Announcement

Collapse

No announcement yet.

DEFLATION: Comin-in strong

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

[QUOTE=errolanderson;550381]To me, there are serious price pressures heading our way . . . .

Barchart is suggesting $5/bu corn and $10/bu beans. There is not a shortage in the world.

__________________________________________________ ____________________________

The whole article - not the headline.

Sub $5.00 Corn? $10.00 Beans? - sub-5-00-corn-10-00-beans

4 hours ago —

This is Jeremey Frost with some not so fearless market thoughts from www.dailymarketminute.com for Barchart.com.

Could we have made our highs in grains and be missing a great selling opportunity? If Barchart’s production numbers are correct look for a complete melt down in the corn and soybean markets. The next USDA report could be a major market moving event, one that perhaps causes prices to make a limit price move.

Now before you go and fear sell everything I am going to tell you why I think Barchart’s numbers could be wrong. First off I don’t know how they get the numbers that they get and that means I need to put a disclaimer out that they could very well be spot on. Maybe they are simply more accurate then the rest or know something I don’t know.

Having made a disclaimer that I may be wrong I do want to emphasize that I do not think the Barchart.com numbers are correct. I think corn and soybean production numbers get smaller not bigger in the months to come.

The main reason I don’t think so is the wheat production yield dropping by 127 million bushels last week. If you overlay drought monitor from today on top of one from late July or early August one would see why wheat production was down so much. We simply ran out of water. I think the same has happened in corn and bean country; maybe not the eastern corn belt so much. But I think that the western corn belt dry areas are so bad that it is going to pull our average down a fair amount.

To hear more of my thoughts on why I think we will see corn futures trade above $7.50, soybeans above $15.00, and wheat above $11.00 listen below.

https://www.dailymarketminute.com/previousnewsletters/what-happens-if-barchart-corn-production-numbers-are-right

Comment

-

I’m sure u will be right eventually ErrolOriginally posted by errolanderson View PostTo me, there are serious price pressures heading our way . . . .

Barchart is suggesting $5/bu corn and $10/bu beans. There is not a shortage in the world.

