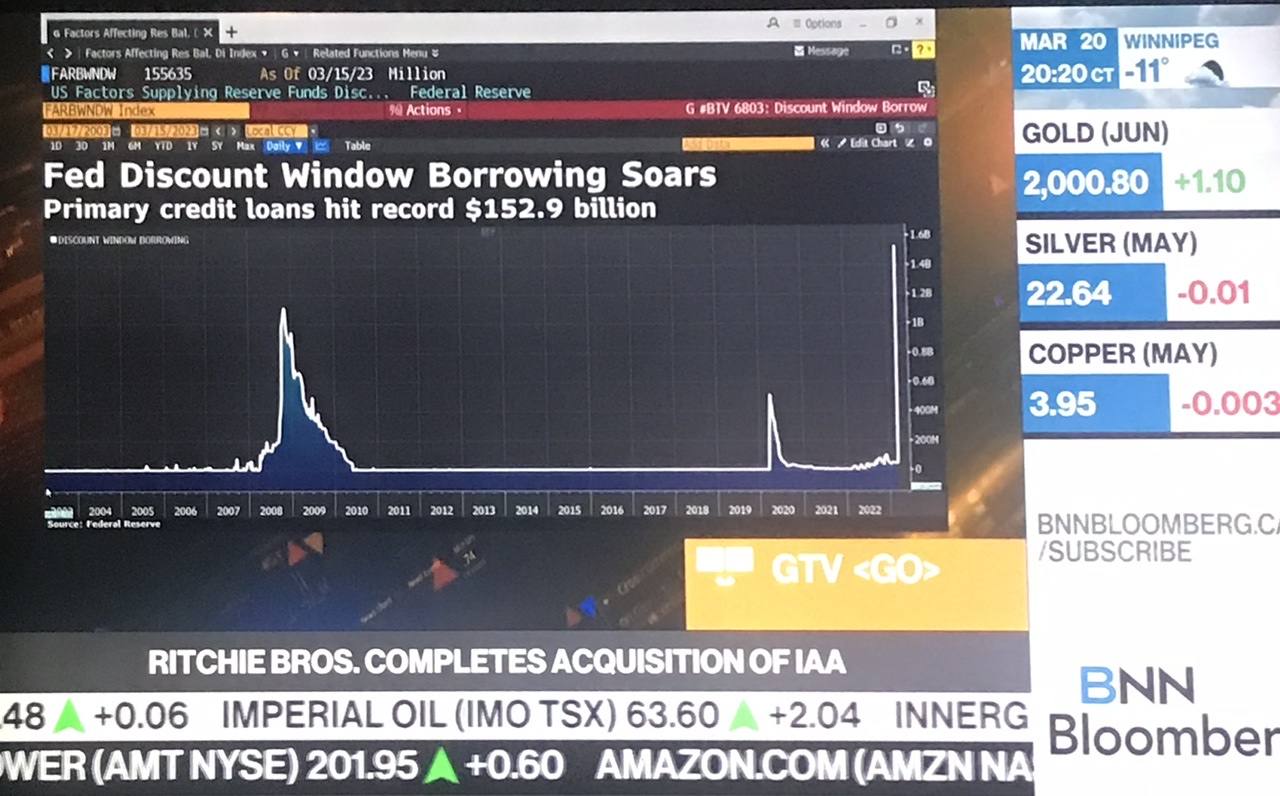

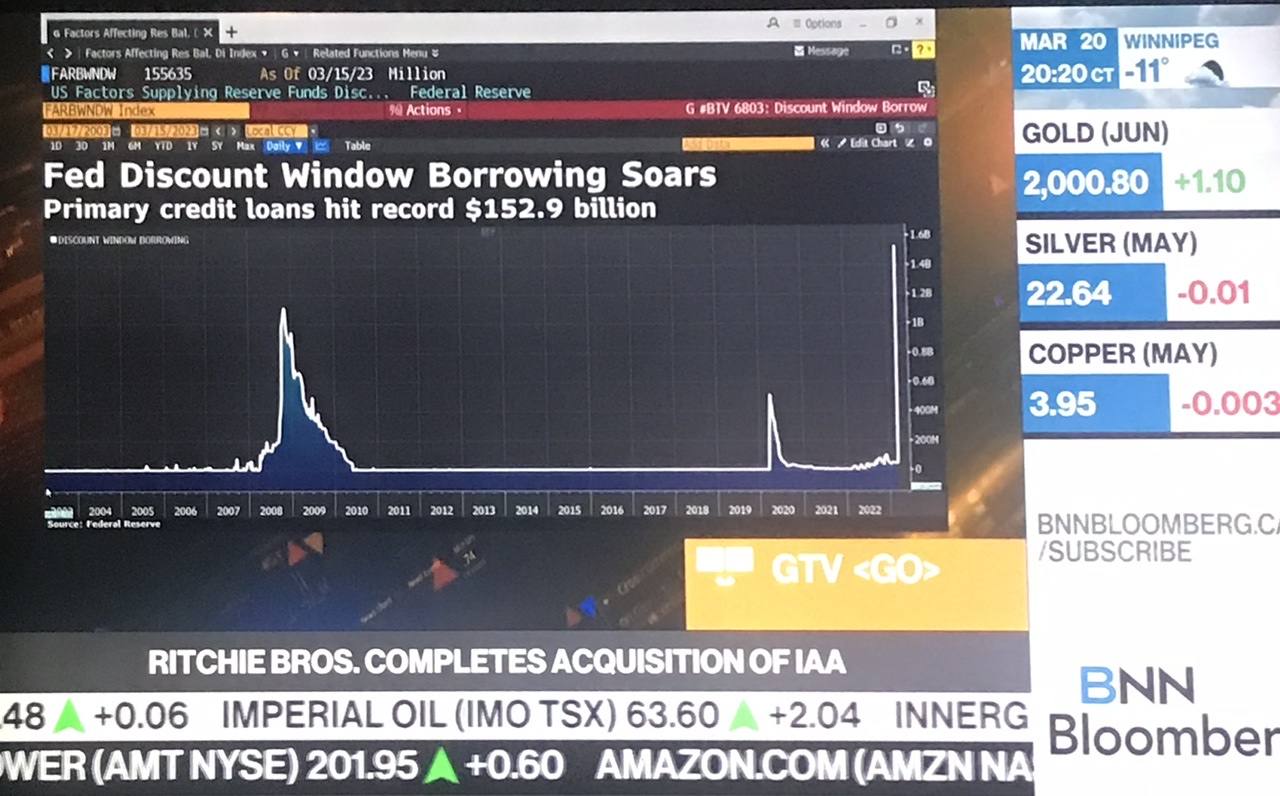

US Fed dumps more currency into banks than 2008 crisis:

The US Fed May be forced to pause interest rate hikes… “for now “

Gold over $2000….

ATB and Alberta Credit Union deposits are 100% Alberta Government backed… I was reading other provincial governments have different Credit Union backing levels… some at $250,000.

Cheers

The US Fed May be forced to pause interest rate hikes… “for now “

Gold over $2000….

ATB and Alberta Credit Union deposits are 100% Alberta Government backed… I was reading other provincial governments have different Credit Union backing levels… some at $250,000.

Cheers

Comment