Good info , thanks Larry ðŸ‘

Announcement

Collapse

No announcement yet.

The great debt crash

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

TAKE A DEEP BREATH: U.S. Federal Reserve indicates 722 American banks now have unrealized losses of more than 50% of their entire capital.

A hair-trigger financial crisis on-the-doorstep . . . .

Comment

-

I don’t Canadian banks are in any better shape. When you lend the same dollar 15-20 times over and hang your hat on the fact that everyone will make good on debts the system is broken and has been for decades.

The savers will lose and those that borrow to the nuts will be the smart ones.

Not much we can do about it other than hope to start over when the day of reconning happens

Comment

-

Yellen Warning Again . . . .

Treasury Secretary Janet Yellen on Tuesday delivered her most dire warning yet about the debt ceiling, urging Congress to raise it immediately so the government avoids running out of cash by early June. “A default would crack open the foundations upon which our financial system is built,†Yellen warned in prepared remarks. “It is very conceivable that we’d see a number of financial markets break – with worldwide panic triggering margin calls, runs and fire sales.â€

Comment

-

U.S. debt ceiling talks halted . . . . markets beginning to sell off. U.S. government default risk now high.

Comment

-

Would be awesome if the debt ceiling talks would bring about a meaningful reduction in gubmint spending. That would get rid of hyper inflation and the demoncraps in one blow. Likely would have positive spill over effects north of the border as well and end the war in the Ukraine at the same time. Everybody wins.Originally posted by errolanderson View PostU.S. debt ceiling talks halted . . . . markets beginning to sell off. U.S. government default risk now high.

Comment

-

SO if you don't tell a government they can't keep spending more than they make don't you end up being another South American country ? Seems people stopped buying crap for there homes but spending money they do or don't have on seeing the world. Home depot can't get $25 for their 2/4's tsk tsk but Westjet pilot's get raise from pultry $300,000 yearly income.

Comment

-

Wells Fargo?

Should panic grip the U.S. Fed and government, rates could be cut cut quickly.

Market now heading from significant Fed tailwinds of liquidity to stiff headwinds.

Don’t believe anything a central banker says.Last edited by errolanderson; May 21, 2023, 05:24.

Comment

-

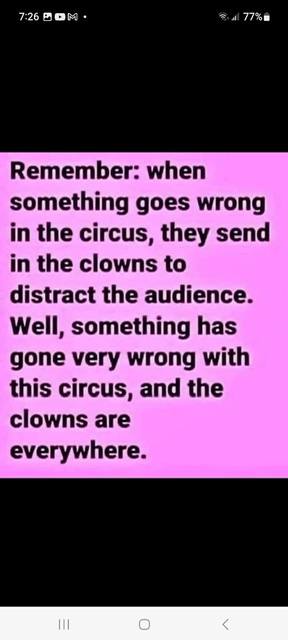

A circus . . . At the current insane pace of government spending, the U.S. government will reportedly run out-of-money in just five (5) days . . . 5 days.

Comment

-

-

There is some form of a default already in-progress (IMO). Government may be very slow payers especially for contract work, building leases. We'll see who squawks . . . .Originally posted by Marusko View PostThey won't run out of money Errol, they'll just make more. It's a doom-and-gloom show in the news when they approach the debt ceiling.... then they raise it and suddenly, all is well again. it's a circus, alright.

Comment

-

I remember for a fund raiser for hockey we sold books of Macdonalds coupons that were valued 3 for 1. That was before fast food became so popular.Originally posted by biglentil View PostDeflation always just around the corner, all the while the currency is relentlessly inflated.

[ATTACH]12642[/ATTACH]

Comment

-

If I was PP, I wouldnt want to be PM of this country in 2025. Watch out folks. Very few will be able to qualify for higher debt servicing. BoC has been talking another rate hike. Its clear as day this is all deliberate. Govt spending is accelerating not slowing and so is inflation and interest rates. Protect yourself now.

And mere days after the fake debt ceiling fight, US printed up $25B in a single day.

Errol, you are way off on this.

Last edited by jazz; Jun 5, 2023, 16:51.

Comment

- Reply to this Thread

- Return to Topic List

Comment