money but the US was golden. Things will likely change.

Announcement

Collapse

No announcement yet.

Banking failure

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Bingo, we wont be trading with that new eastern bloc.Originally posted by sumdumguy View PostBut who will want to trade in Communist dollars? No one, US dollar is only safe trading currency.

China and US will be in a stalemate. We wont buy their stuff unless USD is used, and they wont sell their stuff unless yuan is used.

So globalization ends.

Hope we can find a new home for our exports. Probably US just takes it all. Fine with me.

Comment

-

103 countries have applied to join the Brics, things are moving quickly. Usd is not required anymore in international trade, its the great unwind. The confidence in the purchasing power of the dollar is waning. The party is over the race to the exit has begun. A tsunami of USD will be hitting American shores. Price inflation is just getting started imo.

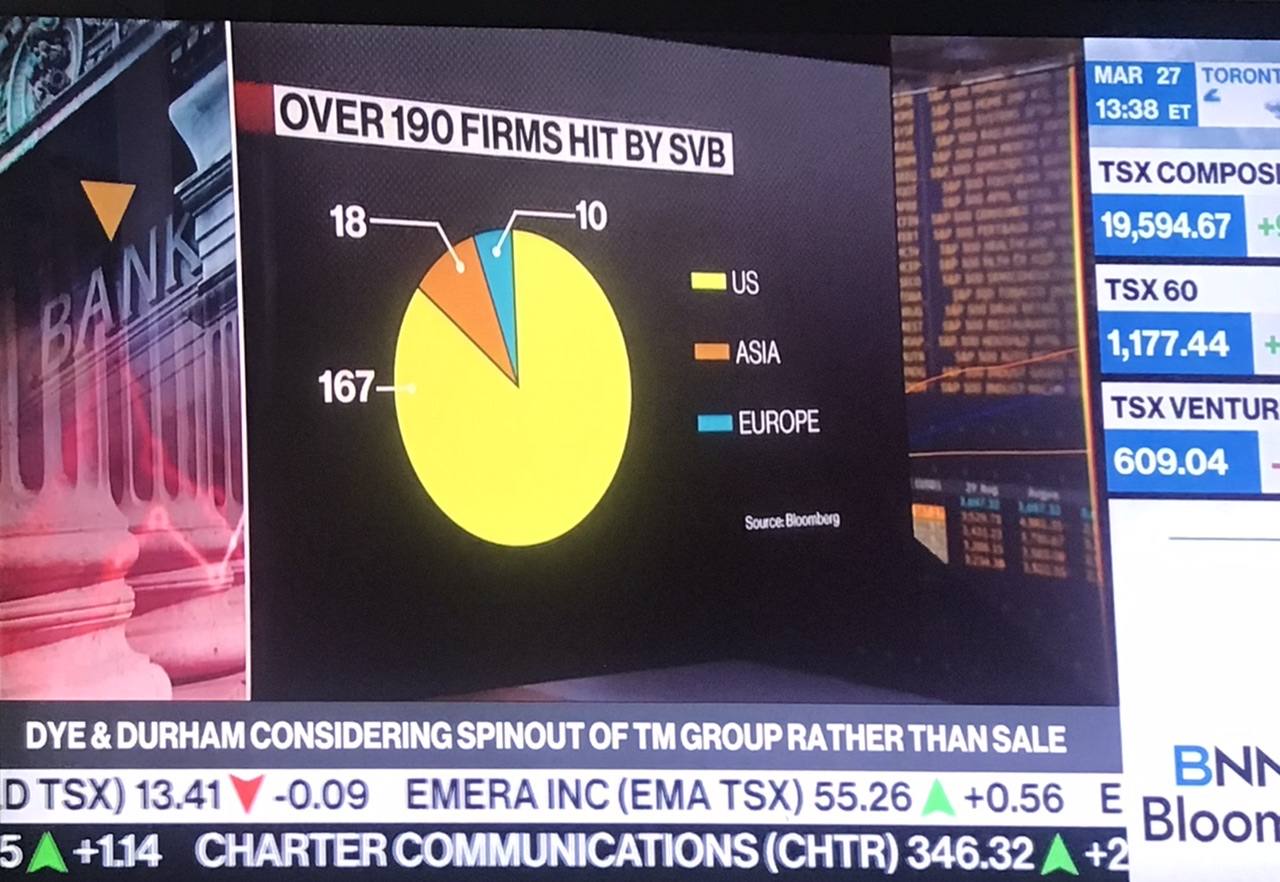

Is it any coincidence its woke western banks failing? Now its Deutsche Bank suffering massive deposit withdrawals. This is a TBTF bank. Counter party risk is rising among banks worldwide.

Can't make this up Fed blamed SVG's failure on too much exposure to US Treasuries.Last edited by biglentil; Mar 26, 2023, 15:13.

Comment

-

I never take USA dollars.I take cnd and go and find best exchange from cnd to pesos.Resorts do not give good exchange but many street places offer good rates.Many people you tip live in smaller towns and do not have the same access to exchange cnd.Mexicans love Canadians they just hate our weather.Originally posted by wiseguyMexicans laugh at the Canadian dollar !

USA dollars only for tips !

Comment

-

Some outfitters accumulate significant amounts of USD that they don't mind trading at fair rates.

