Announcement

Collapse

No announcement yet.

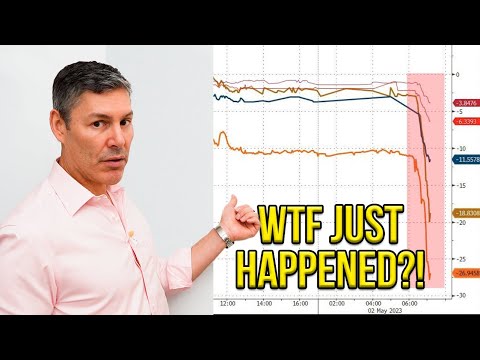

The great debt crash

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

JP Morgan CEO Jamie Dimon stated yesterday; “Markets will be gripped by panic as the U.S. approaches a possible default on its sovereign debt. The closer you get to it, you will have panic. There will be stock market volatility and upheaval in treasuries. Such an event would ripple through the financial world, impacting contracts, collateral and clearing housesâ€

Comment

-

Very interesting he said he wouldnt put a dime into sovereign debt any where in the world. Thats telling me fiat is on the downside and the rumblings of CBDC to extend it are getting louder.Originally posted by errolanderson View PostJP Morgan CEO Jamie Dimon stated yesterday; “Markets will be gripped by panic as the U.S. approaches a possible default on its sovereign debt. The closer you get to it, you will have panic. There will be stock market volatility and upheaval in treasuries. Such an event would ripple through the financial world, impacting contracts, collateral and clearing housesâ€

Trust is leaving the system pretty fast and without that, its a potential house of cards.

Comment

-

Argentina seems to enjoy a currency collapse as with astounding regularity throughout history.Originally posted by beaverdam View PostFWIW, "Argentina Is Going Broke to Stall a Full-On Currency Collapse"

Around 30 months after taking office, the country found itself in a desperate economic situation, with a troubling run on the peso and a faltering economy given the lack of reserves in the Central Bank’s coffers.

Around 30 months after taking office, the country found itself in a desperate economic situation, with a troubling run on the peso and a faltering economy given the lack of reserves in the Central Bank’s coffers.

https://finance.yahoo.com/news/argen...180628424.html

What does that typically do to their agricultural production? Inflation is usually good for farmers, do they expand? Or does the capital intensive nature of modern agriculture make it impossible to access the required capital? Less the uncertainty and the resulting tax burden?

Comment

-

"What does that typically do to their agricultural production?"Originally posted by AlbertaFarmer5 View PostArgentina seems to enjoy a currency collapse as with astounding regularity throughout history.

What does that typically do to their agricultural production?

The main reason I posted this, do farmers in Argentina become "holders" of their raw commodities, "quick sellers", or might there be "no change" in their selling pattern? On the input side, fert and chem costs, where do they go for those producers?

and how, if any does that effect Canadian farmers?

Comment

-

We need Klaus to come back. He would have first-hand knowledge.Originally posted by beaverdam View Post"What does that typically do to their agricultural production?"

The main reason I posted this, do farmers in Argentina become "holders" of their raw commodities, "quick sellers", or might there be "no change" in their selling pattern? On the input side, fert and chem costs, where do they go for those producers?

and how, if any does that effect Canadian farmers?

My understanding is they are holding on to inventory as long as possible before converting it to a depreciating currency. Which is why the government had to have their conversion specials on three separate occasions to prop Farmers to sell for a better currency rate.

And that they had purchased their inputs far ahead of time at least a year ago. However in the event of a full-blown currency collapse, I expect the capital would be nearly impossible to come by to buy inputs ahead of time. Might become hand to mouth just out of necessity?

Comment

- Reply to this Thread

- Return to Topic List

Comment