Announcement

Collapse

No announcement yet.

24 Hours

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

I think the reality of “things†not needed when inflation destroys the middle class .

You can’t live without food but everything on that list is basically a luxury and not needed like Facebook, Netflix and others . So losing value in something that was way way overvalued does not concern most average Joes …. But food and fuel do .

Not surprising at all , when you demolish the disposable income of the middle class this is the result .Last edited by furrowtickler; May 9, 2022, 21:56.

Comment

-

-

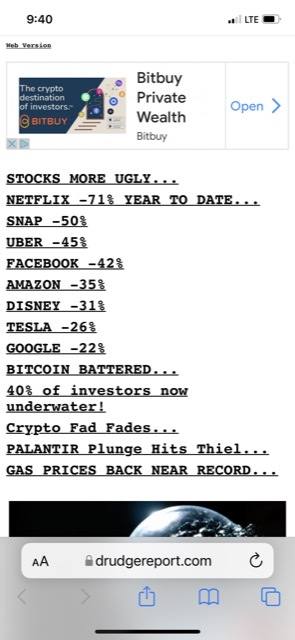

NASDAQ index threatening to break below 12,000 points, but even this index doesn't reflect the true valuation carnage in technology taking place right now. Tech stocks in absolute turmoil along with cryptos. Bitcoin breaks $29,000. Some secondary cryptos have almost totally collapsed . . . .

It's been estimate $35 trillion of market value has been wiped out since January. Apparently 14% of all global wealth has evaporated.

Robinhood- 54% down since Jan

Wix- 77% down

Coinbase- 80% down

Zoom- 70% down

Shopify- 75% down

Zomato- 60% down

This may take years to repair . . . .

Comment

-

Bricks and mortar. Solid p/e, solid value, good dividends etc. Last tech bubble in late 90’s early 2000’s the solid stocks were undervalued vs techs. I bought CIBC for $30 and put into a drip and forgot about it. Wish I invested more. My opinion cryptos look like a scam. I don’t follow enough to back that up but that’s what I think. It’s the blockchain which enables the scheme to function which has the value.

Comment

- Reply to this Thread

- Return to Topic List

Comment