Comment

-

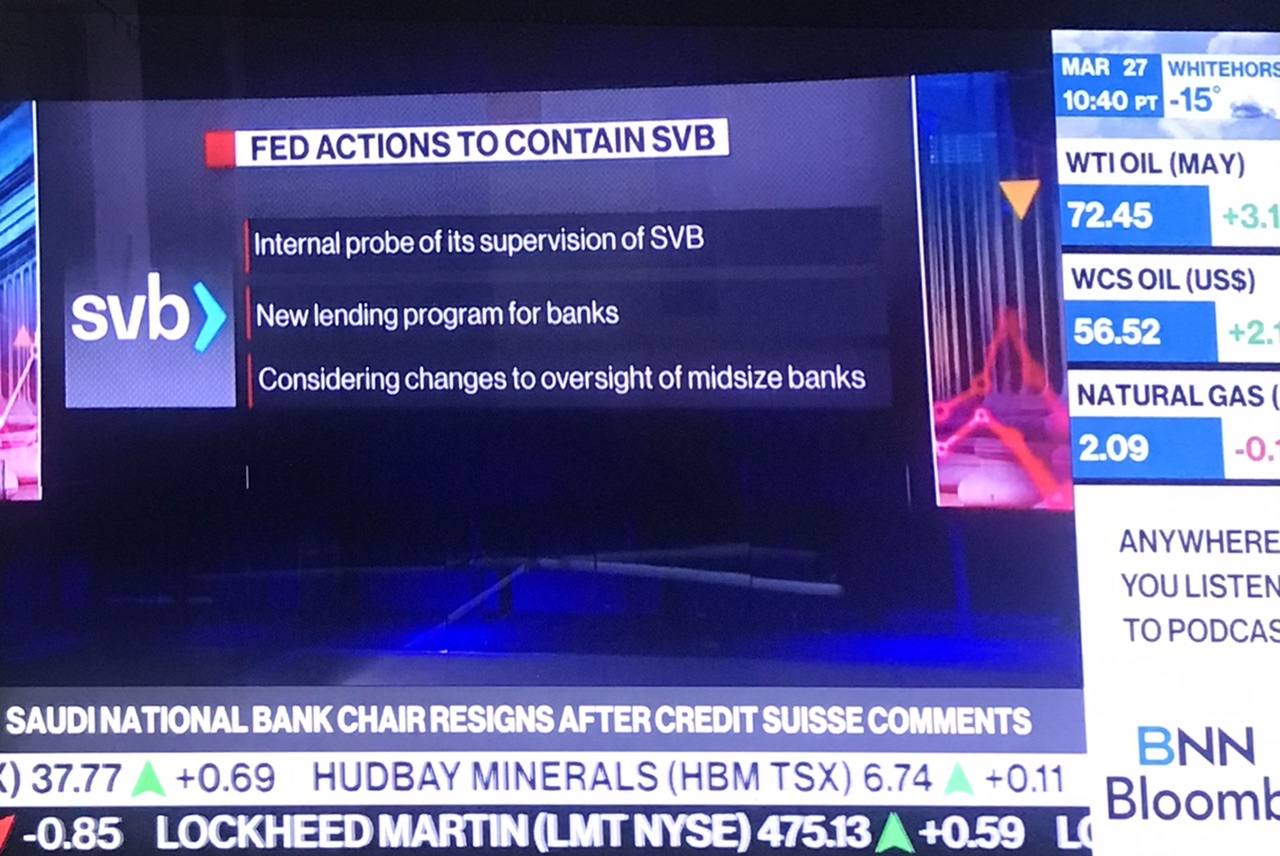

The US Fed was highly involved… carefully overseeing SVB Before the collapse and run on SVB deposits…. Now to be taken over by First Citizens… the