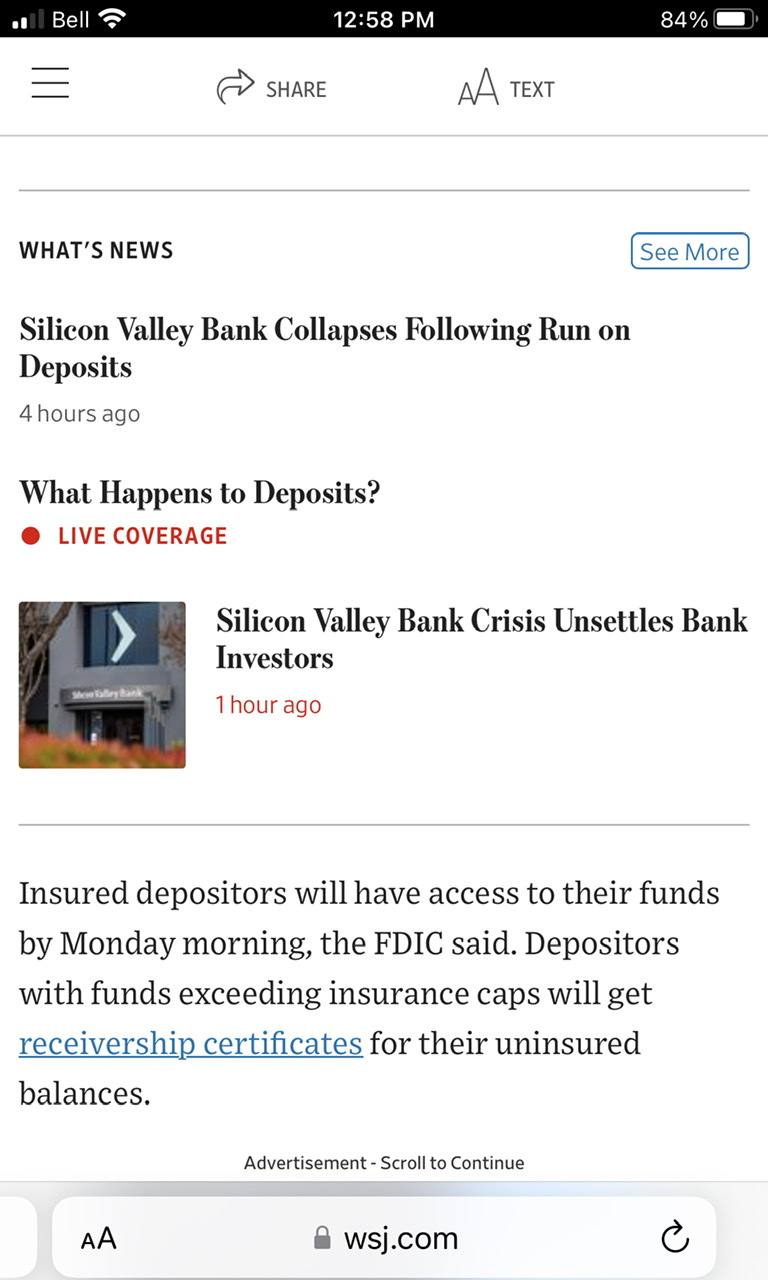

I had never heard of Silicon Valley Bank until today, and was surprised to see that it is the 18th largest bank in the U.S. with over $200 billion in assets.

The trip from "good cash flow" to "lost 60% of its value" to "in receivership" took about 2 days.

Another Bear Stearns moment.

This is what zero percent interest rates get you.

https://www.zerohedge.com/markets/expect-mass-layoffs-real-world-impact-svbs-failure

The trip from "good cash flow" to "lost 60% of its value" to "in receivership" took about 2 days.

Another Bear Stearns moment.

This is what zero percent interest rates get you.

https://www.zerohedge.com/markets/expect-mass-layoffs-real-world-impact-svbs-failure

Comment