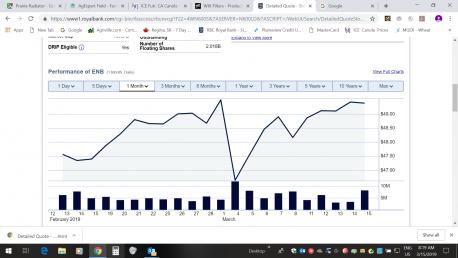

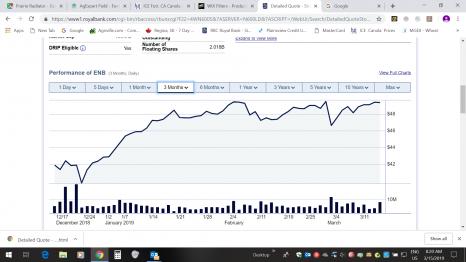

Below are a couple of screen shots of a stock that has been declaring a quarterly dividend equal to about a 6% annual return, which of course varies depending on stock value. Notice the chart movement around those quarterly payments. I never went back very far but it seems to show how people/funds likely buy in shortly before the dividend, get the dividend and then bail. Hmmmmm.......

1 month chart:

3 month chart:

1 month chart:

3 month chart:

Comment