US Fed retaining control of some $90 Billion in SVB “assetsâ€â€¦.

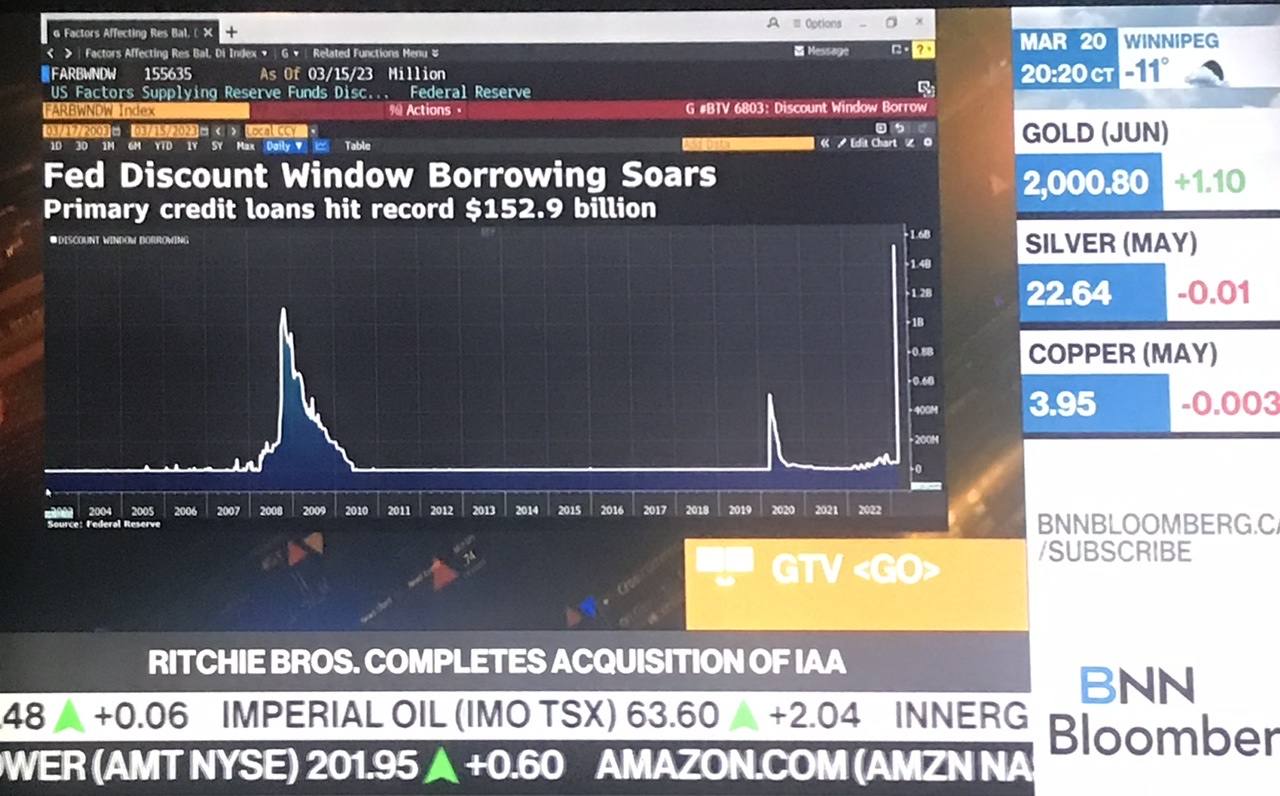

30% more liquidity has been inserted into the US banking system… than in 2008….

