So, given the 30%(ish) S/U in world wheat supplies, what is a decent price for HRS with decent Px?

We are supposed to have a premium product used to blend with(carry) other lower quality wheats. Are we getting a big enough premium for it and should we continue to grow it(CWRS) to try and differentiate yourselves from the lower quality run of the mill wheat grown the world over.

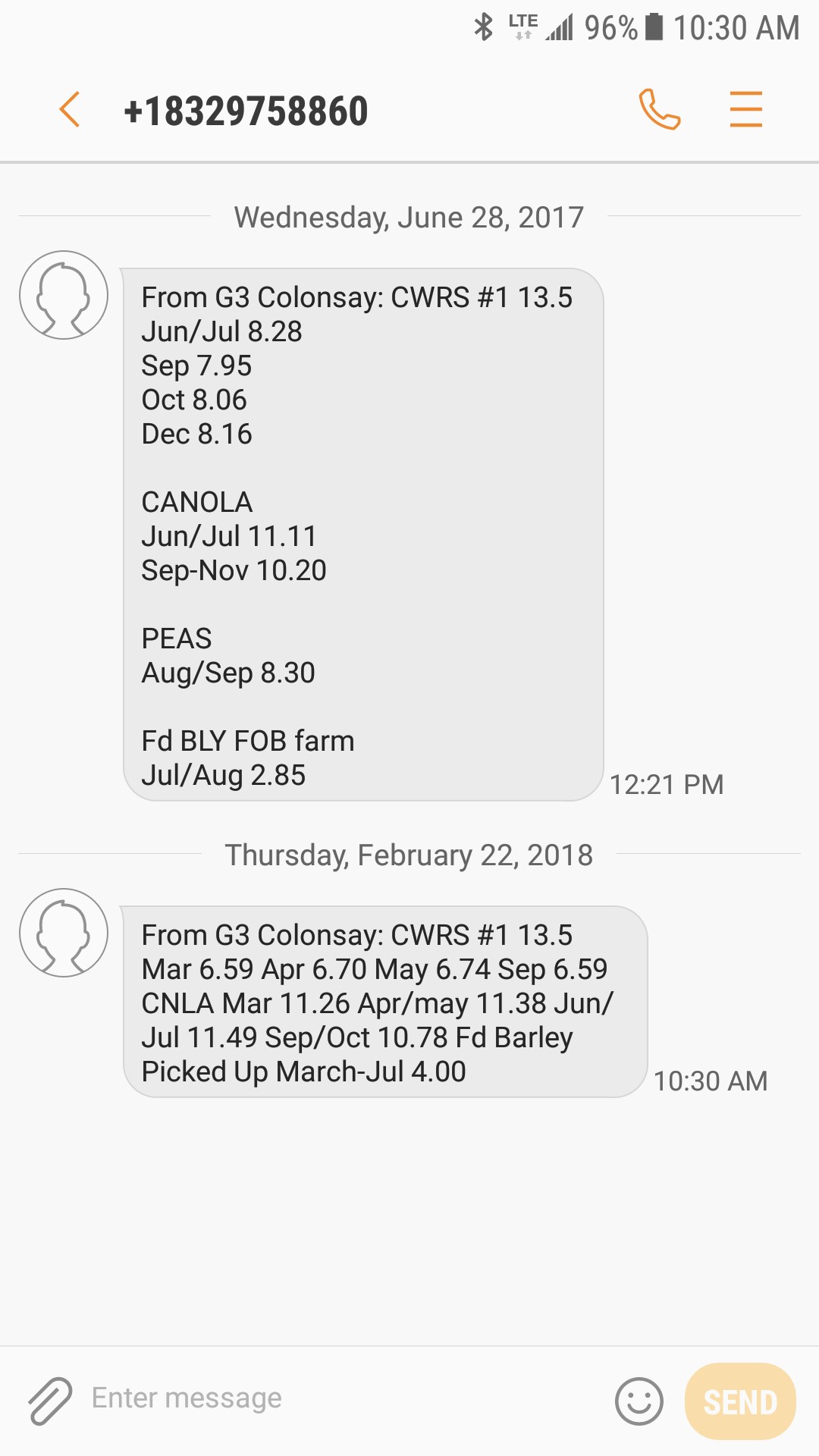

$7.00 bids for #1 CWRS 13.5 Px on the horizon for further out months with in the current crop year.

What were you hoping for or expecting?

We are supposed to have a premium product used to blend with(carry) other lower quality wheats. Are we getting a big enough premium for it and should we continue to grow it(CWRS) to try and differentiate yourselves from the lower quality run of the mill wheat grown the world over.

$7.00 bids for #1 CWRS 13.5 Px on the horizon for further out months with in the current crop year.

What were you hoping for or expecting?

last June so could happen

last June so could happen

Comment