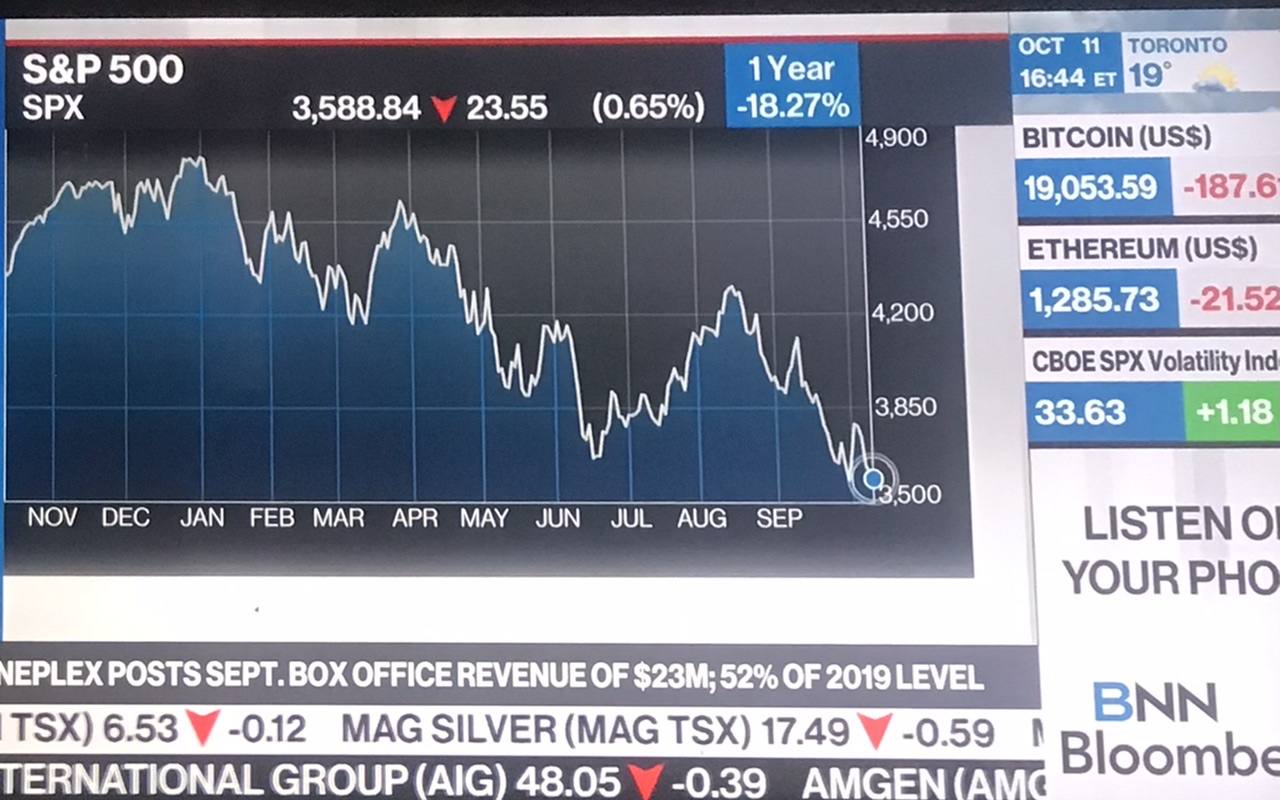

The financials are a complete train-wreck.

The consumer totally tapped-out. All the press wants to hear is; inflation, until it isn't, big-time. Deflation is real, even OPEC will get tuned-up. And the Fed , good grief. Has there been a worst Fed in the U.S.? My opinion . . . 2023 and 2024 will be hard-hit years of deflation and bankruptcies, rising unemployment and mergers and For sale signs.

The reporting of the financial press makes me ill, as a lot of people has been gulled into the ideas that this a just a normal downturn. It isn't . . . .

Comment

-

Overseas shipping costs plunging. Retailers now cutting prices. Costco may be leading-the-way. Watch for big Christmas discounts as retailers are swamped with invento0ry . . . .

Comment

-

Thats right if you or I were to print 'Federal Reserve Notes' they would throw us in jail for counterfeiting. When the fed , controlled by an undisclosed group of private shareholders, does it they call it stimulus and charge interest on the newly created debt. Dollars only come into existence as debt with interest owing, therefore its an impossibility for the debt to ever be paid back.Originally posted by sumdumguy View PostBut it’s just fake(fiat) money, right?

Comment

-

Now it is called 'quantitative' easing...[if the Fed "must" buys bonds that no one wants to prevent monetary illiquidity or currency overvaluation] or 'quantitative tightening' [if the Fed wants to shrink money supply] supposedly to lower inflation...Originally posted by biglentil View PostThats right if you or I were to print 'Federal Reserve Notes' they would throw us in jail for counterfeiting. When the fed , controlled by an undisclosed group of private shareholders, does it they call it stimulus and charge interest on the newly created debt. Dollars only come into existence as debt with interest owing, therefore its an impossibility for the debt to ever be paid back.

Cheers

Comment

-

-

After the central bank has spent ten years hypnotizing young people into heavy-duty debt loads, they wonder how to put a lid on young person’s insatiable lust for bigger and bigger houses, cars, boats, furniture, trips and more. Now we are going to hang them out to dry. Great Plan.

Comment

-

At the current rate of CPI using the 1980 methodology a person will see the purchasing power of their savings cut in half in just 4 short years.

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.... I believe that banking institutions are more dangerous to our liberties than standing armies.... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." - Jefferson

Comment

-

Originally posted by biglentil View PostAt the current rate of CPI using the 1980 methodology a person will see the purchasing power of their savings cut in half in just 4 short years.

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.... I believe that banking institutions are more dangerous to our liberties than standing armies.... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." - Jefferson

Here we go!

$.7177… Cdn$ down hard… Dow down 450…

Grain down…Last edited by TOM4CWB; Oct 13, 2022, 07:08.

Comment

-

Major fallout in global natural gas prices in-progress. European electricity prices in a dive. LNG shipments now backing-up at Spanish ports. Can’t unload as storage full. Gas prices dropping like-a-stone. Some analysts say prices may go to zero. Dutch TTC, Korean and Japan nat gas indexes in-a-meltdown. Suffield AECO spot storage hub price tubed to $1 per gigajoule from $4.25 per gig in late Sept. Henry Hub is now 50 percent of recent $10/MMBTU.

This significant energy market event will likely not be reported by main-stream media as it does not meet their inflationary biases.

Comment

-

- Reply to this Thread

- Return to Topic List

Comment