The Saudi minister that said they would not put any more money in Credit Suisse a couple of weeks ago… has resigned… supposedly for personal reasons….

Comment

-

More details:

Since the Fed closely monitored the contagion that occurred… clearly the US Fed is required to backstop all bank assets… because $Billions move in minutes now…. With phone transfers instantly stressing any banking system… Fed monitoring of small banks under $250B…. Is virtually impossible… without backstops for instant liquidity…. Of $Billions of currency.

My observation:

Adding $Trillions in currency to the monetary system… instant banking streamlined by the pandemic… all have created massive structural challenges to our monetary system….

A Brave new world!

Cheers

Comment

-

The OTC derivative market is over $600 Trillion….

This monetary system … is broken….the Biden administration has Not got the practical experience…. Saying that problems are “transitory “… is refusing to admit failure… which doubles down the problems….

Insanity is doing the same thing over and over and over again… expecting a different result….

The monetary system is Broken!!!!

Comment

-

De-dollarization is already spreading like wild fire! "There are outbreaks of peace between intense geopolitical rivals, which would have been unthinkable before.. developing countries are suddenly breaking free from the clutches of a rigged global financial system.. and a new world order is emerging at an astonishing pace." Consider these examples:

Comment

-

Propaganda I am sure...

"The Bank of Russia had been preparing for an escalation of Western sanctions since 2014 and was beefing up additional funds as a hedge against future restrictions on its foreign exchange reserves, the regulator revealed on Wednesday.

Amid “increasing geopolitical risks†the central bank ramped up investments in assets “that cannot be blocked by unfriendly nations†and transferred part of its reserves to gold, Chinese yuan and foreign currency in cash, the regulator announced in its annual report.

The central bank managed to stash billions of imported dollars “in volumes limited by logistics capabilities,†the report said without specifying the amount of accumulated funds. Alternative reserves in dollars and gold bars have been stockpiled in the vaults of the Bank of Russia.

“This safety cushion was created in the form of alternative reserves – less liquid and convenient in everyday life, but more reliable in the face of a tough geopolitical scenario,†the regulator explained.

It was impossible to abandon reserves in dollars and euros, as these currencies were used for settlements in international trade as well as in the domestic financial sector, the central bank added.

“Therefore the structure of foreign exchange reserves needed to take into account the needs of citizens and businesses,†the regulator concluded.

Seizing Russian assets is ‘challenging’ – EU task force headREAD MORE: Seizing Russian assets is ‘challenging’ – EU task force head

The central bank could have “unloaded†part of this money to banks during the first wave of Western sanctions to stabilize Russia’s banking system and offset the withdrawal of dollars and euros by “panicking depositors,†the chief analyst from Ingosstrakh-Investment, Viktor Tunyov, believes.

According to some estimates, last year almost $20 billion was withdrawn by depositors from the country’s second largest bank, VTB, alone.

In 2022, Russia was hit by sweeping Western economic sanctions, which included measures to cut the Russian central bank off from the international financial system, while around $300 billion of the bank’s foreign reserves were frozen. Moscow has criticized the seizure of its assets, saying it constitutes theft."

Canada has NO gold, thanks TURDO

Comment

-

WTI gapped up above $80 today on news of many OPEC+ countries cutting production.

Biden has mostly emptied the stratigic reserve and has to refill it at much higher prices than he sold it for.

China made regular purchases at lower prices making no sense at all.

So much for Strategic.

Bootleggers always make great profits when legislators make product hard to get.Last edited by shtferbrains; Apr 2, 2023, 19:04.

Comment

- Reply to this Thread

- Return to Topic List

Comment