One should never be the bearer of bad news but...

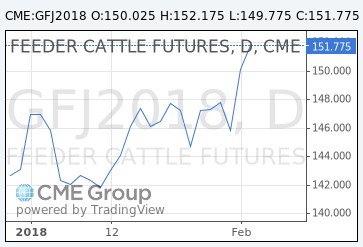

Daily feeder and live cattle futures charts have given sell signals suggesting a short term (to begin with) setback could be seen.

March Feeder futures have an initial target of $132 or $13/cwt below current levels (US).

Live Cattle futures suggest a dip to $113 or $10/cwt US below current levels could be seen.

This is for those inclined to use futures or put options to hedge their risk.

Daily feeder and live cattle futures charts have given sell signals suggesting a short term (to begin with) setback could be seen.

March Feeder futures have an initial target of $132 or $13/cwt below current levels (US).

Live Cattle futures suggest a dip to $113 or $10/cwt US below current levels could be seen.

This is for those inclined to use futures or put options to hedge their risk.

Comment